In the seven or eight years since I first came into contact with stocks, it was only after I left the poker table that I could understand whether I was holding a good card or a bad card. In the next seven or eight years, a quarter of the time I knew I had found a good hand; half the time I was holding a half-bad hand and hoping for luck. For the rest of the quarter, I am amusing myself or feeling uneasy with bad hands and unwilling to leave the table.

The good news is that after nearly a year of waiting and searching, I got a good card in Year of the Rabbit. Among them is Station B, a once-in-a-ten-year, S-level investment opportunity, ( webpage link ). And it is equivalent to my A-level investment opportunity in Weichai in 2016 and Guanghui at the end of 2020-Guodian Power. $ Guodian Power (SH600795)$

(1) Industry

Electricity is a very boring industry. New energy and the electric power industry are also not within my circle of competence. When studying electric power stocks, the unit conversion between electric power, such as kilowatt-hours, kilowatts, degrees, gigawatts, and MW, makes me very confused. But I have some experience and grasp of the business model of public utilities. After several months of study and thinking, I think I can understand power operators. The industry research on photovoltaic and wind power is the hottest field in the market in recent years. As a novice, I don’t have any deep and unique insights, but I will also state the advantages and disadvantages of this industry from my perspective.

In 2022, the national electricity consumption will be 8.64 trillion kWh. Based on the average on-grid electricity price of 450.29 yuan/kWh of Guodian Power, the annual sales of power plants in the country will be about 3-4 trillion. This is undoubtedly a very large industry. Among them, the installed capacity of thermal power accounts for about half, and the contribution to power generation is still close to 70%. Considering that the growth rate of the electricity market is slightly lower than the GDP growth rate, it is expected to double in about 15 years in the future, and the growth rate is relatively low. However, the carbon-neutral policy makes the growth rate of each power subdivision track very different.

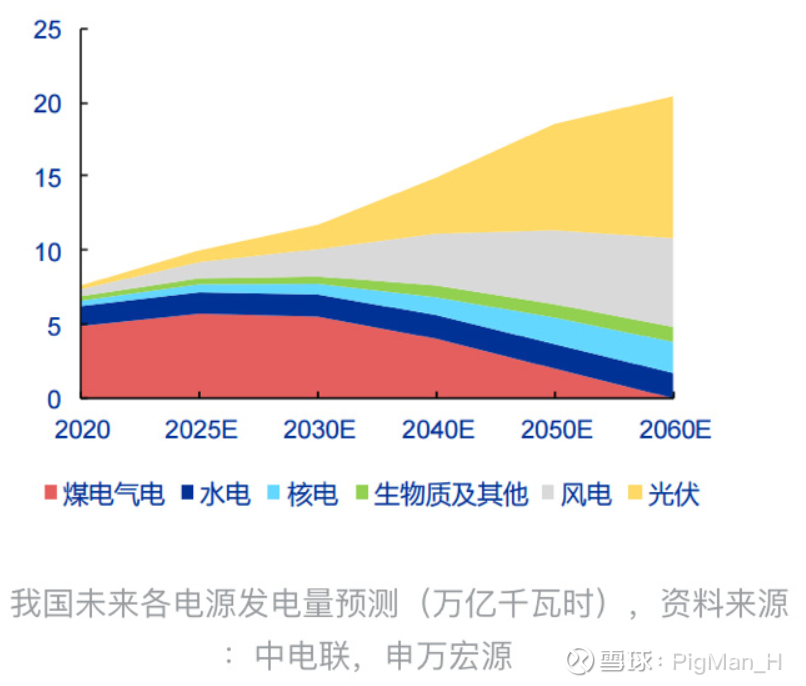

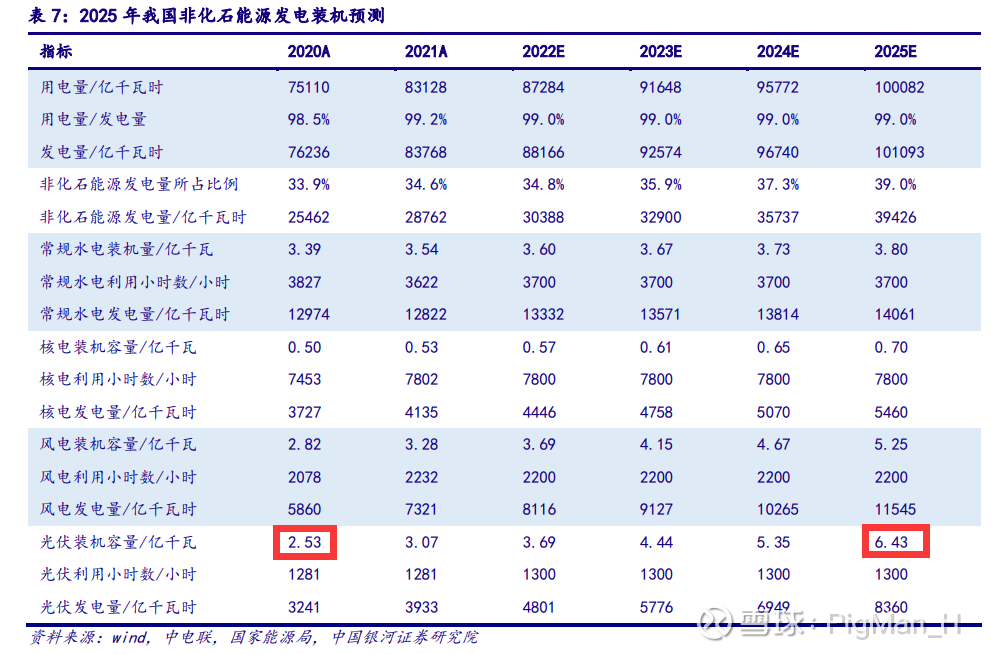

If we predict that the national electricity consumption in 2060 will increase by 2 to 3 times compared to now, and from the above figure, we can see that thermal power, which accounts for 70% of the current electricity consumption in 2060, will drop sharply. That is to say, in the next 30 years, in addition to the natural growth of 2-3 times, wind power photovoltaics will also gain an additional share of thermal power that has been developed for hundreds of years. Considering that our prediction for 2060 is difficult to be accurate today, but at least the trend seems to be established in recent years. It can also be seen from the forecast in the figure below that during the 14th Five-Year Plan period (2021-2025), the growth rate of photovoltaics may reach 153% when electricity consumption increases by 33%, and the difference in growth rate is about 5 times.

Therefore, new energy power generation may be an industry with a scale of hundreds of billions at present, one or two trillions in 2025, and more than ten trillions in 2060, with a compound growth rate of 10%+. It belongs to a large-scale industry with high growth rate and high certainty.

(2) Business model and profit model of power companies

Power plants belong to the public utility sector, and the profit model is distinct from cyclical industries (such as energy, shipping, non-ferrous chemicals, heavy truck machinery, pig raising, etc.) and consumer industries (such as Moutai, Haidilao, Juewei, etc.). After the completion of photovoltaic wind power and hydropower, the electricity price is basically stable, and the depreciation and amortization that is almost unchanged account for the majority of the cost. Therefore, the profit model is very standard, and it is one of the very few industries where the results calculated by DCF and other models are not much different from the reality. However, thermal power is different from wind power, hydropower and photovoltaics. Thermal power is also stable on the income side, but the largest component of cost is coal procurement. The cyclical rise and fall of coal prices has also caused fluctuations in the performance of thermal power plants. Therefore, if hydropower, photovoltaic, and wind power stations are complete public utility models, thermal power is more than half of public utilities and a small half of cyclical industries. This rather embarrassing feature leads to investors who are unwilling to bear cyclical fluctuations not buying half-cycle thermal power companies, and investors who are able to judge the cycle do not need to invest in thermal power companies with weak cyclical performance elasticity. That is to say, holding thermal power stocks is neither stable nor exciting enough. Among the power stocks, I choose Guodian Electric Power only a small part of the reason is its thermal power.

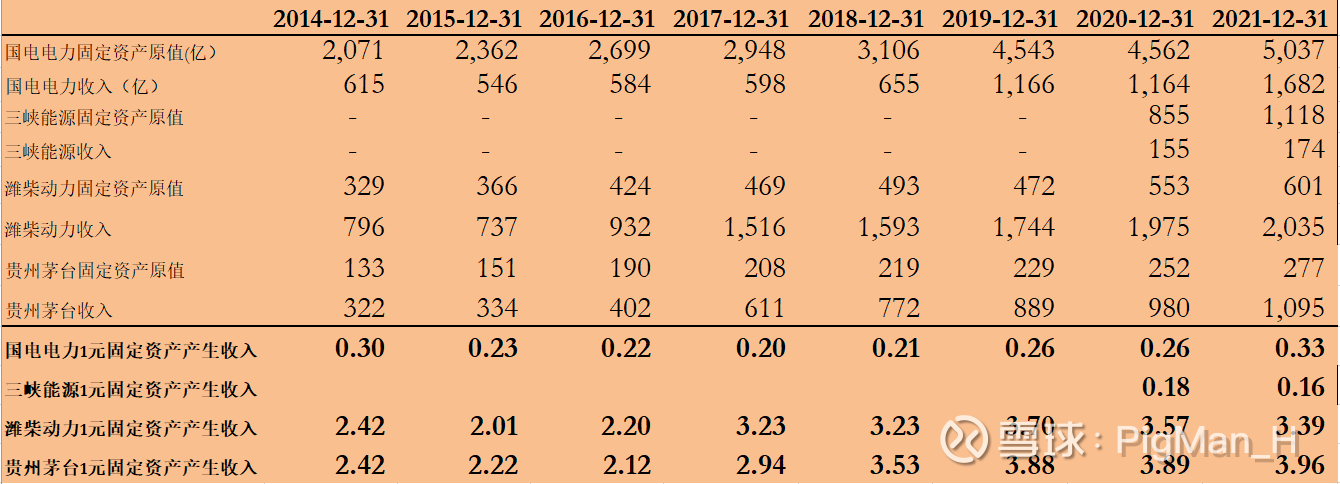

Next, use an example to compare the difference between the profit models of public utilities and cyclical and consumer companies. Suppose a capital party is investigating the models of cyclical, consumer and public utility companies. When reviewing historical data, he gets the following table:

(1) After investing 1 yuan of capital expenditure in Weichai Power (cyclical stocks), investors can earn about 2 to 3.5 yuan in income every year (the peak of cyclical stocks in 2010 reached 5.2 yuan). At the same time, the income generated at the high point of the cycle such as 2010 and 2019 may be more than double that at the low point of the cycle (2015). It shows that when the industry is good, there may be three shifts at full production, but when the industry is poor, the capacity utilization rate may be only half. At the same time, products in cyclical industries such as coal, LNG, chemicals, and agricultural products are mostly products of perfect market competition. For example, the price of coal of brand A and brand B of 5,500 kcal in the same area may be exactly the same. These cyclical companies can sell all products at market prices after the new production capacity is put into production. However, the cyclical fluctuations in product prices lead to major uncertainties when companies make production expansion decisions. When the newly added production capacity is put into operation, it may be able to make a lot of money, but it may also lose money by begging on the street.

(2) After investing 1 yuan of capital expenditure in Kweichow Moutai, investors can earn about 2 to 4 yuan per year. Good consumer product companies such as Moutai or See’s candy can increase this number year by year through product price increases. But most consumer goods companies are likely to generate less and less revenue for each additional dollar of capital expenditure. It seems that the 900 newly added Haidilao stores in the short term may have significantly lower sales per square meter than the previous 100. At the same time, the first 100 Haidilao stores have also been pulled down due to the emergence of a large number of new stores. In addition, unlike cyclical products with no difference, many consumer products are differentiated. Therefore, new products produced by consumer companies after aggressively increasing capital expenditure in the short term may not necessarily be recognized by the market. Therefore, the production capacity growth of consumer companies is often relatively stable and restrained, and the dependence on capital expenditure is not strong.

(3) When consumer companies are in the limelight or cyclical industries are at the peak of the cycle, every 1 yuan of capital expenditure can even bring 5 yuan or more in profit returns within a year. For example, the story of Zhou Hei Ya store which used to cost 200,000+ per square meter or a certain coal mine/iron factory recovered its cost within 1 or 2 months. But when the capital invests 1 yuan in companies such as Guodian Electric Power (thermal power) and Three Gorges Energy (wind power photovoltaic), they only get a pitiful 20 or 30 cents in income every year. This is why power plants always give people a somewhat boring impression. After all, who doesn’t want to pay back their investment in a month.

But the power plant’s profit model also has its own characteristics, that is, stronger certainty. As a commodity, “electricity” itself can be regarded as a cyclical product, so after the Russia-Ukraine conflict, there will be news such as a seven-fold increase in electricity prices in the UK. However, the current domestic electricity price is not completely liberalized and set by the market, so the income of power plants from selling electricity is mainly determined by the production capacity. At the same time, new energy power generation such as wind power and photovoltaics is not subject to the unpredictable impact of coal prices like thermal power. That is to say, almost all the parameters in the profit model of the power plant, such as power generation, electricity sales price, depreciation and amortization amount, interest expenses, etc., can be accurately calculated.

At the same time, what is different from cyclical commodities is that cyclical commodities “sell all products at the market price”, but the market price itself fluctuates greatly. Maybe the supply of new production capacity has increased by 10%, but the market price may therefore A drop of 20% or more. However, the price of electricity is basically locked, and the market depth of trillions of electricity and the characteristics of “electricity” as a commodity that is difficult to store and form inventory have led to the fact that power plants can “sell all products at a fixed price” within a certain period of time. Therefore, the capital side will find that although the annual return of IRR may only be 6-7% after deducting interest costs for investing in power plants, under high certainty, the capital side can use leverage to push up ROE. With 1 yuan in hand, borrow 4 yuan from the bank (power plants are often state-owned units with higher administrative levels, and the difficulty of borrowing is relatively low). money), so the annual rate of return of 30% is very attractive.

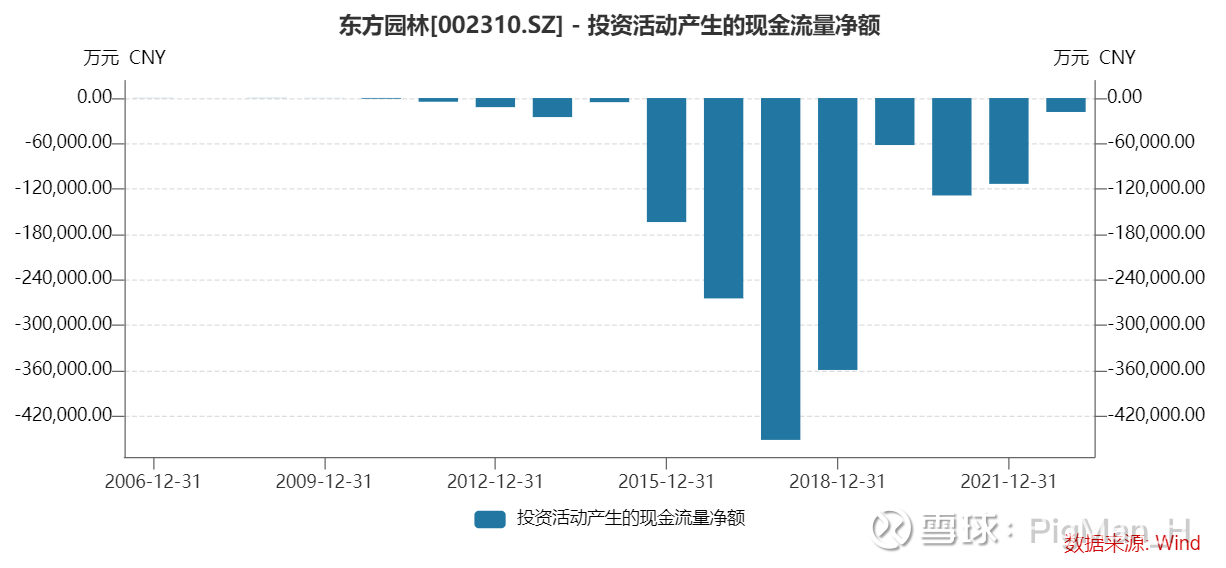

Another factor that brings power plant profitability models to life is cash flow. Also as a public utility sector, power plants and environmental protection companies have many similarities in terms of business models and profit models. The IRR return rate of the environmental protection industry can reach 20%, which can be said to kill the investment in new energy power plants. Under the same logic, the former environmental protection industry has indeed experienced a stage of desperate leverage. But in the end, companies like Dongfang Garden, Sanju Environmental Protection, Tus-Sound, etc. were all thundered. The problem lies in the weak cash flow of environmental protection companies.

First of all, the environmental protection project itself can recognize income and profit during the construction process, but there is no cash inflow. Secondly, the income collection of environmental protection companies such as environmental sanitation integration, watershed management, and soil remediation almost entirely depends on the willingness and ability of the government or Party A to pay. For Party A, the investment in environmental protection is either entirely cost-dependent on financial appropriations, or it can collect fees from downstream for sewage treatment, kitchen waste, etc., but there are always obstacles. Therefore, Party A’s payment is usually intermittent, and privately-owned environmental protection companies are naturally in a relatively passive position. Similar to it is the government subsidy part of new energy power generation. The nature of this part of subsidy income is also as difficult as that of environmental protection companies. However, the social acceptance of electricity bills is already very high (we often hear disputes and avoidance of property fees, but the electricity bills will be much less), and the receivables from electricity sales are in good condition. We can intuitively see the essential difference between the two public utility subdivision tracks by comparing some of the cash flow statement subjects of Oriental Garden and Three Gorges Energy:

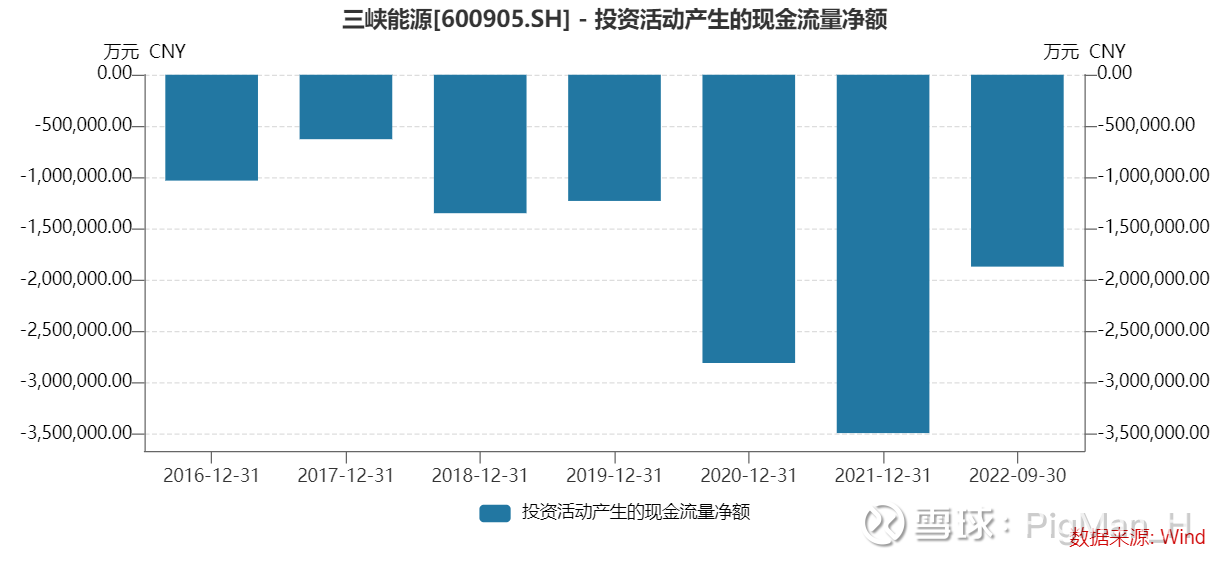

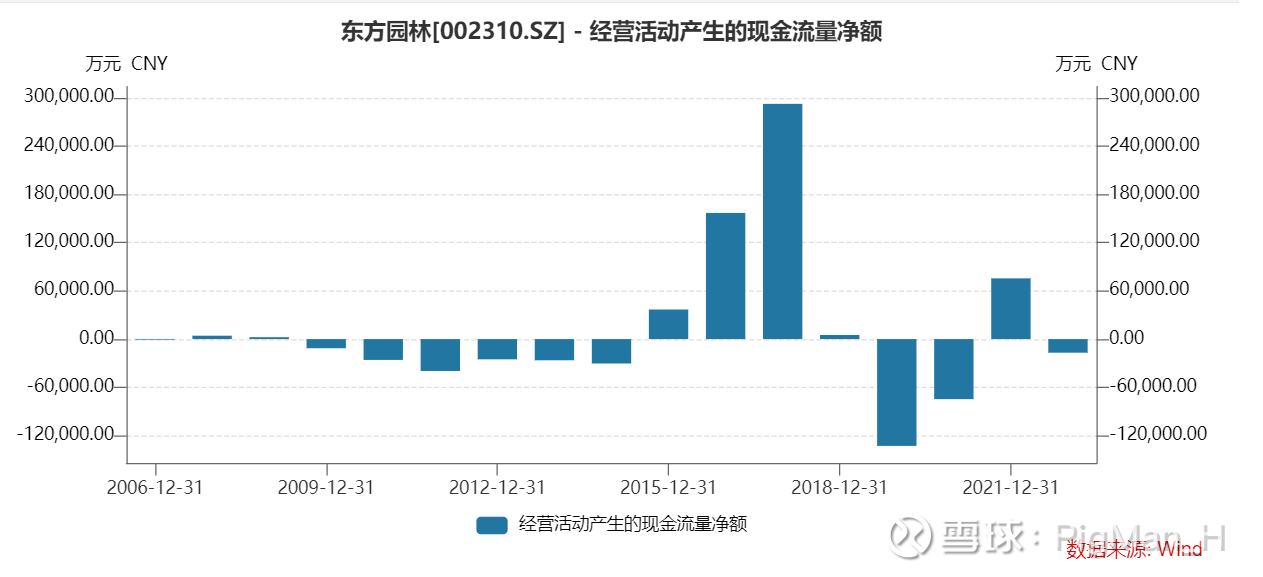

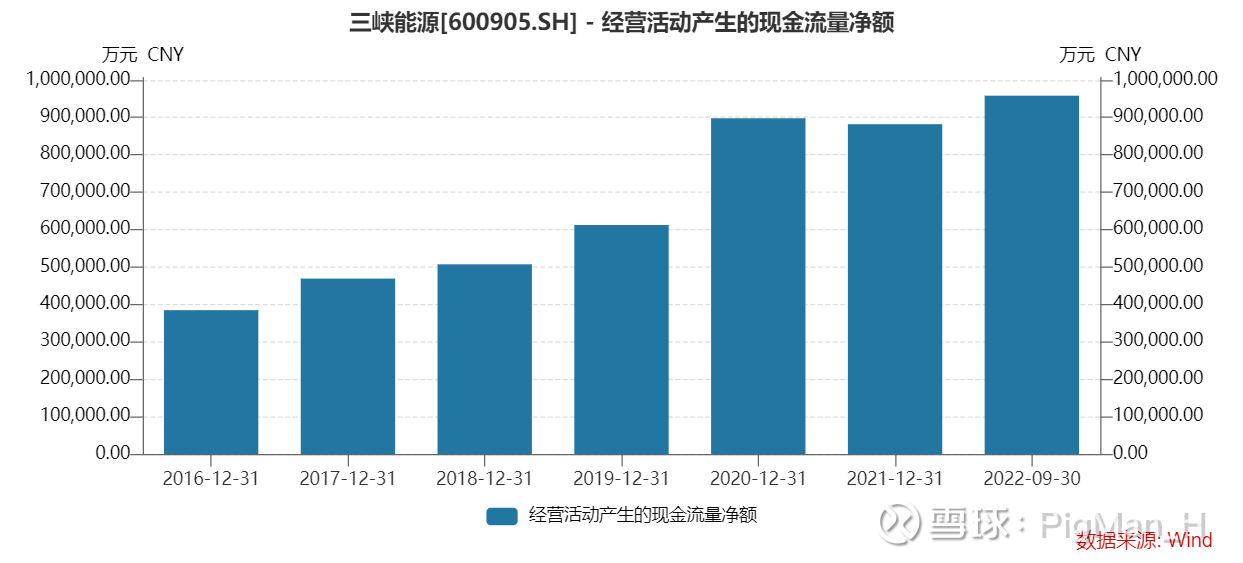

Both companies are asset-heavy investment enterprises, and the net cash flow from investment activities is a large outflow every year, which is used for the construction of new projects. However, it can be seen from the net cash flow of operating activities of the two companies that the cash flow of environmental protection companies and power plants is very different. The net cash flow of operating activities in more than half of the years of Oriental Garden is negative. In this state, as long as there is a problem with financing, the company will be unsustainable.

(Three Gorges Energy’s net cash flow from operating activities in the first three quarters of 2022 is greater than RMB 9 billion, and if it is invested at a ratio of 20% of its own funds, it can theoretically complete an investment of RMB 45 billion)

(3) Opening a position

The above are some thoughts on the power industry and business model. The reason why I choose Guodian Power among the power companies will be written next time. At present, Guodian Power is my entire position in A shares except Hong Kong stock station B. The following are screenshots of my two main holding accounts, and there are several small accounts, which together hold about 1.4 million shares of Guodian Power.

There are 10 discussions on this topic in Xueqiu, click to view.

Snowball is an investor social network where smart investors are all here.

Click to download Xueqiu mobile client http://xueqiu.com/xz ]]>

This article is transferred from: http://xueqiu.com/6127301807/240564798

This site is only for collection, and the copyright belongs to the original author.