ByteDance ushered in a new CFO.

On April 25, ByteDance CEO Liang Rubo announced the appointment of Julie Gao, a former senior partner at Skadden, a well-known law firm.

Gao) as ByteDance CFO (Chief Financial Officer).

During his career, Micro Motion is good at IPO of Chinese concept stocks. Since 2003, Micro Motion has participated in Ctrip’s IPO on Nasdaq in the United States. Micro Motion has participated in the IPOs of many Chinese technology companies, including Xiaomi, Meituan, and Pinduoduo. In addition, Micro Motion has also participated in the merger and acquisition services between almost all the large Internet companies in China.

Micro Motion’s CFO appointment has made the industry start to speculate, is ByteDance going to restart the IPO?

Zhang Dongwei’s view is not.

Although hiring a CFO is a prelude for companies to prepare for an IPO, Micro Motion’s primary goal is to list TikTok separately first, so as to realize the realization of TikTok.

Transparent operations in the United States.

“Localization” has always been the core strategy of ByteDance when deploying globalization. That is to say, Tiktok in the United States is an American company, and Tiktok in Germany is a German company. They are not responsible for everything from data to operation. The main body, but the “local company” operation.

This strategic arrangement of TikTok is conducive to avoiding political factors and focusing on realizing the positioning of an “entertainment company” – just as there are few countries in the world that formally boycott Disney.

Based on its global influence, Tiktok has caused security reviews in many countries. As mentioned above, ByteDance has completed the business isolation of each country based on forward-looking strategic considerations. , Tiktok is based on European and American systems, Douyin is based on mainland China and radiates to Southeast Asia, and technology, products, data, and operations are all completely localized. It can be said that in addition to capital connections, as well as the leadership team of Zhang Yiming, the global CEO In addition, ByteDance is not actually a “multinational company”, but more like a “business consortium”.

First, at present, Tiktok is the most eager to turn itself into a public company in the US capital market.

As we all know, the United States almost banned Tiktok during the Trump era. The reason is that the relationship between Tiktok and ByteDance is unclear, and there may be data security risks. ByteDance has moved through the corporate structure of the past two years. Although Tiktok is temporarily safe, it still must solve its own national identity problem as soon as possible.

Second, the development of TikTok needs more cash to fight the war.

ByteDance started from the “Today’s Toutiao” at the beginning. In addition to the meticulous cultivation of technology and products, the more important competitiveness is the operation style of “vigorously producing miracles”.

This style of play requires a lot of capital, and it is crushed with money.

Tiktok itself is not profitable. Today, due to the international political environment, ByteDance still needs to keep a distance from Tiktok, so that Tiktok must raise funds independently in order to continue to develop.

Through financing, Tiktok can also attract important and influential shareholders to join, and better achieve “localization” in European and American countries.

Third, the clue can also be seen from the office of the CFO.

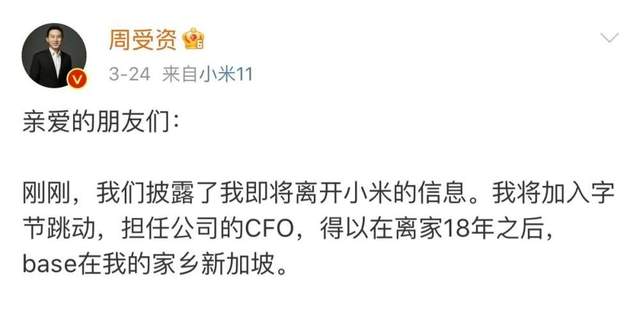

Before Micro Motion, Zhou Shouzi, who used to be the CFO, is a Singaporean.

Today, Micro Motion is also BASE in Hong Kong and Singapore, not in the mainland. That is to say, the core communication object needs of the past two CFOs were not the regulators in mainland China.

If the IPO of ByteDance is to be realized, the office location chosen by the CFO is obviously unimaginable.

Therefore, whether it is Zhou Shouzi or Micro Motion, it should be to arrange actions in the capital market in the United States.

The previous CFO, Zhou Shouzi, was finally appointed as the global president of Tiktok to solve the communication and governance problems between Eastern and Western teams. The successor, Micro Motion, should be here to complete the unfinished task of Zhou Shouzi, starting with the law. In terms of capital relationship, complete the reasonable and compliant divestiture of TikTok from the ByteDance system, and then promote an independent listing.

A few final additions:

1. The high probability of this appointment shows that the Chinese regulatory authorities have a favorable answer to the security review of ByteDance.

2. It also shows that the US regulatory authorities have also reached a preliminary positive conclusion on TikTok’s identity review. Because Tiktok only strips off its identity as a “subsidiary of a Chinese company”, will it be possible to obtain regulatory approval in the United States, and this kind of approval is the premise for Tiktok to enter the European and American capital markets.

3. On the road of internationalization, there are Huawei model and Lenovo model in hard technology, Tencent model and Alibaba model in soft technology, and ByteDance may contribute a new model to Chinese people.

The above arguments are based on the analysis of public information and do not constitute investment advice.

Author: Zhang Dongwei (senior Internet person, marketing expert, college student employment and entrepreneurship mentor)

This article is reproduced from: http://blog.sina.com.cn/s/blog_5937f90e0102zs9k.html

This site is for inclusion only, and the copyright belongs to the original author.