Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text/Jingyu

Source: Juchao WAVE (ID: WAVE-BIZ)

The scorching hot summer is an eventful autumn for shells.

After experiencing many difficulties such as the supervision of Chinese stocks, the question of the platform economy, and the real estate cycle, Shell started a new strategy of “one body and two wings” this year, and returned to Hong Kong to list in an attempt to create a second growth curve.

However, at the critical stage of the strategic transformation, its important shareholder Sun Zhengyi voted with his feet and sold all his shares short.

According to documents recently disclosed by SoftBank, it has liquidated shares of Shell. The shares sold were worth a total of $2.5 billion at their May 11 market value. Even in the current period when investment institutions are concentrating on reducing their holdings of Internet companies, such large-scale, liquidation-style reductions are not common.

SoftBank once invested US$1.35 billion in Shell’s D+ round of financing in 2019. The prospectus for Shell’s US stock listing shows that SoftBank’s shareholding ratio is 10.2%. This figure was reduced to 10.2% when Shell was listed on the Hong Kong Stock Exchange in May this year. 7.1%, and it has recently dropped to zero.

In addition, in February this year, Hillhouse Capital, which had accompanied and participated in multiple rounds of Shell investment, disclosed that its share of Shell has also dropped to 3.3%, compared with about 5% a year ago.

In the past year or so, although the downturn in the domestic real estate market and the deterioration of the fundamentals of the intermediary industry are obvious to all, the share price of Shell has also fallen by more than 80% due to the negative impact. Choosing to reduce or even liquidate positions at this stock price position, in addition to the special reasons of the institution itself, also means that the capital has a clear value judgment for Shell.

Shell’s basic business (that is, one of the two-wing strategy) – the real estate brokerage business, is still suffering from the continuous negative impact of the real estate cycle; while the two wings – leasing and home improvement, although the market space is large enough, they are both difficult to operate. It is very difficult to contribute decent income and profits to the parent company in a short period of time due to the high traditional business format.

Whether it is one body or two wings, the current shell has not shown a clear reversal signal.

01

just bounce

After a brief recovery in real estate sales in May-June, the housing market turned weak again in July-August.

Since the beginning of this year, in the cold winter of the property market, stimulus policies have emerged one after another across the country, ranging from reducing the down payment ratio, issuing housing subsidies, adjusting the provident fund policy, lifting restrictions on purchases, etc.

Especially in May and June of this year, the gradual fading of the impact of the epidemic and the frequent introduction of real estate stimulus measures in various places led to a significant improvement in the property market transaction data.

According to data from the National Bureau of Statistics, although the decline in sales continued to expand in the first five months, the sales volume and price in a single month in May both rose. 29.7%.

In terms of second-hand housing, the monitoring data of Shell 50 cities shows that the transaction volume of second-hand housing in May and June increased continuously, with a month-on-month increase of 14% and 25% respectively. The transaction volume in the second quarter increased by about 15% compared with the first quarter.

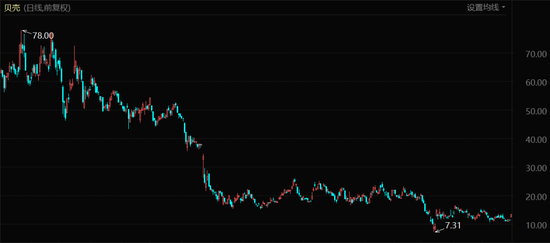

Along with this process, the share price of Shell also rebounded from the lowest point at the end of March at US$7.3/share to the highest at US$19.35/share in June, an increase of 165%. Therefore, some investors have begun to expect that the property market will become active again, and Shell’s performance is expected to recover.

Shell share price performance (January 2021 to date)

Shell share price performance (January 2021 to date)However, this expectation was soon falsified by reality. After a brief recovery in real estate sales in May-June, the housing market turned weak again in July-August.

According to the sales situation of real estate companies released by CRIC in July, the TOP100 real estate companies achieved a monthly sales volume of 523.14 billion yuan, a decrease of 28.6% month-on-month and a year-on-year decrease of 39.7%.

The agency said that at present, the overall demand and purchasing power of the real estate market are overdrafted, and industry confidence is at a low level, and the pressure on companies to de-purchase is still relatively high in the short term. That is to say, the short-term recovery of real estate sales in May-June this year is only a rebound, not a reversal.

From any point of view, the disappearance of the “golden age” of real estate has become the consensus of all parties.

In addition, according to the 2020 China Census Yearbook released by the National Bureau of Statistics, the per capita living area of households in my country has reached 41.76 square meters, which is very close to the per capita area of 50 square meters in developed countries around the world. This means that the historical high of new home sales in my country is approaching, and the future trend can almost only be downward. This is also one of the important backgrounds of Shell’s new strategy of “one body and two wings”.

02

face the bottleneck

“Why is there no giant in the trillion-dollar home improvement market?”

On November 25, 2021, Shell officially proposed the strategy of “one body and two wings”. “One body” refers to the second-hand and new house transaction service track, and the “two wings” are the large-scale home furnishing business group and the inclusive residential business group. In particular, the home improvement and home wing have high hopes.

Shell’s layout of the home improvement and home furnishing business can be traced back to the home furnishing platform “quilt home furnishing” launched in the Zuohui era. The financial report shows that in 2021, Quilt Home Improvement delivered more than 3,500 home improvement projects to customers.

Under the leadership of Peng Yongdong, Shell has made a new big move in the field of home improvement and home furnishing. On April 20 this year, Shell announced the completion of the acquisition of the home improvement and home furnishing brand “Shengdu” at a price equivalent to about 8 billion yuan.

Data shows that by the end of 2021, Shengdu Home Improvement has opened more than 110 stores in 31 cities across the country, serving more than 150,000 families in total. It is not difficult to see from the drastic acquisition that Peng Yongdong expects the rapid growth of the home improvement business and the second curve.

Peng Yongdong’s expectation is to help the shell’s home improvement business to rapidly increase its volume. He said at the Shell’s 2021 annual performance meeting, “The Shell has already gone through the process of going from 0 to 1 in the home improvement business, and Shengdu will allow Shell to achieve scale replication from 1 to 100 more quickly.”

According to the CIC report, the total size of my country’s home furnishing market in 2020 will reach 2.6 trillion yuan, and the market is broad enough; however, there are also significant industry bottlenecks in this track, which is not conducive to the development and growth of giant companies.

Home improvement has always been a track of “big fish and small fish”. There are very few companies with revenue exceeding 10 billion yuan, which has led to a question in the industry, “Why is there no giant in the trillion-dollar home improvement market?”

The reasons behind this are various, such as the difficulty of fully grasping the length of the industrial chain, the geographical limitation of construction radius, the difficulty of standardizing and duplicating home improvement services, and the serious asymmetry of information between buyers and sellers. Previously, the domestic Internet home improvement track also had a boom in entrepreneurship, but eventually hundreds of Internet home improvement companies closed down, and the development of the remaining players was also tepid.

If you choose Shell, which is deeply involved in home improvement, you will also face these problems. If you want to increase revenue, you must invest in a wide range of online and offline layouts, but these layouts are difficult to generate scale effects – because services are difficult to standardize, even large companies are difficult Guarantee service quality; and because of information asymmetry between buyers and sellers, it is difficult to accumulate good word of mouth, while bad word of mouth is easy to spread, and it is difficult for enterprises to accumulate brand effects.

Therefore, in a short period of time, it is difficult for Shell’s home improvement business to increase rapidly, and it can only expand gradually. Shell said that, assuming that the Shengdu business is consolidated, the revenue of Shell’s home improvement and home furnishing business in the first quarter will increase by 54% year-on-year to 860 million yuan. However, this scale is still very far from the stock house transaction and new house transaction business (total revenue is 12.1 billion yuan).

From the perspective of the capital market, home improvement companies generally have poor growth and weak scale effects, so their valuations are closer to traditional companies than Internet companies. The expansion of the home improvement business is not all positive, and the overall valuation level of Shell may also be a drag.

03

Layoffs to increase profits

Shell’s performance is not as simple as following the market’s year-on-year contraction.

As a derivative industry of real estate, real estate agencies make a lot of money in prosperous times; when real estate falls into a cold winter, it will naturally bear the brunt.

For Shell, the two-wing business has not yet played a major role in performance, and the basic housing transaction business (accounting for more than 97% of revenue in 2021) is still the anchor of its valuation, and it will inevitably bear the impact of cyclical fluctuations in the real estate market.

Judging from the performance of the first quarter, Shell’s performance is not as simple as following the market’s year-on-year contraction, and its profit margin has also declined significantly, or even a loss.

The financial report shows that in the first quarter of this year, Shell achieved a turnover (GTV) of 586 billion yuan, a year-on-year decrease of 45.2%; operating income was 12.5 billion yuan, a year-on-year decrease of 39.4%; a net loss of 620 million yuan, adjusted net profit of 28 million yuan, compared with an adjusted profit of 1.5 billion yuan a year earlier.

In fact, as a heavy asset company with a huge offline layout, Shell’s profit margin itself is not high. Even when the industry is booming, Shell’s gross profit margin is only in the early 20s. After deducting management expenses, sales expenses and R&D expense rates, the remaining net profit margin is only single digits.

At this time, once the real estate enters a new situation and a new situation occurs, such as the commission rate is compressed due to the overall downturn in second-hand housing transactions, the risk of bad debts for primary housing customers (real estate developers), and the reduction of commission rates for new house sales by central state-owned enterprise customers, etc., it is easy to lead to the final loss. In the third and fourth quarters of last year, Shell suffered consecutive losses of 1.765 billion yuan and 930 million yuan.

That is to say, the cold winter of the industry not only causes the shrinking of shell revenue, but also the overall difficulty in making profits, which is a common problem of many service-oriented industries. Therefore, Shell began to compress various expenses since last year.

It is reported that as of now, Shell has made at least three waves of layoffs in the past year. In October 2021, Lianjia Shanghai regional finance, shell research and development and other teams were laid off; in March this year, the “integrated” business main body housing transaction business group and other teams also began to lay off staff. The last wave was in May this year, and the scope of layoffs involved almost all business, production and research, operations and functional lines.

Reflected in the financial report, Shell’s overall operating expenses fell by 17.49% year-on-year in the first quarter of this year. Among them, sales, marketing and administrative expenses all decreased to varying degrees. Although it failed to turn losses, it also contributed to the “growth” of Shell’s profits.

This kind of “recovery of profits” situation is not recognized by Sun Zhengyi and Zhang Lei, so it is not difficult to understand.

04

write at the end

As the real estate industry enters a downward cycle, the current “new situation” will most likely be the norm that Shell has to continue to face. For example, the commission rate is compressed due to the overall downturn in second-hand housing transactions, and the central state-owned enterprise developers strongly reduce the commission rate for new house sales, which will continue to have a negative impact on Shell’s revenue and profits.

Peng Yongdong’s bet on home improvement and home furnishing and inclusive living is essentially an attempt to circumvent the long-term difficulties faced by the main business in the future.

The fundamental source of long-term difficulties is the long-term fluctuation of the real estate industry. The so-called all things are cycles, cycles are supply and demand, and the real estate industry as the “mother of cycles” is no exception, but its cycle takes about 20 years.

Since the housing reform in 1998, the overall sales of commercial housing in my country has shown a continuous growth trend, but as my country bids farewell to the “golden age” of real estate, its downward cycle will also be very long.

Few companies can withstand such a prolonged down cycle. This is not just a rumor from one or two people, but a fact that has been repeatedly verified in the development of the real estate industry in developed countries in Europe and America for hundreds of years.

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-08-11/doc-imizmscv5762887.shtml

This site is for inclusion only, and the copyright belongs to the original author.