Author: WebX Lab / Source: Vernacular Blockchain

Author | WebX Lab

Produced | Vernacular Blockchain (ID: helloBTC)

For most crypto users, we have completely adopted TRC-20 USDT as a habit. As one of the most important tracks in the cryptocurrency field, stablecoins have become the first “tokens” for many people to officially enter the crypto market . In the entire stablecoin market, USDT issued based on TRC-20 occupies an absolute dominant position. In the official data released by Tether last month, the issuance of TRC-20 USDT has fully surpassed the Ethereum version of USDT, becoming the USDT version that accounts for the first in total circulation. Since then, TRON has built four stablecoin business structures consisting of USDT, USDC, USDJ, and TUSD, covering the top two stablecoins in the industry, decentralized stablecoins and compliant USD stablecoins.

With the changes in the external environment and market demand, the stablecoin itself is undergoing new changes. The industry hopes to develop a new kind of decentralization based on the collateralized stablecoin, which does not rely on central institutions and is not disturbed by external regulatory factors. stablecoin solutions. Thanks to the successful experience in TRC-20 USDT, on April 21, 2022, TRON founder Justin Sun issued an open letter stating that TRON DAO will design a highly stable decentralized algorithm with a wide range of usage scenarios. Coin – USDD, aims to provide a truly usable value medium for subsequent cryptocurrency applications and decentralized economies.

The significance of the birth of algorithmic stablecoins headed by USDD is that although the market has now adapted to the role of the medium of centralized stablecoins, from the perspective of blockchain and decentralization, this medium still has certain risks. The fragility of stablecoins in the face of extreme environments and emergencies is still debatable. As long as the issuance rights of stablecoins are still in the hands of centralized institutions, as long as centralized institutions have the authority to freeze and confiscate at will, as long as there is a risk of running If it still exists, then the original vision of individual sovereignty and the inviolability of private assets envisioned by blockchain and the spirit of decentralization is a dead letter . As Justin Sun mentioned in the open letter, TRON needs to continue to complete self-iteration and self-revolution, and use the mathematics and algorithms that blockchain believes in to eliminate the last threshold in the financial world, so as to avoid users’ individual sovereignty from being infringed by huge profits and central power. .

01

Algorithm-based currency stability triangle

Stablecoin is a digital currency with a relatively stable market price, that is, the legal currency in the digital currency market. The background of its birth comes from the fact that the volatility in the digital currency market is too huge, and a relatively stable digital currency is needed to provide liquidity and benchmark other funds . At the same time, it acts as a bridge between the blockchain market and traditional market assets.

Stablecoins not only serve as a connection between currencies in the digital currency market, but also keep funds from flowing out when the market fluctuates, so as to maintain the basic capital activity of the digital currency market in the cold winter. Stablecoins play a role in the market. Fiat currency duties, but collateralized stablecoins are not suitable for long-term operation in a decentralized market.

Mortgage means that all the funds in the market are gathered in a currency issuing institution similar to the central bank. The degree of supervision and transparency of the assets in the institution determines how much trust the market has in the central bank that issues the currency. When the central institution loses trust It also represents a bank failure with any insurance measures, and the resulting run risk is enough to completely destroy the market in the short term.

Algorithmic stablecoins are the most imaginative legal currency processing solutions in the decentralized market. The biggest difference from traditional stablecoins is the definition of algorithms in stablecoins, whether through a certain arbitrage model or scarcity algorithm to make the price relative The anchoring of price is achieved by stabilizing price figures such as US dollars (digital mapping) rather than by staking.

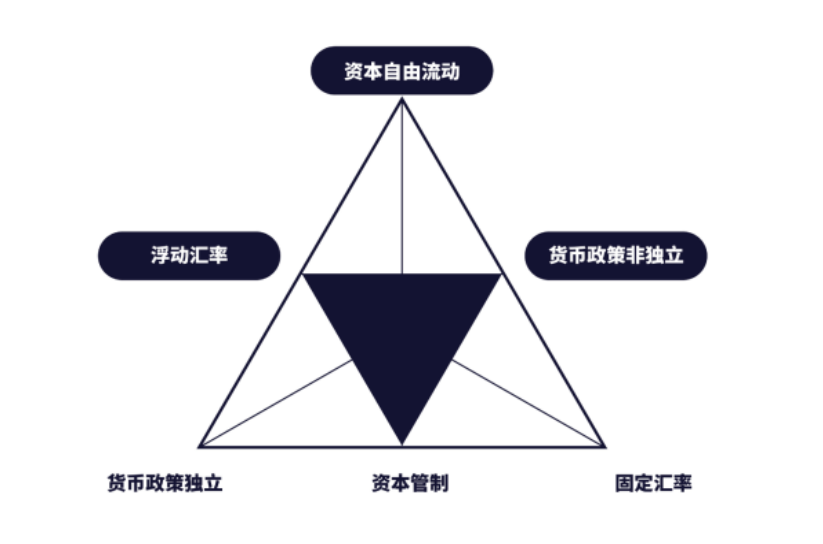

Therefore, the method of algorithmic stable currency is more in line with the concept of decentralization in the blockchain world. It not only gets rid of the trust risk of the central agency, but also gives the most malicious minting rights to the users of each token, and there is no centralization. Under the risk of abuse, it not only improves the liquidity of the token, but also uses the algorithm to achieve a relatively stable currency stability triangle.

02

Exploration of Decentralization of Current Algorithmic Stablecoins

The blockchain world always seeks to decentralize everything, whether it is the once-popular Decentralized Finance (DeFi), or the algorithmic stablecoin that is now popular with LUNA’s unsecured currency, the most profitable and market prospects in the financial market. The huge one is the centralized banking institution, which can bring seigniorage at the same time as it obtains the right of coinage.

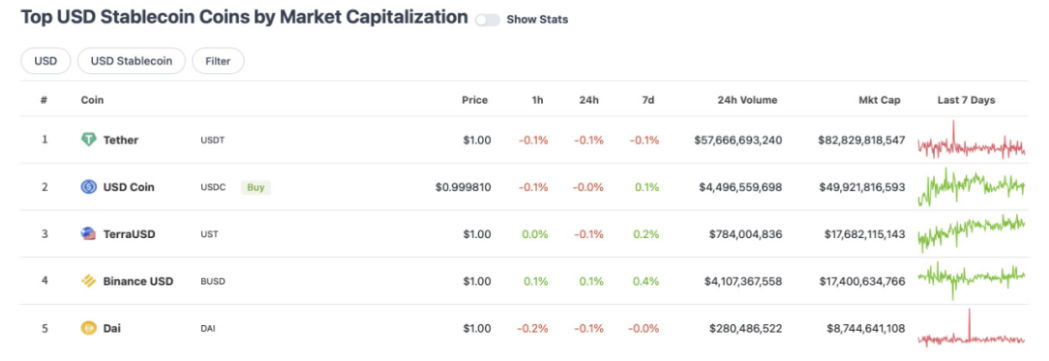

Whether it is LUNA, which is pushing the algorithmic stablecoin to the public, or the main chains that are chasing the algorithmic stablecoin, such a game of enclosure is being played. Before bringing payment systems to traditional consumption or financial markets, the biggest opponent of algorithmic stablecoins is still collateralized stablecoins (USDT/USDC).

Algorithmic stablecoins usually achieve relative stability in three ways, through scarcity (inflation deflation), arbitrage design (two-way arbitrage mechanism), and multi-currency model (fluctuation transfer) . The specific logic is as follows:

Scarcity: The scarcity design is similar to the way traditional banking institutions conduct macro-control of currency, that is, to adjust the supply and demand relationship through monetary easing policies and monetary tightening policies, which is usually replaced by repurchase and destruction in the algorithmic stablecoin market. The monetary policy is tightened, while the monetary easing is simpler, which is equivalent to printing money and throwing it into the market. Of course, in the algorithmic stablecoin, a fixed algorithm is still required for implementation and disclosure.

Arbitrage design : Arbitrage design is the simplest and most practical short-term stabilization scheme among many methods. If the stable price is assumed to be 1, when the price is greater than 1, the token can be sold to obtain a premium profit, and when the price is less than 1. In the case of 1, the token can be purchased and exchanged for a token equal to 1 value through the exchange scheme designed by the arbitrage model.

Multi-currency model: The volatility generated by the transfer of stablecoins by softly anchoring other digital currencies is a method designed in an algorithmic stablecoin system endorsed by other digital currencies, and the transfer of algorithmic stablecoins requires a stable control method. The cost that should be incurred under the algorithmic stablecoin, for example, the stablecoin needs to be deflated, and the cost of deflation is borne by other tokens. This method can make the algorithmic stablecoin more stable, but it also makes the algorithmic stablecoin more stable. It is difficult for the market cap to surpass the market cap of its soft-pegged tokens.

03

Compared to traditional stablecoins

How USDD solves the core contradiction of stablecoin from the root

The biggest problem of mortgage-type stablecoins in the current market is to mortgage the liquidity of funds in the digital currency market, and obtain price stability through mortgages. This stability also leads to the loss of more liquidity in the digital currency market. , when the market enters a downturn, not only does it have no benefit to the market, but in extreme conditions, it will lead to capital stampede and accelerate the decline in the value of digital assets.

For algorithmic stablecoins, being able to deal with price volatility and the authenticity of prices obtained by oracles is the foundation for whether algorithmic stablecoins can maintain stability under extreme market conditions. Sufficient liquidity volume + ecological interest binding In order to deal with the bank-like risks brought about by the central bank in the digital currency market.

As a decentralized stablecoin to be issued by TRON DAO, USDD uses long-term supply and demand management for long-term price stability. The short-term fluctuation solution adopts a more general price fluctuation arbitrage method to achieve short-term price control by users and arbitrageurs. Stablize.

The USDD protocol runs on the TRON network, but the USDD price in the secondary market is exogenous data for TRON, so the oracle machine still needs to feed the price to obtain real price data.

USDD as a whole needs solutions to three types of problems , namely, how to ensure that the price fed by the oracle machine is real data, how to manage scarcity to ensure price stability and deal with deflationary costs, and how to design a short-term price arbitrage model to reduce short-term price volatility.

① The USDD oracle service is provided by the super representative of the TRON network. A vote will be counted every N blocks. The super representative of the network needs to vote in each voting stage. The voting content is the current real price of USD in the market. Take the weighted median of the voting prices of each super representative as the real price.

The USDD protocol will calculate a reward deviation value based on the price obtained by the weighted median of the voting results, and all super representatives whose voting results are within the deviation value will be rewarded to encourage super representatives to vote according to the real price. Restrict voters to vested interests in the ecosystem, reduce the possibility of voters profiting from false prices, and punish super representatives whose voting prices are outside the deviation range.

② USDD’s long-term supply and demand management method adopts multi-currency soft connection TRX to manage scarcity. In the USDD protocol, TRON’s super representative absorbs the volatility of USDD. In the short term, if the price of USDD is lower than the target, TRON will Represents minting TRX by burning USDD, prompting USDD to return to the target price .

The cost of currency contraction in the traditional financial market is borne by the central bank, and the cost of bearing currency contraction is usually paid by various financial instruments, that is, the central bank absorbs the volatility generated by the market currency. USDD transfers the responsibilities of the central bank to the super representatives in the ecosystem. In the short term, the TRX of the super representatives is diluted through minting, and in the medium and long term, the USDD protocol exchange market is rewarded and compensated .

③ The USDD protocol runs on the TRON network, and short-term fluctuations are still absorbed by TRX. TRX is the native cryptocurrency of the TRON network. At the same time, TRX is also the most direct defense measure against USDD price fluctuations. The USDD protocol uses TRX for short-term fluctuations generated by USDD. Carry out double-token peg arbitrage.

Through various algorithm methods, unstable ecological tokens replace stable coins to fluctuate, so that stable coins gain relative stability. And the simple algorithm method is easier to pass the test of various extreme market conditions. After all, the simpler the structure, the easier it is to run stably.

04

Behind USDD is a huge setting of a decentralized central bank

Let’s go back and look at the popular algorithmic stablecoin LUNA on the market. Its ultimate goal is to build a shadow bank based on the real world. There is a mobile payment product called CHAI in the LUNA ecosystem. This product can be bought, sold or consumed in the real world by paying Terra stablecoins in CHAI.

Compared with LUNA’s shadow banking dream, Justin Sun’s open letter expresses a larger vision behind USDD, that is, to establish a decentralized central bank that truly belongs to the blockchain industry, to maintain the encrypted market in the conflict between centralization and decentralization in the future. stability. Therefore, when TRON DAO decided to issue USDD, the TRON DAO Reserve was established simultaneously.

This has also become a natural advantage of USDD. TRON has the most powerful transfer system and experience in the blockchain market. In the era of blockchain transfer 1.0, USDT transfers through the Omni chain, and the transfer time of the entire stablecoin takes a long time. It takes more than 30 minutes, and the cost is extremely high. It often costs 100 US dollars to complete the transfer. The daily capacity of the overall blockchain is compressed to 200,000 transactions per day.

In the era of TRON’s USDT-based blockchain transfer 2.0, USDT has migrated to the TRON blockchain across the ages, with an independent decentralized clearing layer. The transfer time is reduced from 30 minutes to less than one second, and the cost is reduced by The US$100 is compressed to the cent level, which is close to zero. The number of transactions per day of the overall blockchain has jumped to 10 million transactions per day, and the total amount of liquidation in a single day has exceeded US$10 billion.

And Justin Sun will push the stablecoin payment to the blockchain transfer 3.0 era after the launch of USDD. USDD will continue to maintain the high-speed, low-fee, and high-scale model standard of USDT in the 2.0 era, but the stablecoin itself does not Relying on centralized institutions for redemption management and reserves , it is completely decentralized on the chain, and is linked to the standard currency TRX on the chain for decentralized anchoring and issuance.

05

The source of firepower for USDD’s future outbreak: the absolute advantage of consensus and liquidity

Traditional pegged stablecoins stabilize their own value by anchoring traditional legal currency assets. Algorithmic stablecoins need to use their own algorithms to maintain the same value as the anchored assets. Mortgage stablecoins transfer all the liquidity generated by themselves to traditional In the financial market, algorithmic stablecoins preserve liquidity in the digital currency market, which is more beneficial to the long-term development of the market.

Algorithmic stablecoins that preserve high liquidity also face the risk of a death spiral. When extreme market conditions occur , the prices of algorithmic stablecoins to which the pegged tokens are both dropped, and arbitrageurs and users will face the risk of rapid devaluation of their assets. , the rapid depreciation means that DeFi and other products with increased leverage in the market face liquidation risks. If the price reaches the liquidation line of some users, in the absence of sufficient consensus and liquidity, the short-term decline in price will It will change from generating arbitrage space to generating a death spiral, resulting in a downward price spiral.

The upcoming USDD may also face the same problem, but the strength of USDD is that TRON DAO is currently the world’s largest decentralized organization in terms of consensus. At present, the number of TRON network users exceeds 87 million, and the number of transfers exceeds 3 billion times, the liquidation amount exceeds 4 trillion US dollars , these TRON ecological users and ecological supporters, compared with the birth of other algorithmic stablecoins, pegging USDD to TRX makes USDD have all TRON before it even started. resources and consensus.

In terms of liquidity, at the beginning of its establishment, TRON Joint Reserve will preserve and host the USD 10 billion of high-liquidity assets raised by blockchain industry initiators as an early reserve, and will continue to absorb more liquid assets as financial reserves.

The blockchain market has gone through an era of savage growth. The process of savage growth is full of decentralized freedom and irresponsibility. When the market enters extreme conditions, this unique market will not be like the traditional financial market. There are core institutions. To protect the market, we should fully protect our own interests and make the fragile market more vulnerable in special times, whether it is the stampede caused by the extreme market conditions of 312 or 512, or the helplessness of all blockchain practitioners in the cold winter of the market. , all prove that this market needs a core similar to the central bank for liquidity regulation.

The core of the blockchain market is decentralization, but it does not mean that the existence of core institutions cannot be accepted . Algorithmic stablecoins are the most likely to compete for the core generation similar to the Fed in the current market. DAO is a good way, and the core is also It does not mean that there can only be one. The central bank with a multi-core decentralized governance algorithm may bring higher security and capital efficiency to the market. The blockchain is also gradually developing from a market full of trials to a market with huge potential. stable market.

This article is reprinted from: https://www.hellobtc.com/kp/du/04/3934.html

This site is for inclusion only, and the copyright belongs to the original author.