This is another big topic that has been planted for a long time: combing all the core product pipelines of the world’s top big pharmaceutical companies, and regularly updating the progress . The starting point is very simple. After all, MNCs have the most powerful resource network and decision-making wisdom in the global pharmaceutical industry. The direction they choose with real money has a higher probability of being in line with the laws of technological progress (of course, this does not mean that they The decision-making must be correct, and it does not mean that these decisions can be effectively implemented), especially in various occasions, such as “big A pays more attention to x technology” and “B’s thigh leads the y target” Such statements (of course, most of them are to put gold on their own faces), naturally, I want to systematically understand, in the discourse system of big pharmaceutical companies , what direction is being done , progress is made, and worth looking forward to. , so that we can have a more comprehensive and intuitive basis for judging what the so-called ” mainstream technology direction ” is.

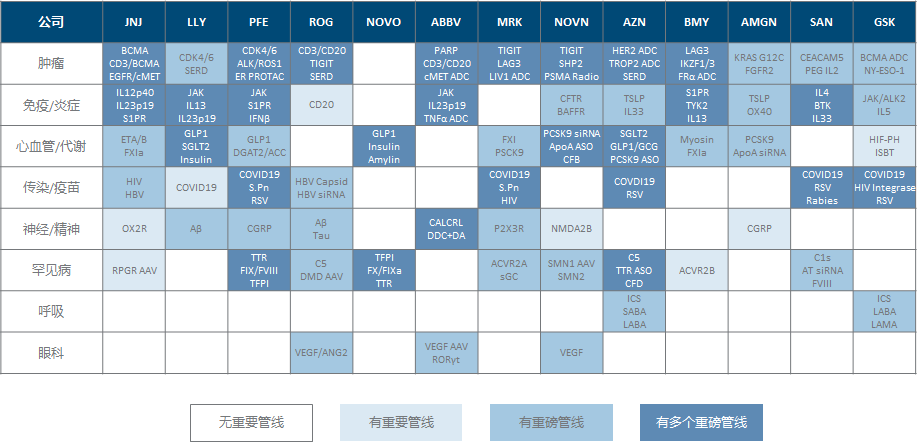

First, the direct perception: they are also big pharmaceutical companies, but the differences in strategies, directions, diseases, pipelines and other dimensions are also visible to the naked eye, which also directly leads to the very different sources and growth trends of each company in recent years . Therefore, it is estimated that Value levels will show a sharp contrast between Lilly at up to 50x P/E and Pfizer at less than 10x P/E. This also means that even on some fundamental trends in the industry, the smartest brains in the global medical field have failed to form a broad consensus, and the consensus that was once formed may be slapped in the face at any time, which cannot provide us with a reliable judgment. Weather vane .

0. Data Declaration

The definition of global big pharmaceutical companies is that there are 13 pharmaceutical companies with a current market value of more than 80 billion US dollars (originally they wanted to simply stick to the line of 100 billion, but they couldn’t bear to leave the distressed Phoenix GSK, so they lowered the threshold).

Listed products include those with a large revenue contribution (annual sales of more than 1 billion US dollars), those still in the growth or stable period (basically not considered for those approved for more than 10 years), and those still in active development (important indications underway) Extended clinical trials); the clinical pipelines under development are combined with the R&D progress update chapters of the annual report and quarterly reports, R&D days and important meeting presentation materials and the company’s daily information disclosure, so it can be understood as the pipeline that the company considers the current higher priority. , instead of covering the entire pipeline.

The preliminary plan is updated every six months (first dig a big hole for yourself), including changes in market value and revenue and profit in recent quarters (multi-core companies only take the pharmaceutical sector), the most important approval progress and clinical data release in half a year, and important milestones in the near future.

1. Johnson & Johnson

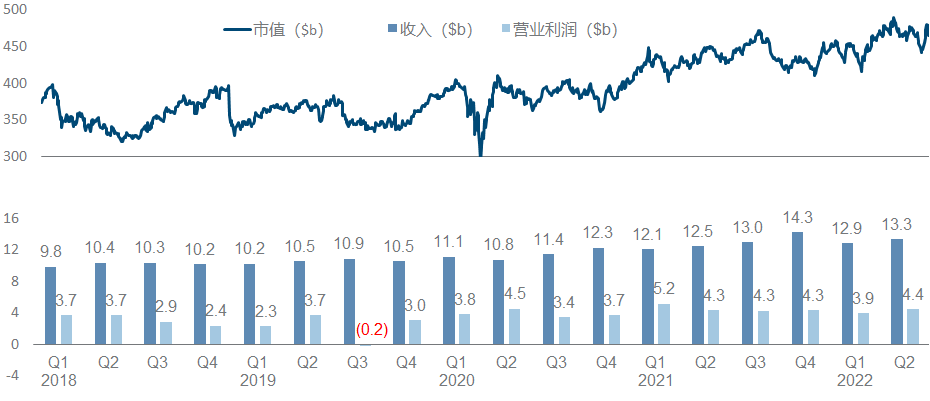

As the world’s largest pharmaceutical company by market value, Johnson & Johnson has maintained a relatively positive trend in the past three years. The single-quarter revenue of the pharmaceutical sector has steadily climbed from 10 billion to 13 billion, and its market value has steadily climbed from 350 billion to 450 billion.

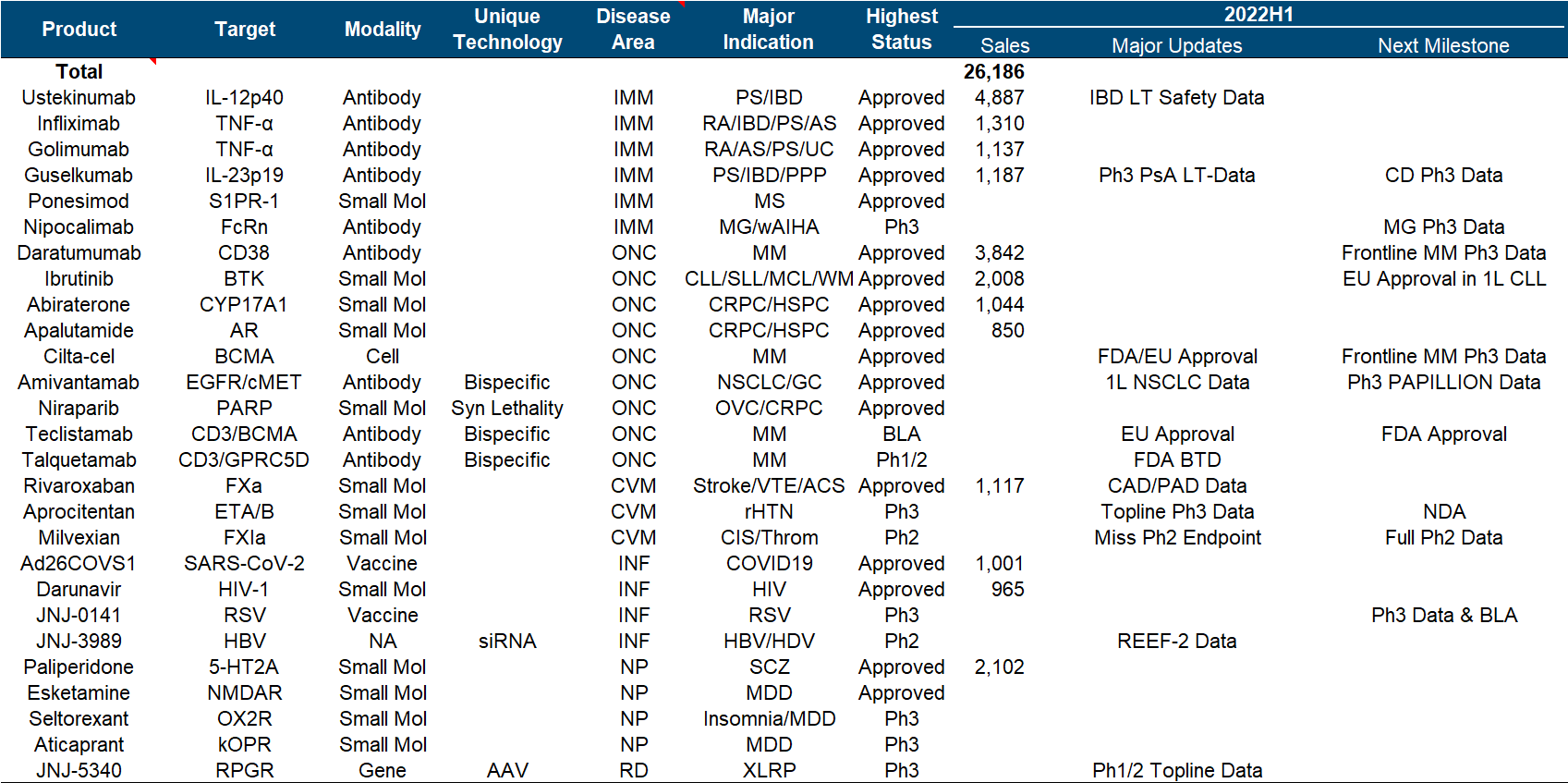

In terms of product pipeline as a whole, Johnson & Johnson can be said to be the one with the most balanced status and the least missed opportunities among major pharmaceutical companies. Major disease areas such as tumor/immunity/cardiovascular/infectious disease/neurology, small molecule/monoantibody/double-antibody/cell/ Technology paths such as gene/nucleic acid, IL12/TNFα/CD38/BTK/BCMA and other hot targets are all covered by the layout, especially the overweight varieties of Ustekinumab/Daratumumab/Guselkumab/Ibrutinib in the field of tumor and immunity. Still in the “year of fighting”.

In the follow-up pipeline, Johnson & Johnson is also not satisfactory. In addition to renewing the life of the heavyweight and expanding indications in hand, the company has two most anticipated R&D focus directions. One is the multiple myeloma therapy composed of the legendary CAR-T and two CD3 double antibodies . (Especially in the constant march to the front), the second is the factor XIa inhibitor from BMS .

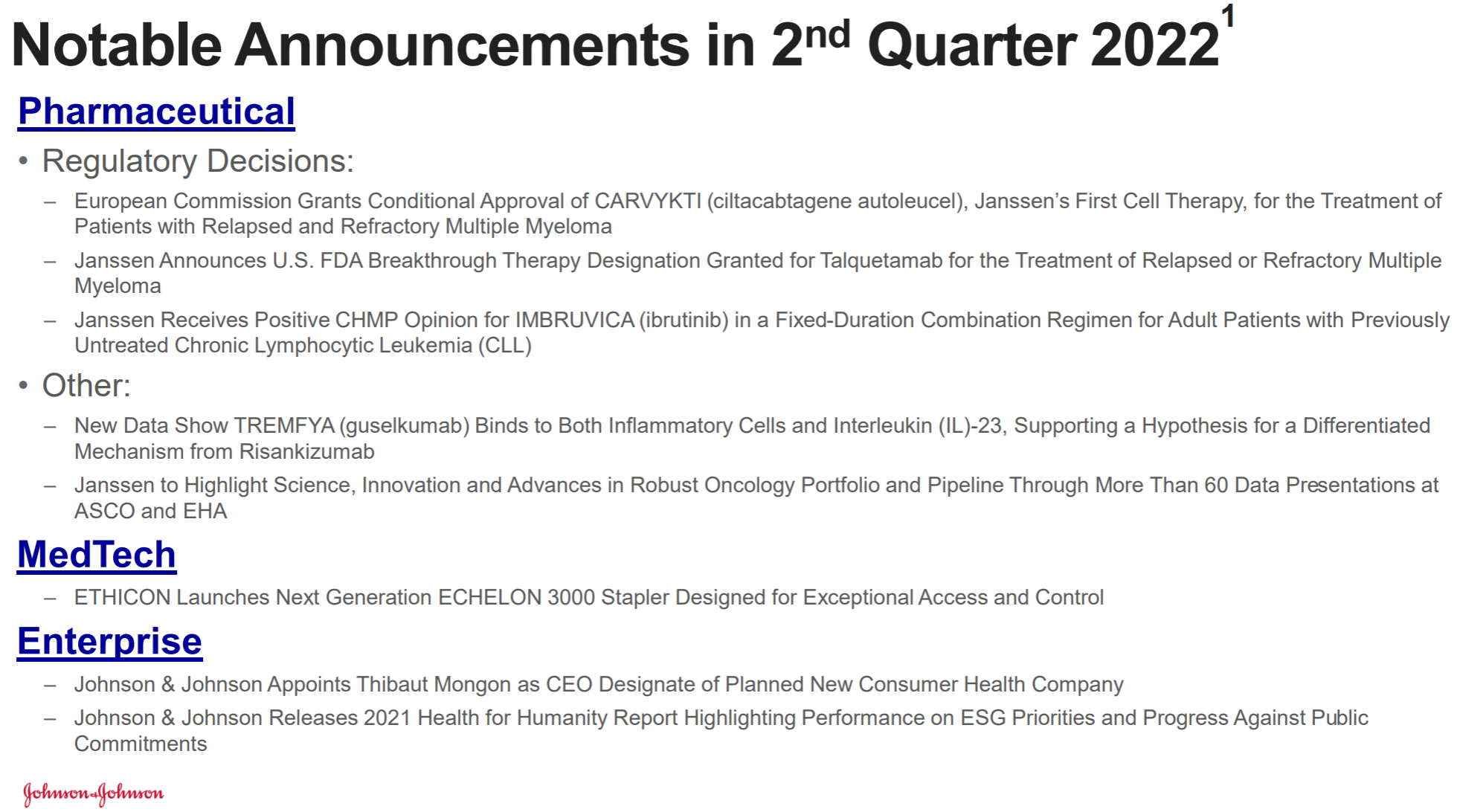

The most important developments this year include the approval of Cilta-cel in the United States and the European Union, the approval of Teclistamab in the European Union , the disclosure of Phase III topline data by Aprocitentan , and the combination of the siRNA drug JNJ-3989 and the capsid inhibitor JNJ-6379. Published Phase II data for the treatment of HBV, and published Phase I/II data for the treatment of XLRP with AAV vector gene therapy JNJ-5340.

2. Eli Lilly

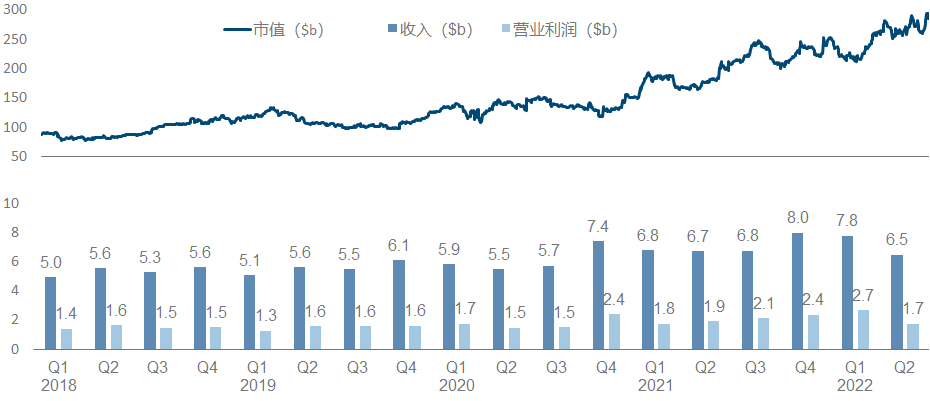

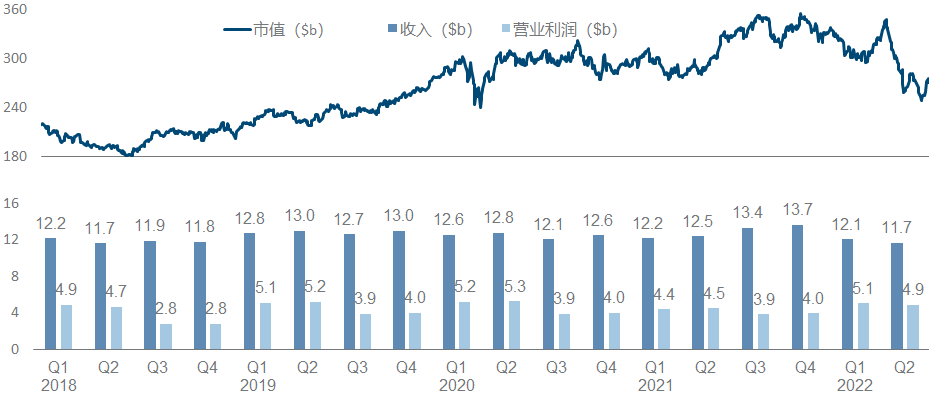

Eli Lilly is undoubtedly the light of pharmaceutical companies in recent years. It has almost appeared in the top ten positions of most heavily-held medical funds. Its market value has soared from less than 100 billion to nearly 300 billion. It can be said that it is the best performance of the whole industry.

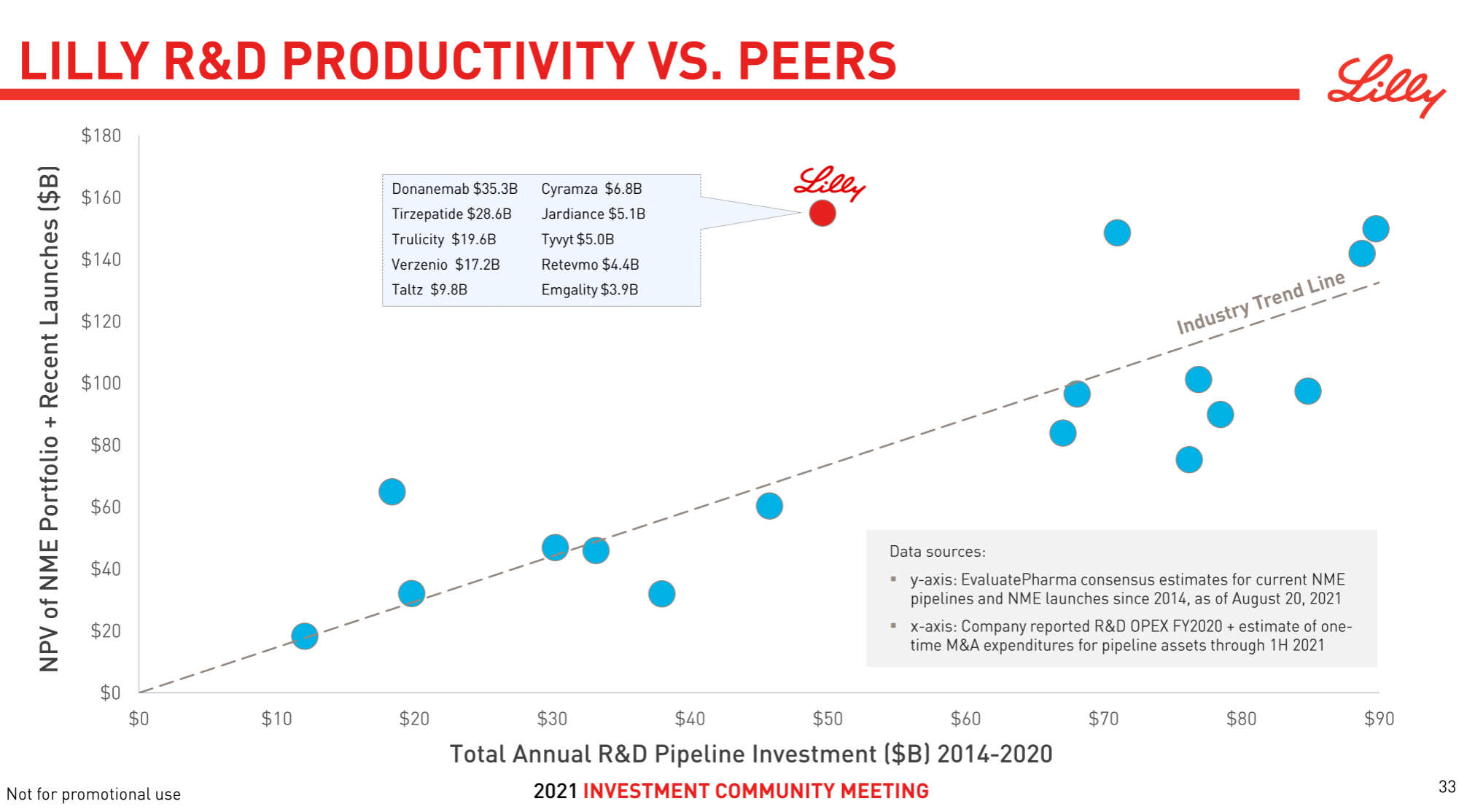

Eli Lilly’s strategy over the years has been typical of pragmatism . In addition to seldom buying assets, it also seldom takes risks to compete for the FIC highland. It is more of a “following” role, but it has often been able to mix up non-FIC/BIC heavyweights. Pound varieties, among the most powerful VC targets in more than a decade, CDK/PD-1/IL-17/IL-23/JAK/SGLT-2/GLP-1/DPP-4/Aβ (crossed out) one Large skewer, it seldom rushed to the front, but all had the meat. At this time, I can’t help but want to post this picture with strong visual impact, which I would like to call “peerless and independent”.

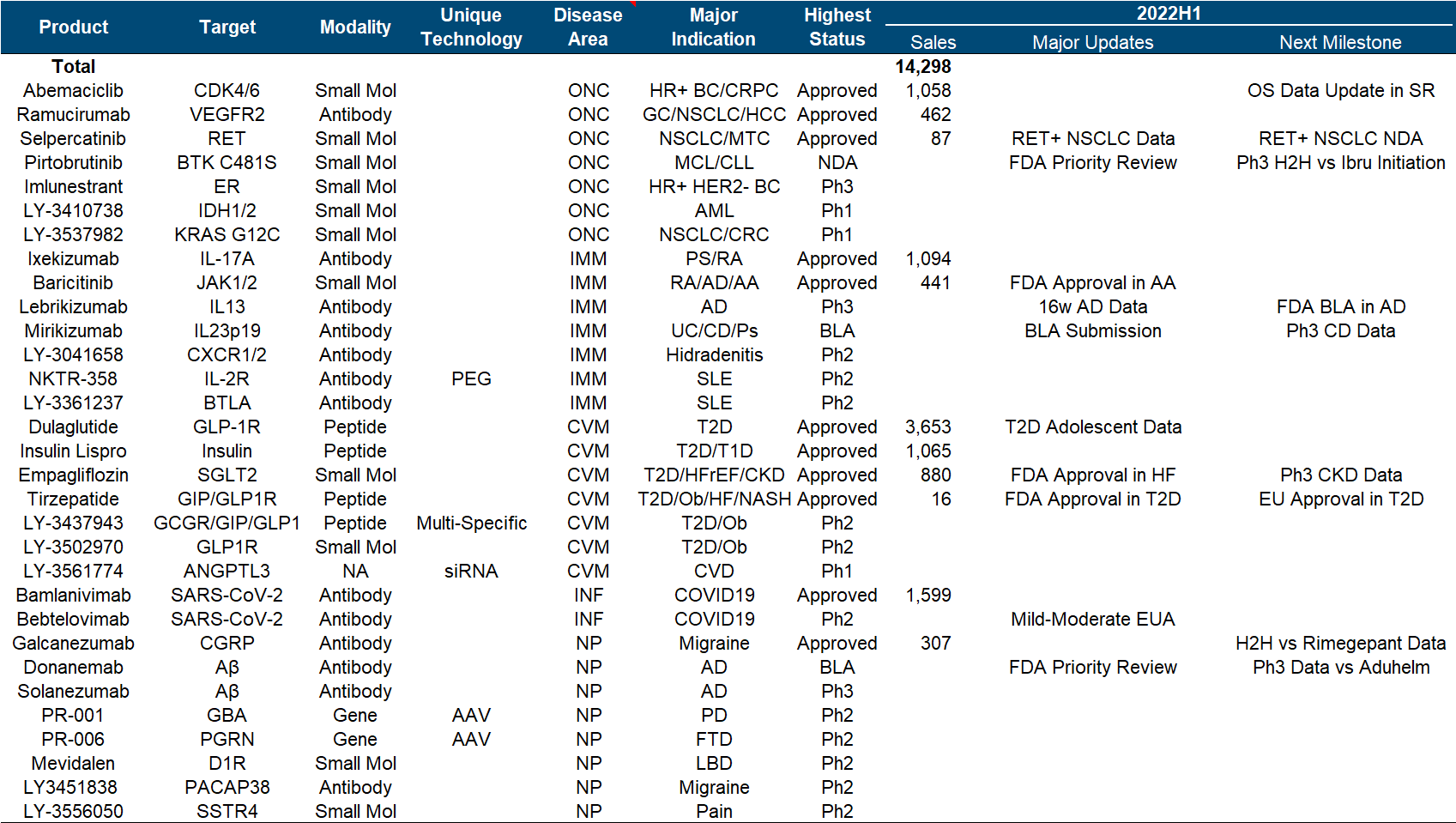

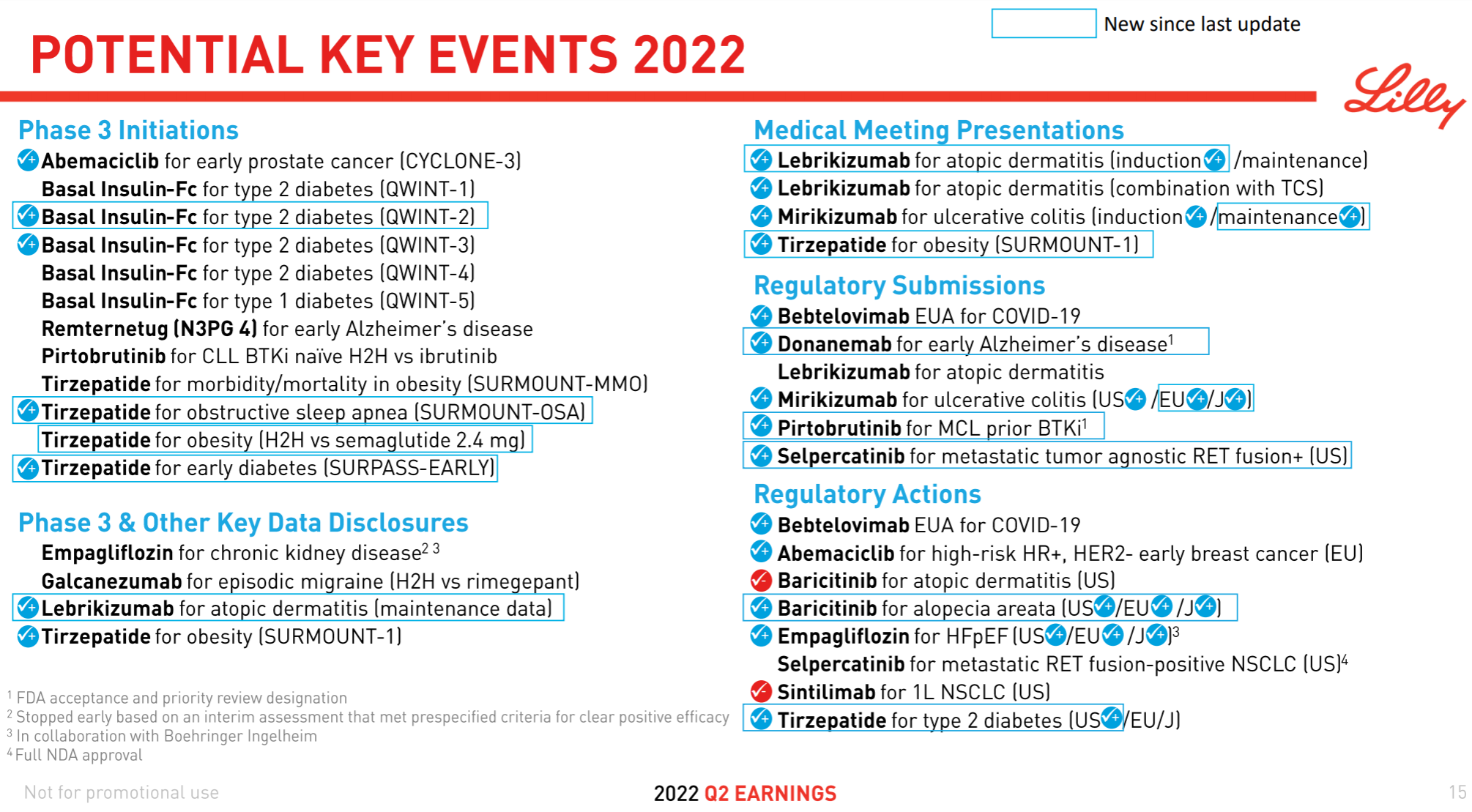

Since the beginning of this year, Eli Lilly has made a number of major pipeline developments in the shock industry, including the FDA approval of Tirzepatide , Empagliflozin’s new indication for heart failure and the end of Phase III CKD clinical trials that reached the end point , and Baricitinib’s new indication for alopecia areata . There are AD Phase III data of Lebrikizumab, Mirikizumab submitted BLA, etc.

3. Pfizer

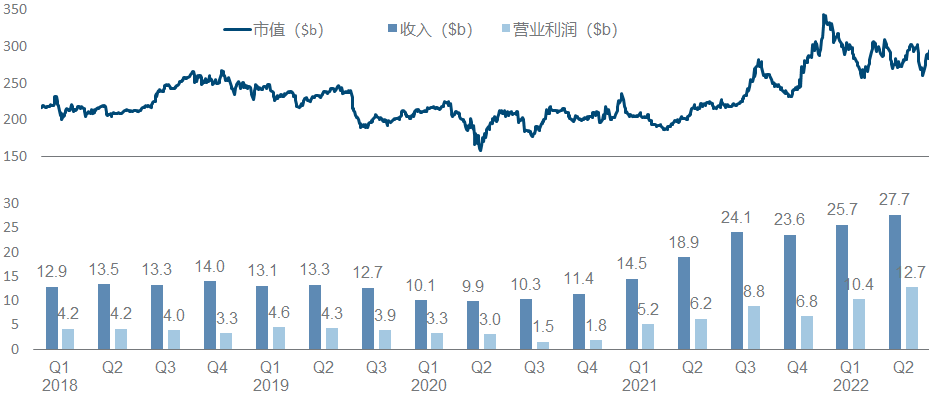

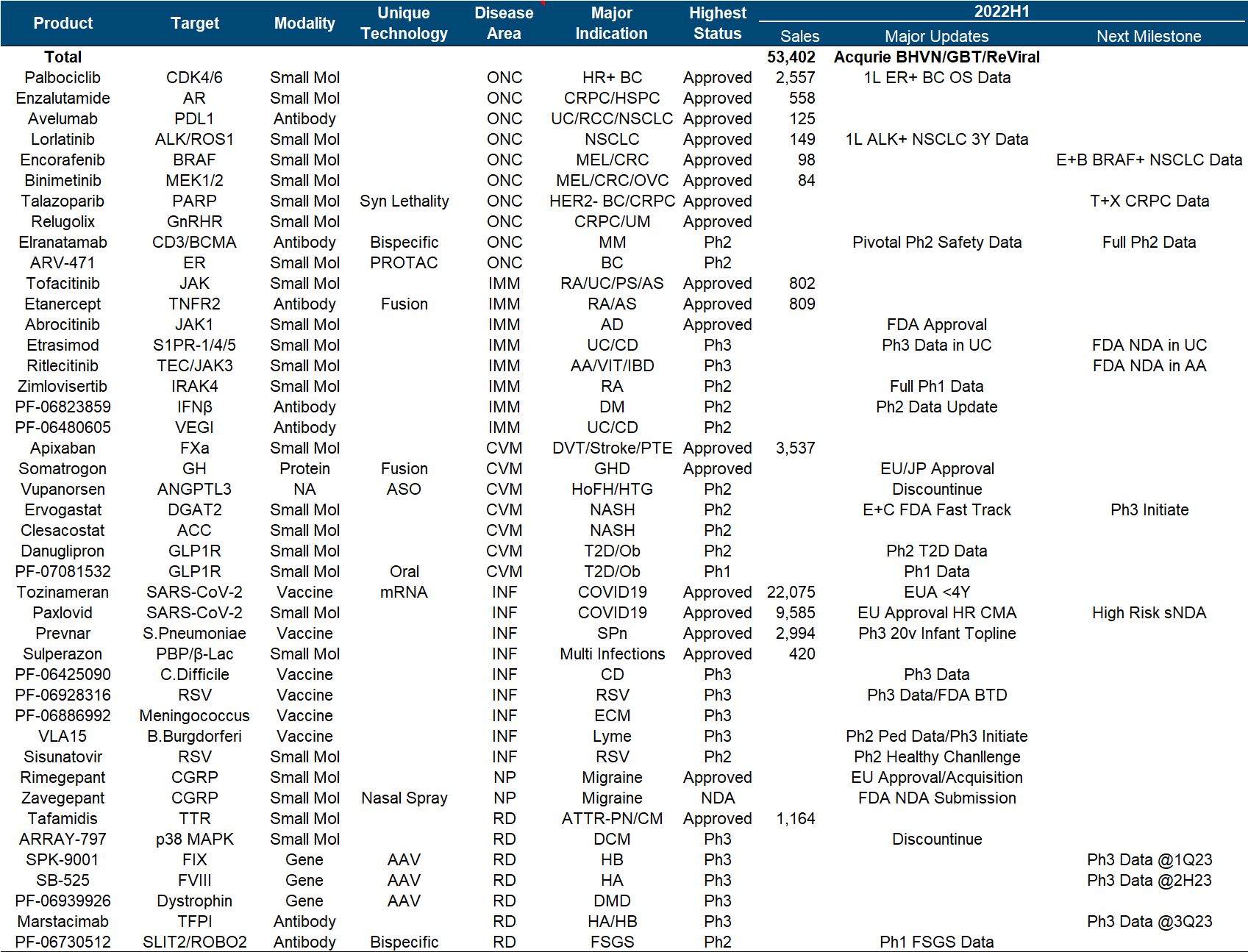

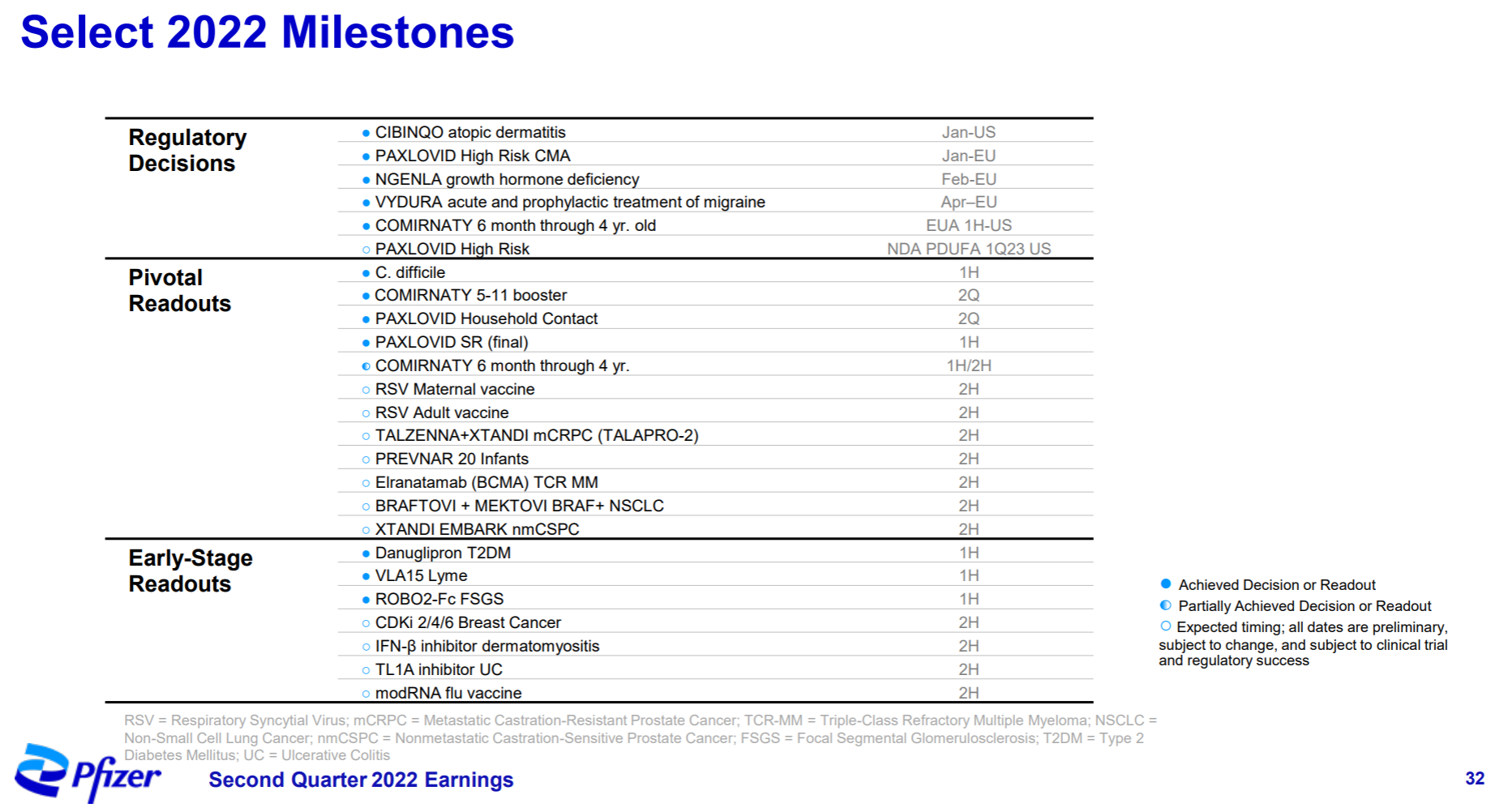

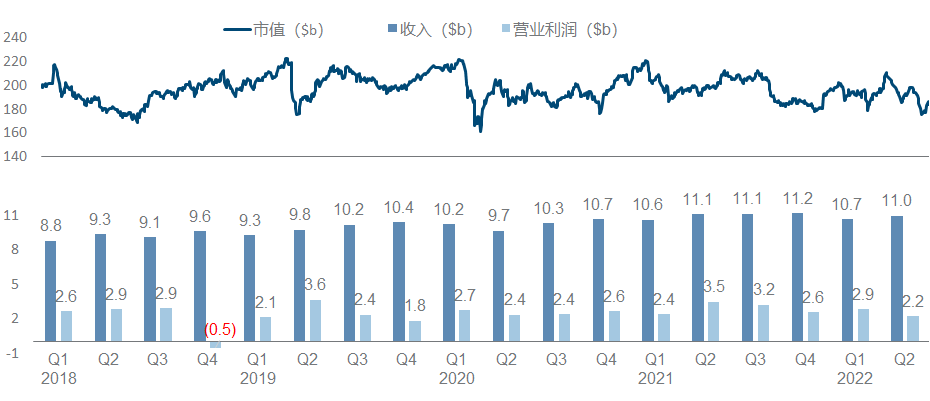

Pfizer, once the largest manufacturer in the universe, has been embarrassed for more than ten years. If it hadn’t recovered a certain position with the new crown oral drugs and vaccines, its performance growth would not be optimistic, and its market value would hover around 200 billion.

What’s more terrible is that since 2020, more than half of the research and development progress in Pfizer’s quarterly report is basically related to the new crown. The main progress this year is in autoimmune diseases, including FDA approval of Abrocitinib, Etrasimod’s release of UC Phase III data , and two early data of Phase I of oral GLP-1 and Phase II of IFNβ antibody. At the same time, the development of ANGPTL3 ASO from Ionis and the p38 MAPK small molecule from Array have been clearly stopped, and gene therapy such as hemophilia and DMD has been quiet for a while.

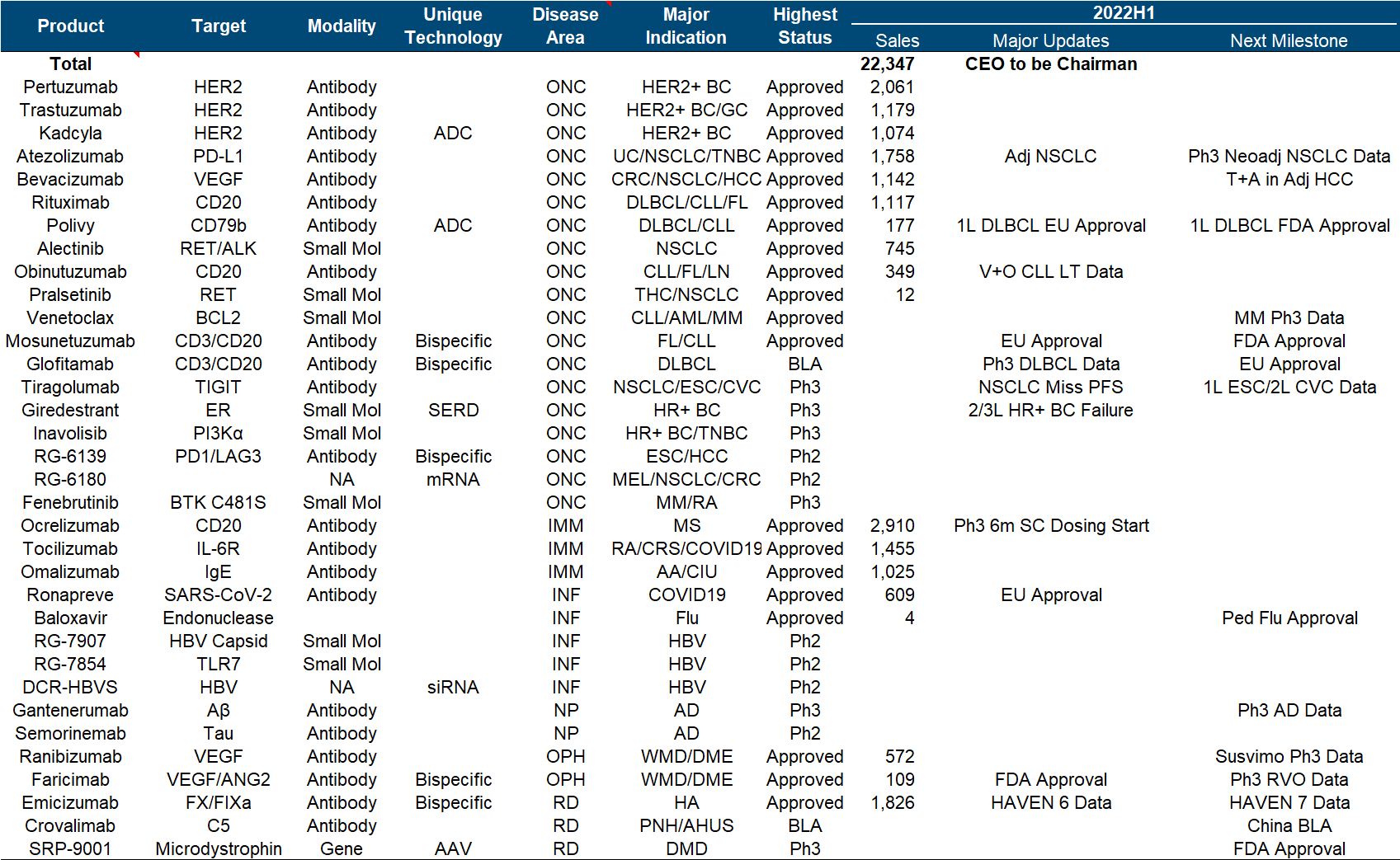

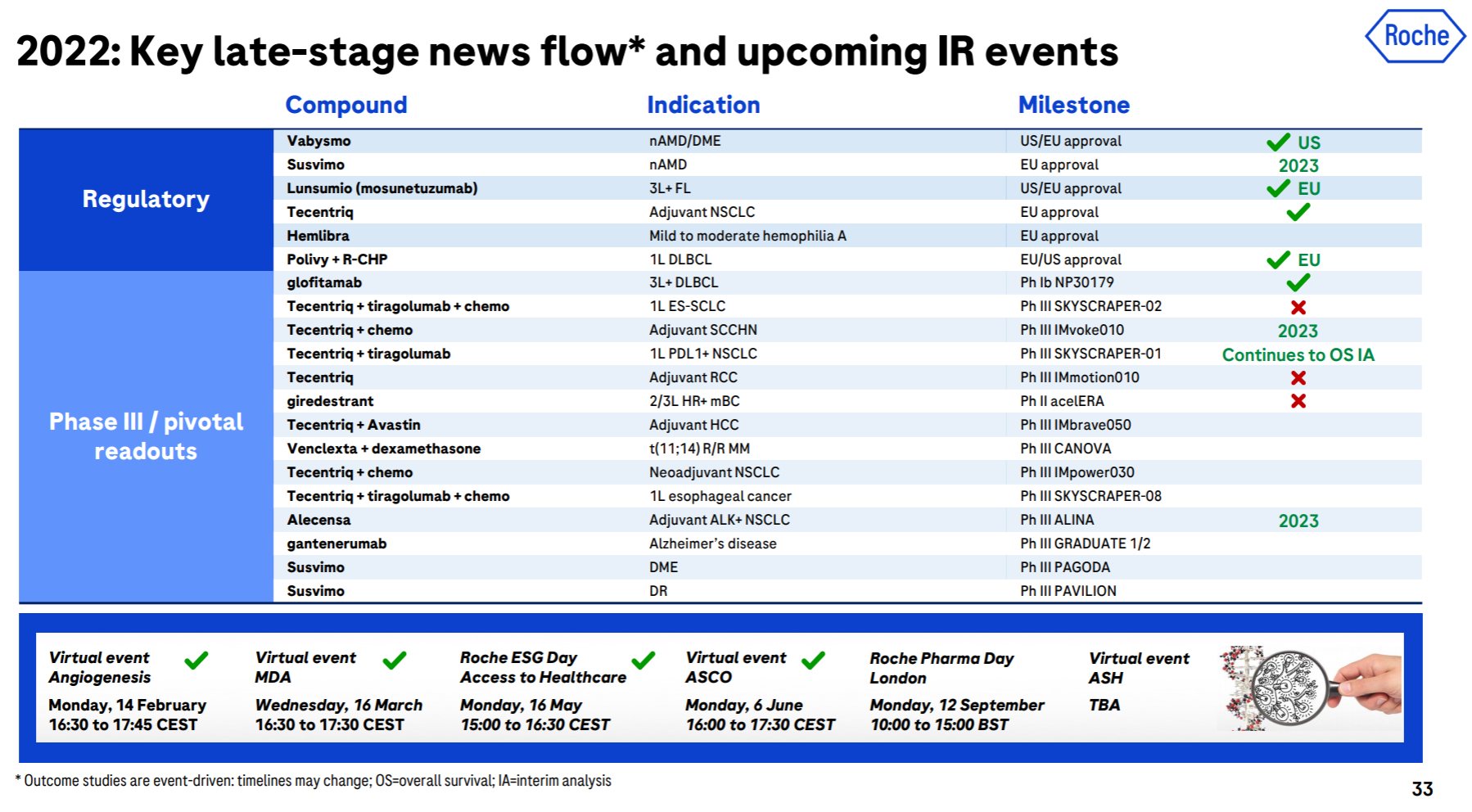

4. Roche

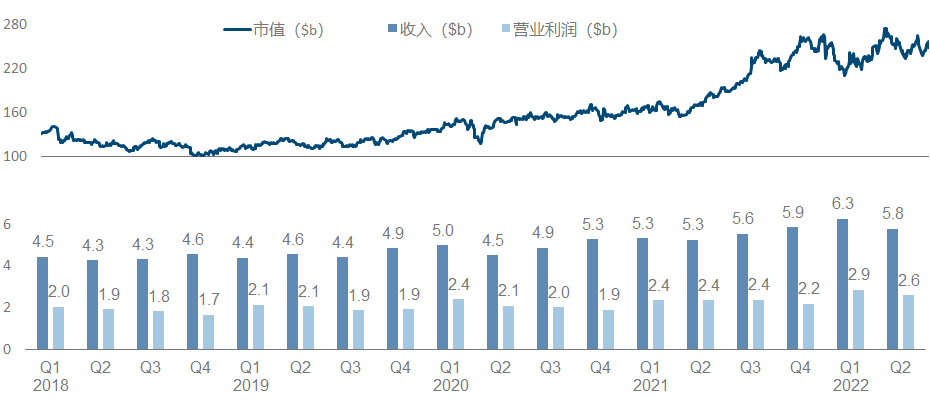

The pharmaceutical segment of the tumor giant Roche has not had a good time in recent years. The traditional advantageous varieties have been impacted by the biosimilar wolf pack, making the performance growth difficult, and the market value is mainly driven by the diagnostics segment.

The brilliance of Roche and Genentech is undoubtedly shining in the annals of history. Let’s look at the top six in the product list (which one is not white on the temples, which one is not the pillar of the imperial court, which one is not the family of my sons and daughters… cross out), but the next generation is with it. In comparison, the successor is obviously weak. Although the CD79b ADC and hemophilia dual antibody approved in the past few years are also promising, it is really not enough to fill in the performance pit of such a size as the “proper combination”. TIGIT and SERD , which were originally high hopes, have been bad news recently. Tiragolumab failed to reach the third-phase PFS endpoint of NSCLC , and Giredestrant’s second-phase clinical trial also failed .

In addition to these disappointments, the major positive developments this year include the FDA approval of Faricimab, the EU approval of Mosunetuzumab, and the EU approval of Polivy’s first-line DLBCL indication .

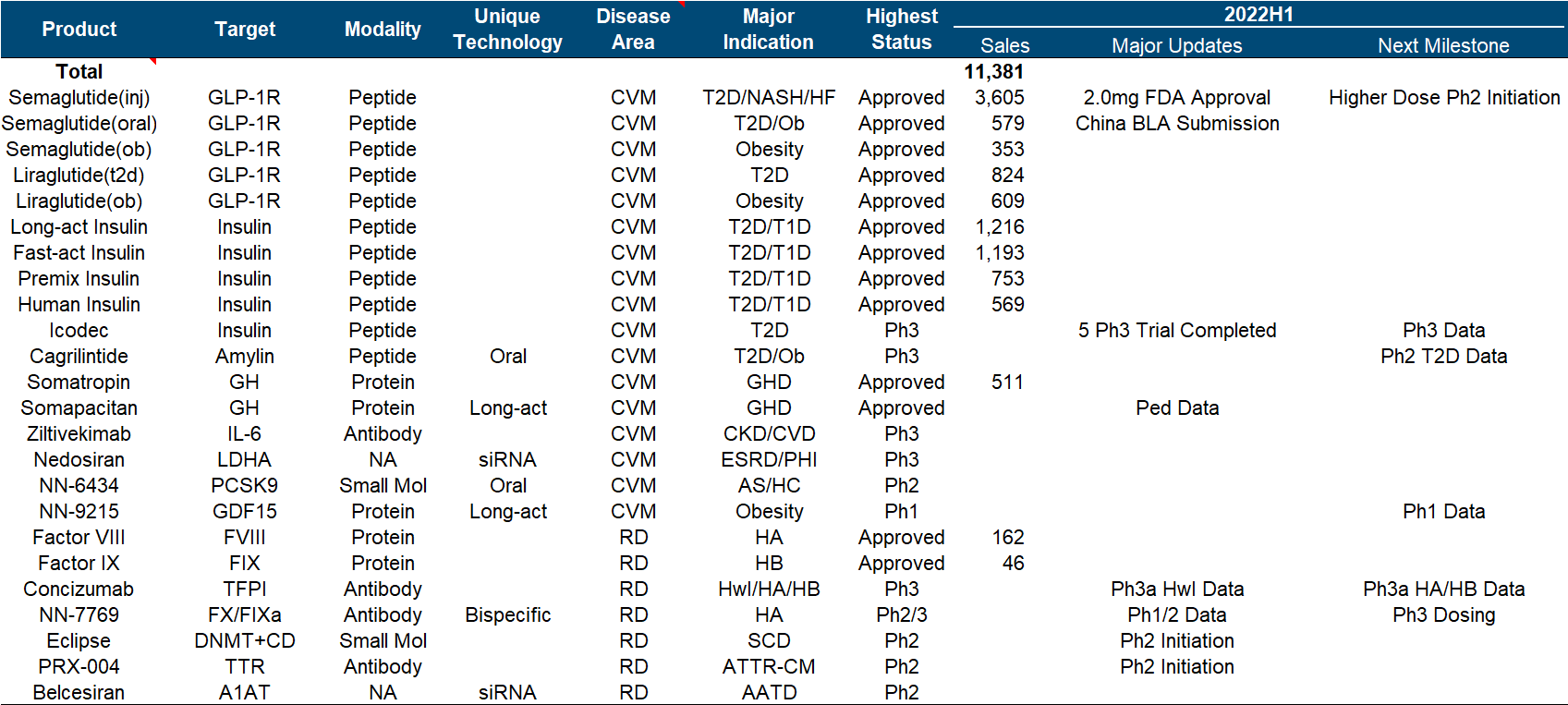

5. Novo Nordisk

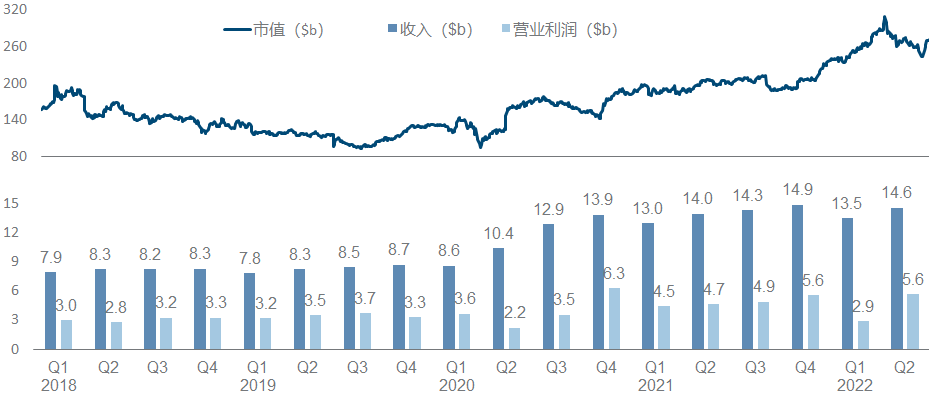

Similar to Eli Lilly, Novo Nordisk is also the darling of large funds in recent years. However, it is more inspirational in comparison. It almost relies on metabolizing a field, or even more directly, GLP-1 alone, to increase the market value from 100 billion raised to 250 billion.

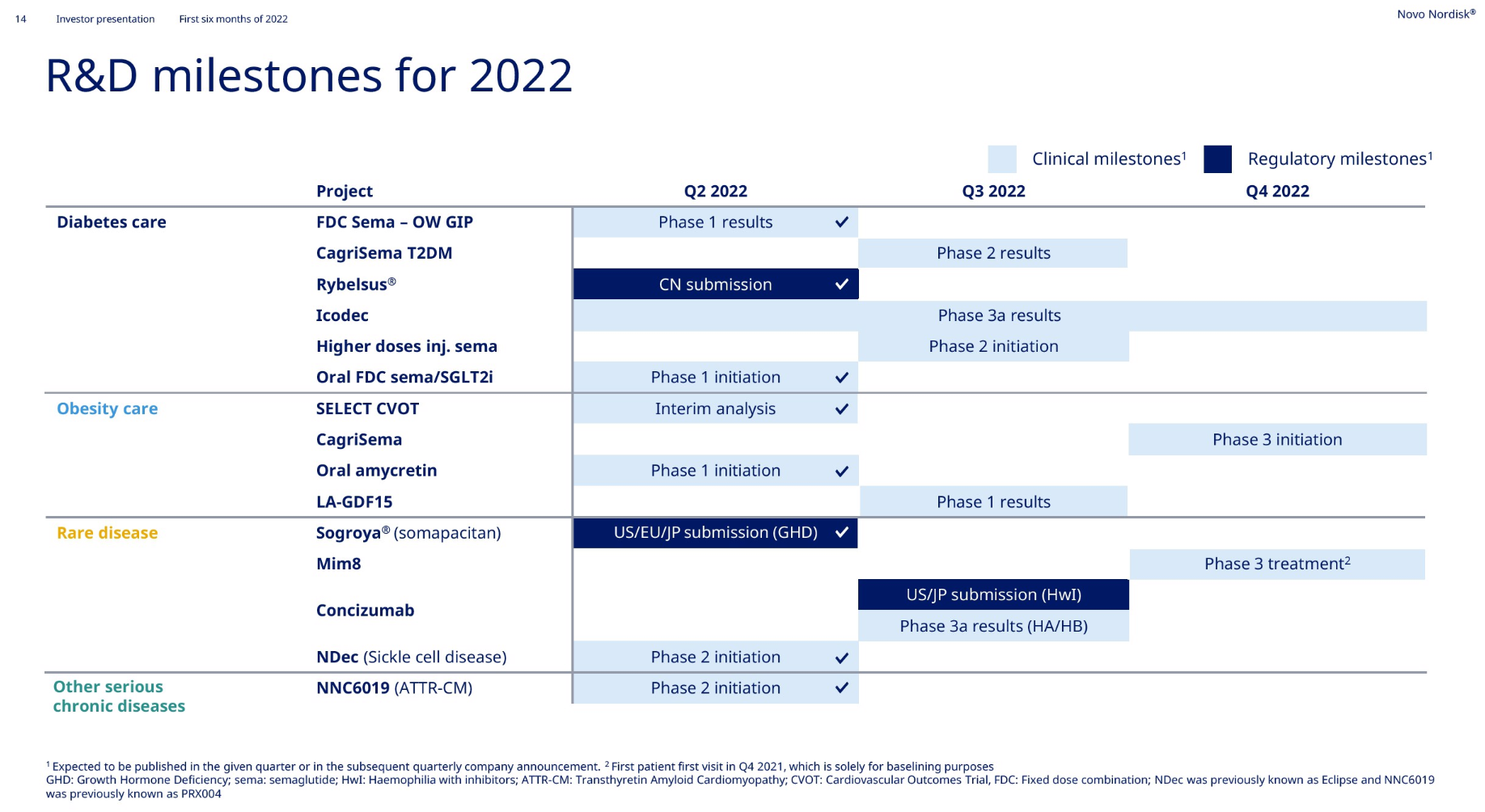

Under this imposing market value, the progress of the product pipeline can be described as monotonous and boring. In addition to the expansion of different indications/dosage forms/strengths/compounds and combinations of semaglutide, other major developments include Icodec insulin has completed multiple Phase III clinical trials , Concizumab has announced positive Phase III clinical data , and NN-7769 has announced Phase I/II Phase clinical data .

6. AbbVie

AbbVie is a wonderful flower in the development model of pharmaceutical companies. With the money from selling overweight drugs such as “Pharmaceutical King”, it bought Allergan and filled in a bunch of medical beauty and ophthalmology content in the income. It doubled its market value in the next two years.

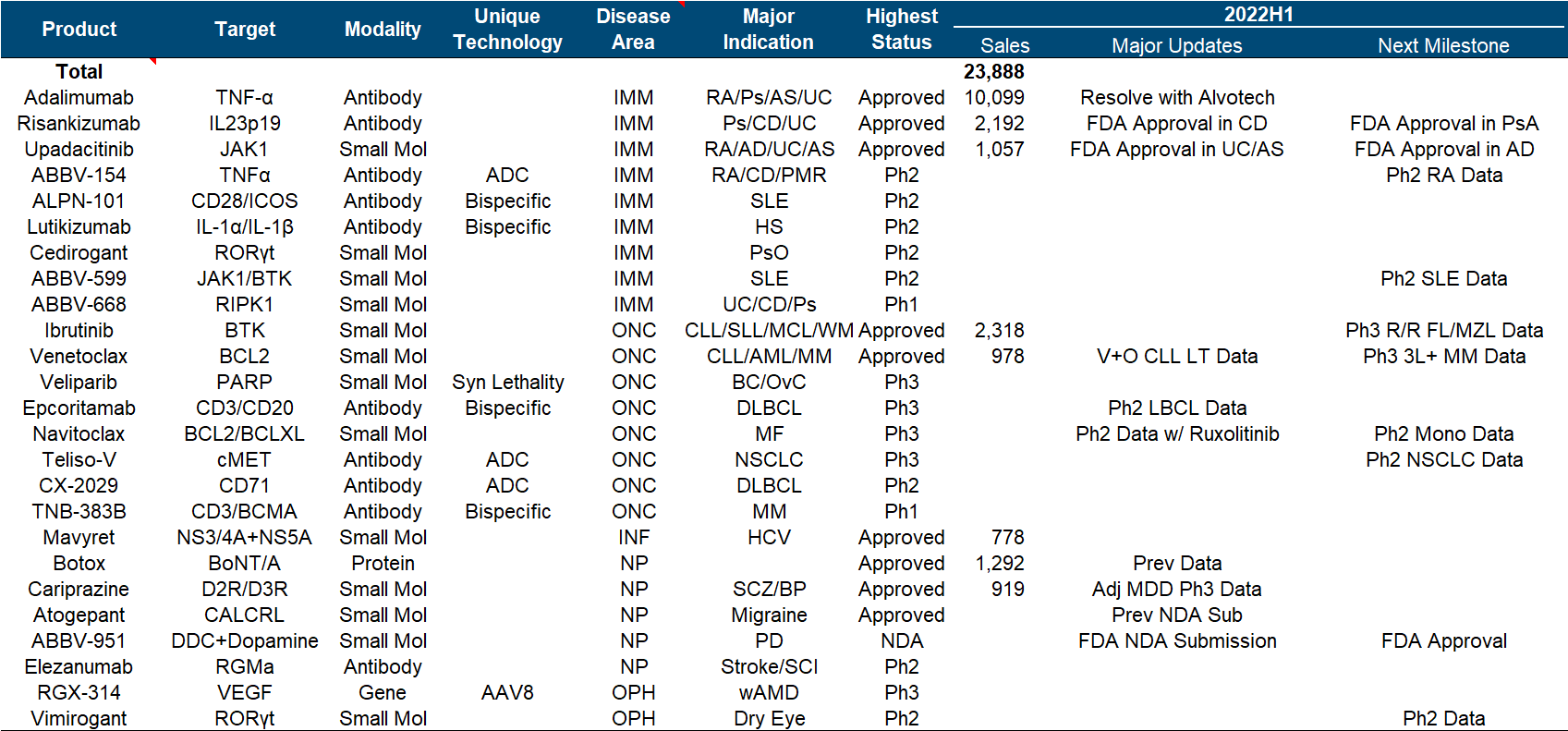

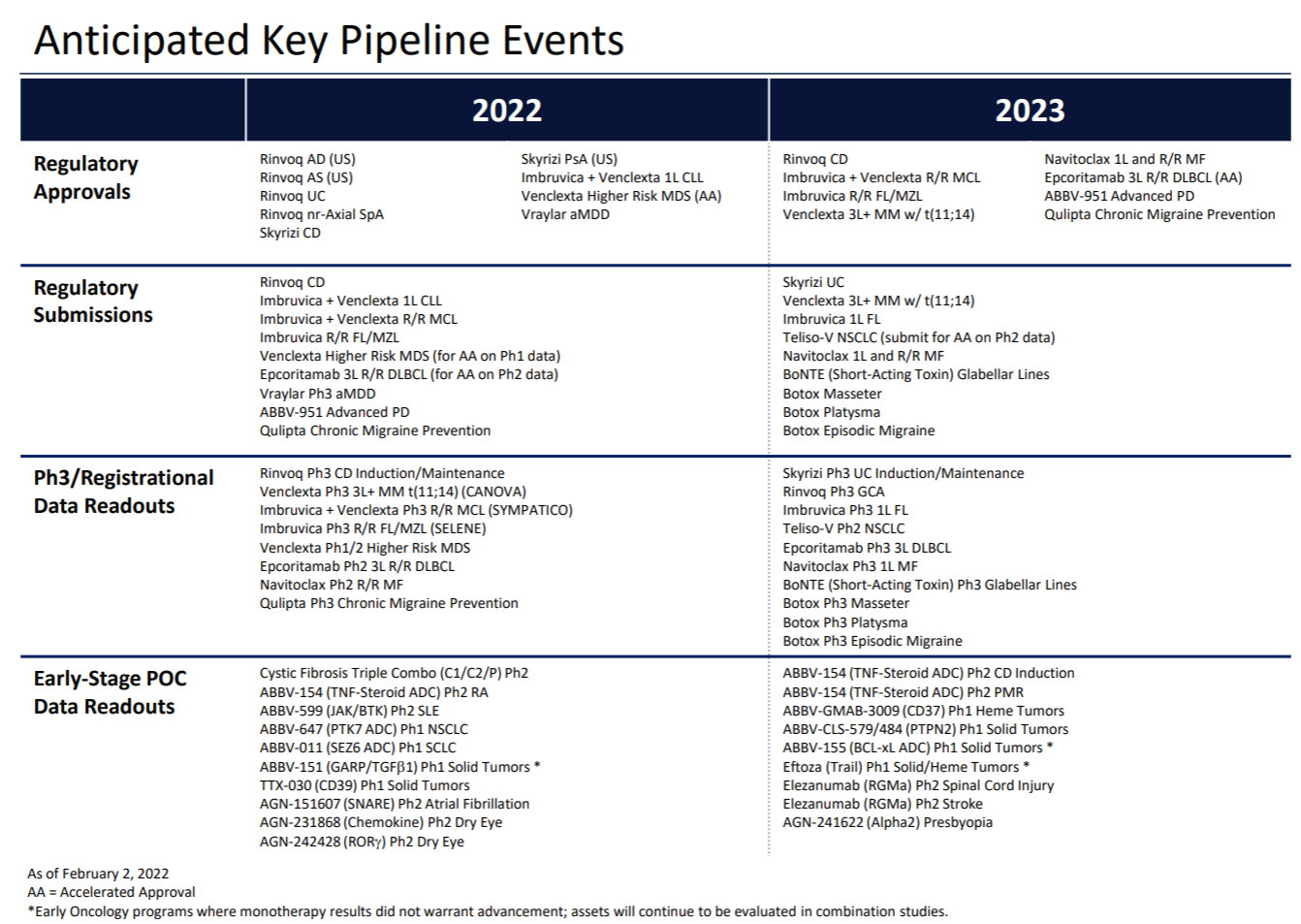

In the product pipeline, in addition to the two big monsters Adalimumab and Ibrutinib, the fields of tumor and immunity are also quite interesting. Upadacitinib’s UC and ankylosis indications and Risankizumab’s CD indications have been approved by the FDA, and Epcoritamab has announced Phase II data; in addition , neurologic drugs are another active front, with both Atogepant’s migraine prevention indication and ABBV-951 submitting NDAs.

7. Merck & Co.

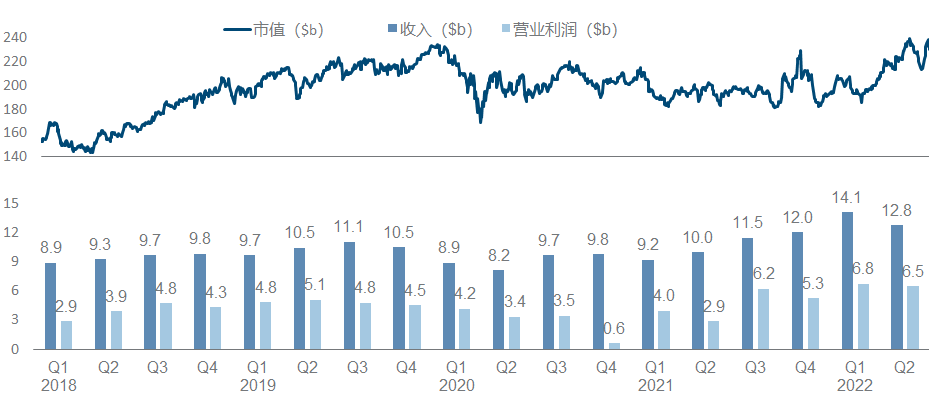

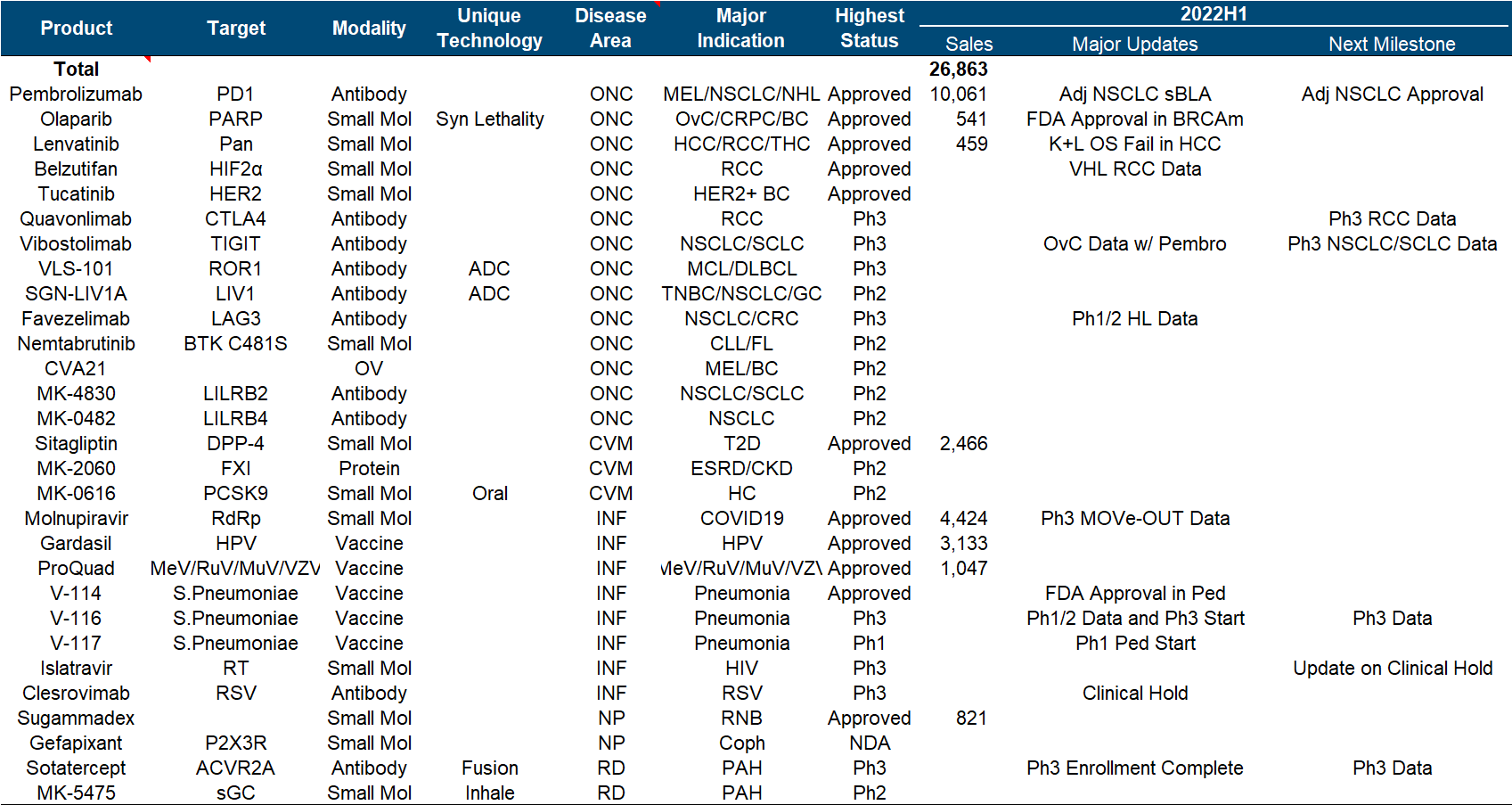

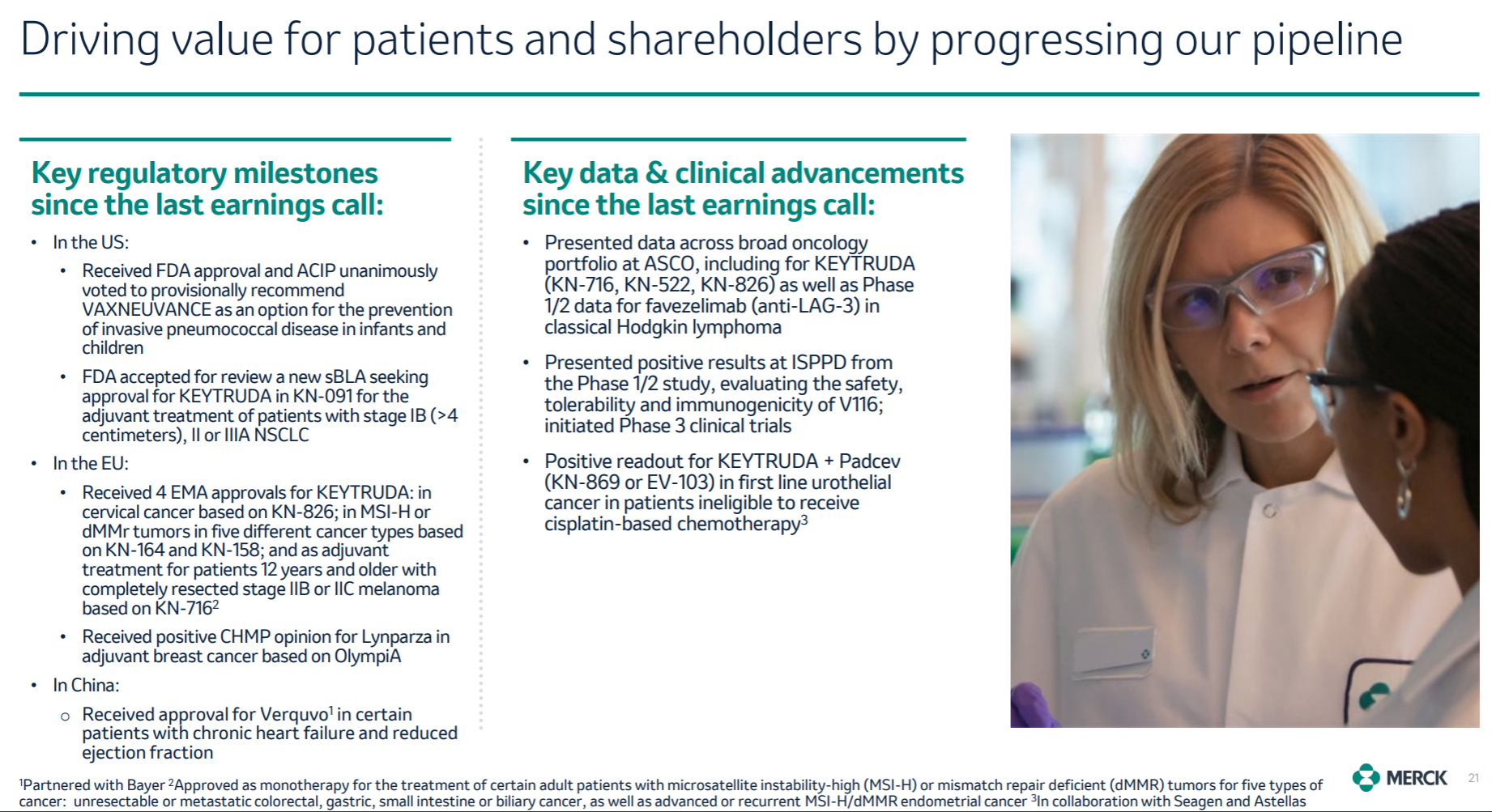

In recent years, Merck has been regarded as a successful K drug and a failed K drug. Not to mention that it continues to refresh its peaks, the HPV vaccine and Molnupiravir have both brought good new growth points. However, it is the K drug, which is a huge potential patent cliff pressure. As a result, the market value has fluctuated around 200 billion for a long time.

More than half of the product pipeline is based on various expansion indications and combination regimens of K drug. What is more noticeable is the clinical failure of K drug combined with Lenvatinib in the treatment of HCC . Other important developments include pneumonia vaccine V- 114 was approved for use by children, V-116 released the second phase data and launched the third phase .

8. Novartis

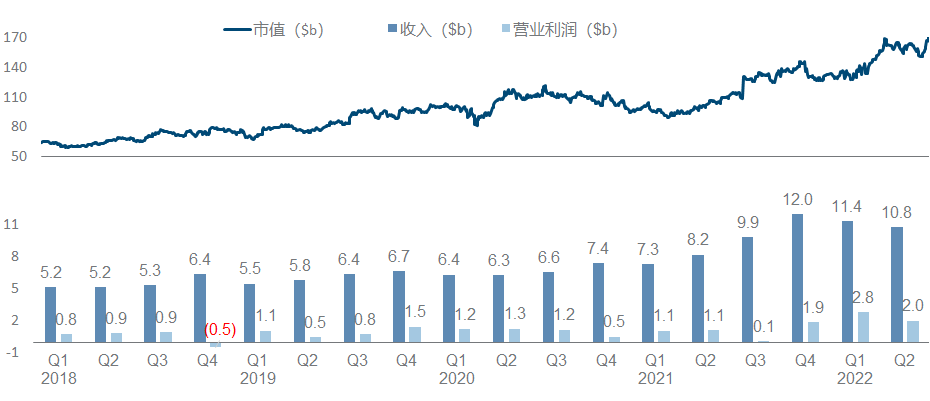

Although Novartis is a strong contender for the top spot in the pharmaceutical sector in terms of revenue, its growth and market value have been very bleak in recent years. On the one hand, it has almost never received the new crown dividend. Seems to have little effect.

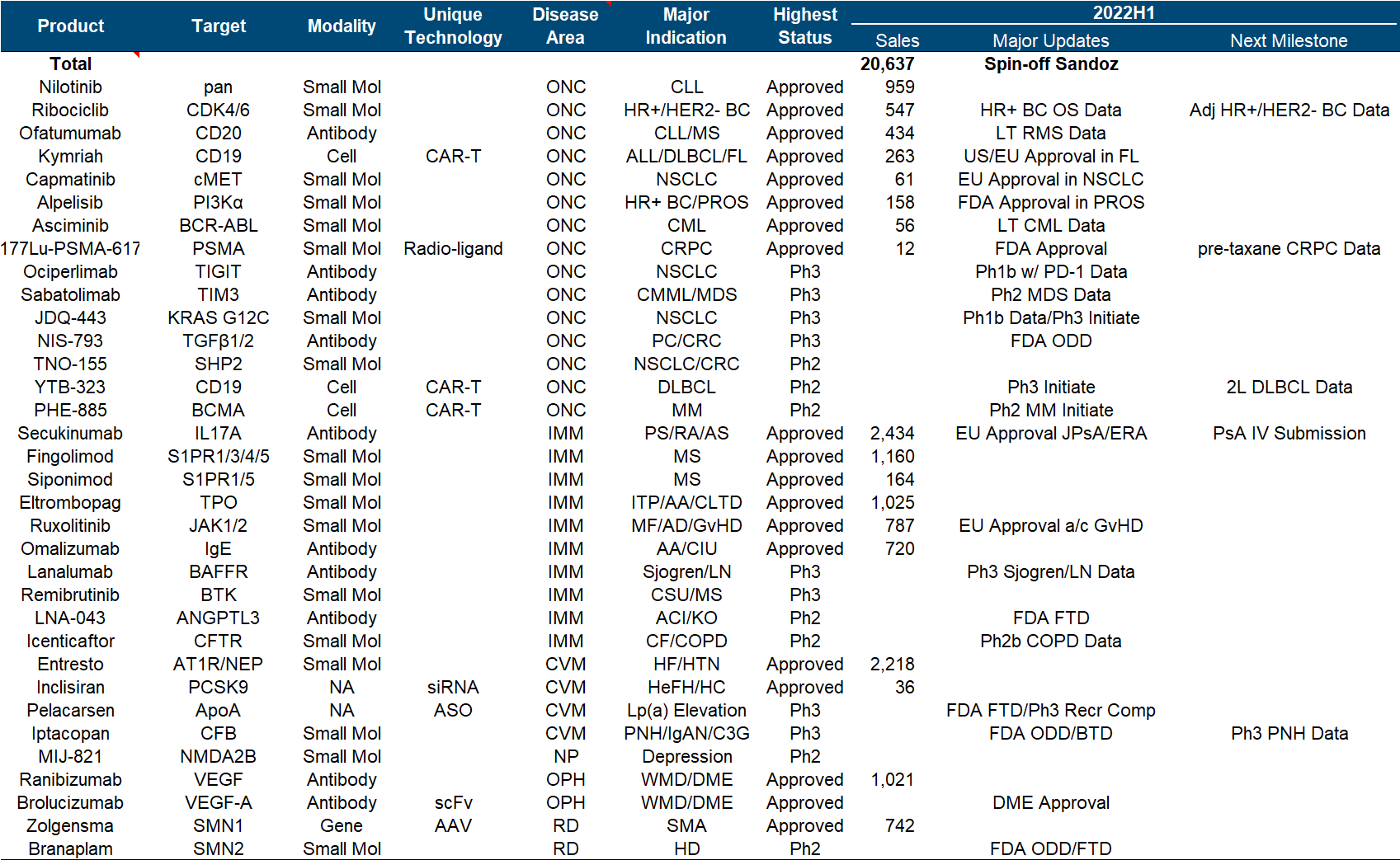

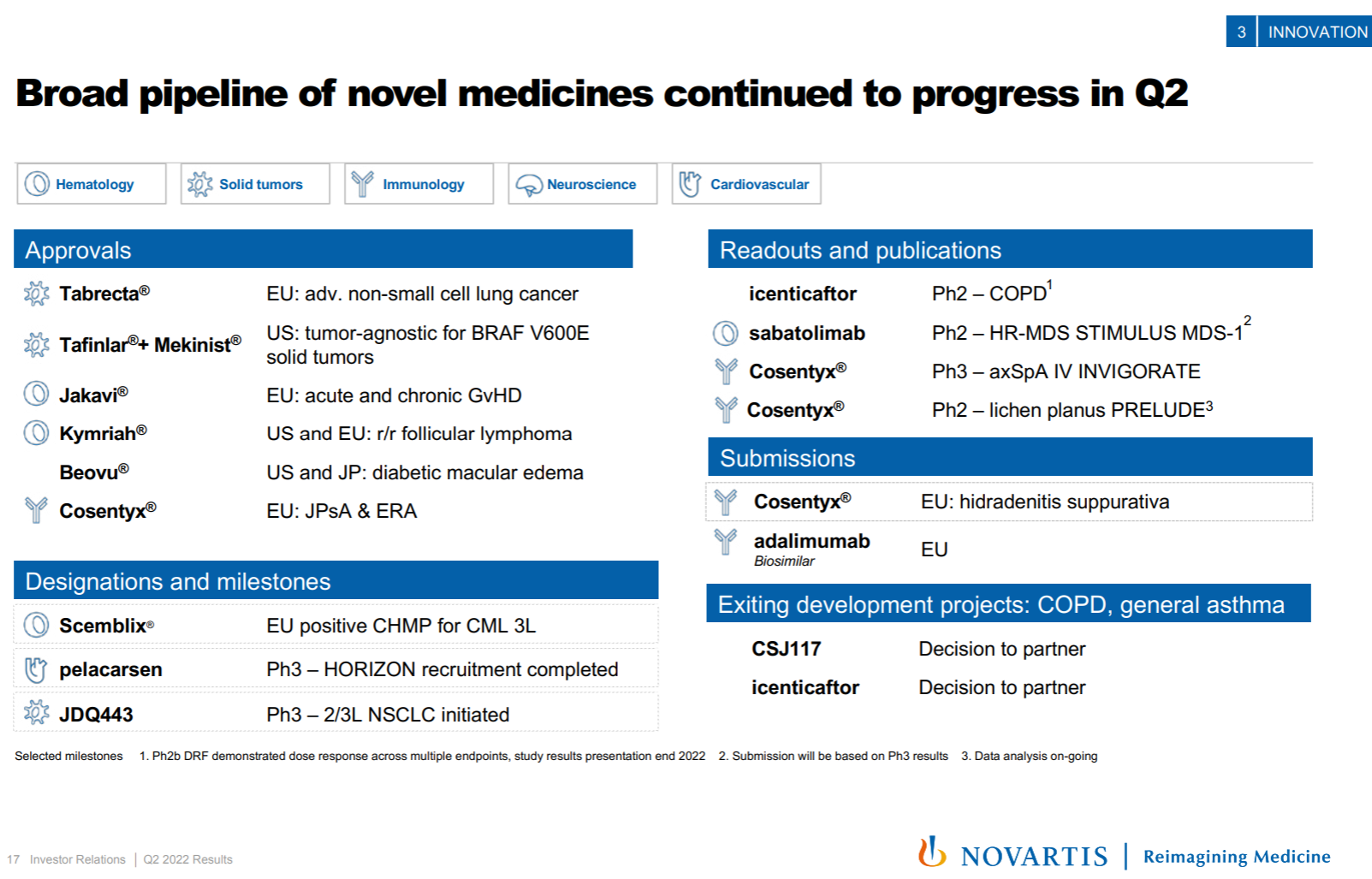

The entire Novartis strategy in the past few years has been a little fancy and scattered, as can be seen from the product pipeline list: Secukinumab/Ribociclib/Entresto, the big guys in the traditional small molecule and antibody fields, can still feel that “ancestors have passed away” As for Kymriah and Zolgensma, which are the backbone of the current performance, CGT is so cool but not affordable enough; look at the nucleic acid drug Inclisiran and nuclear drug Pluvicto, which were recently approved to become the engine of future performance, see what this means It is to carry out the magic tricks to the end. Coupled with the drag of Sandoz’s generic drugs (fortunately, it is finally going to be divested), it is difficult for the entire company to form a clear focus and direction that can be seen at a glance like the previous giants.

Major progress since the beginning of this year, including the FDA approval of Pluvicto, the release of phase I/II NSCLC data by JDQ-443 , the release of phase II COPD data by Icenticaftor, and the third phase of the long-standing Canakinumab for adjuvant treatment of NSCLC has finally officially ended.

9. AstraZeneca

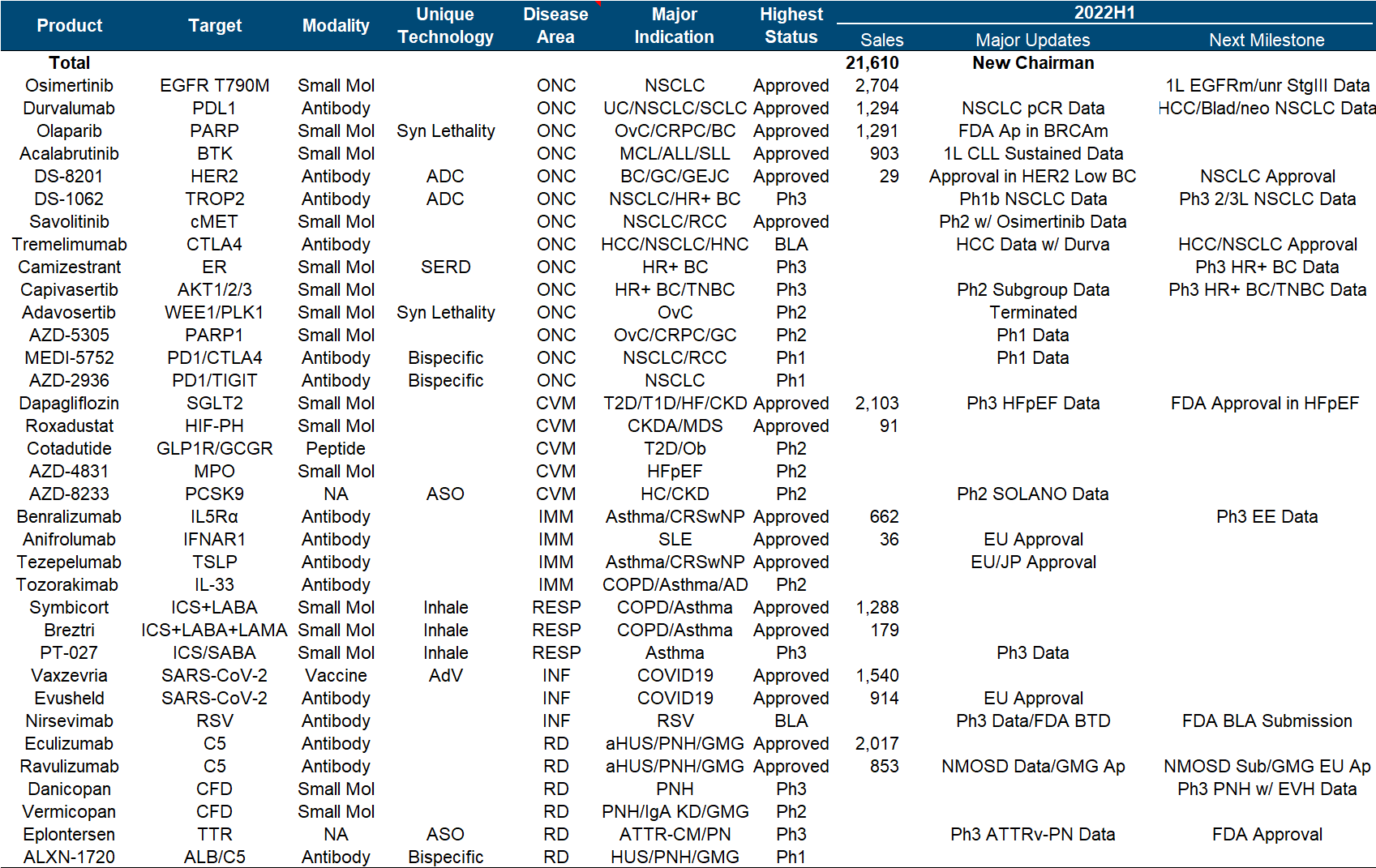

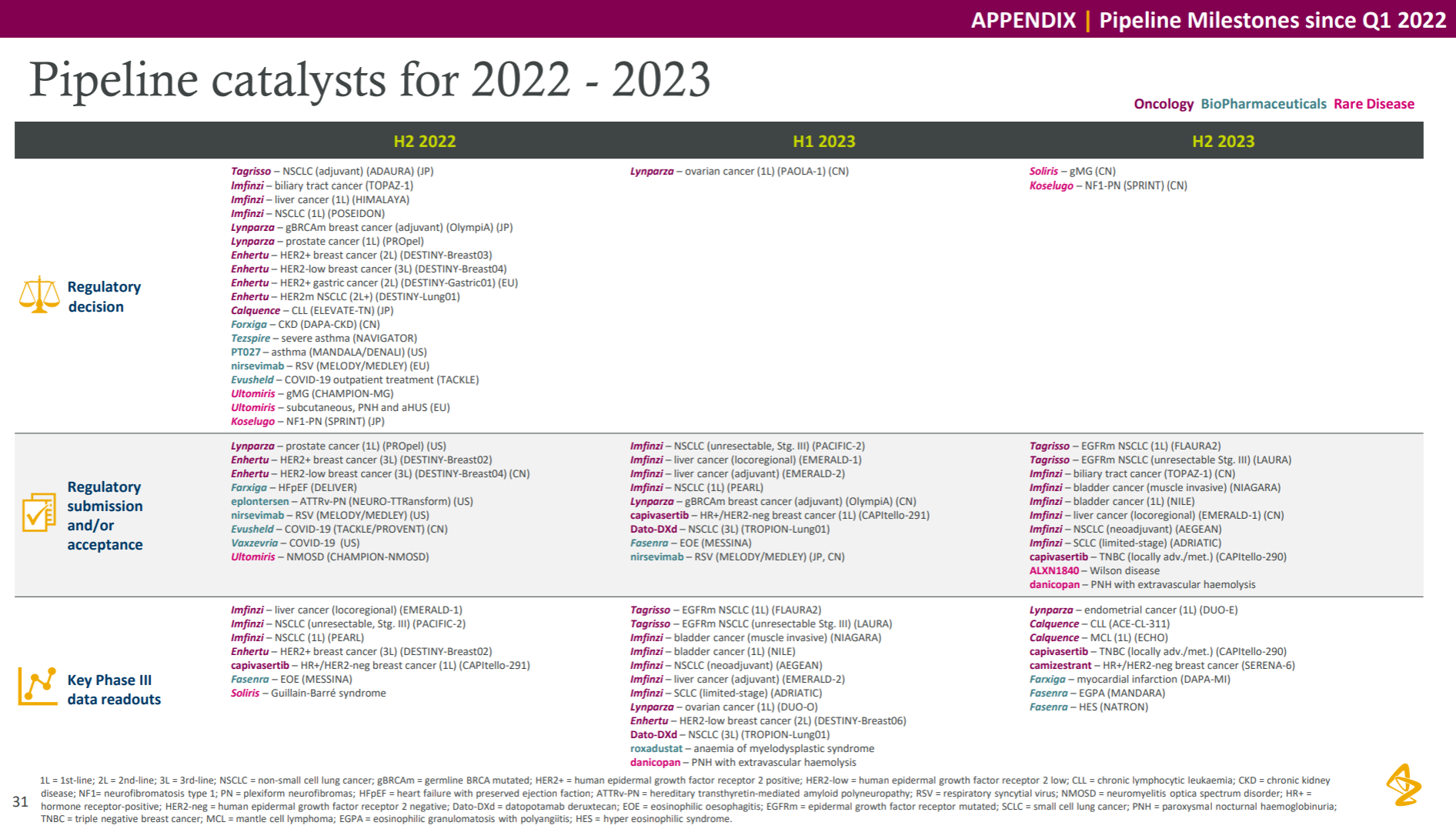

AstraZeneca is also the protagonist of the counter-attack reversal visible to the naked eye in recent years. From the beginning, it was almost swallowed by Pfizer. First, the first-hand third-generation EGFR TKI was born, and then it was strongly bound to the ADC thigh DS series, which doubled its performance and quadrupled its market value. , and completely return to the sequence of big pharmaceutical companies.

ADC assets are naturally the most beautiful in the current AstraZeneca pipeline, and this year is still the story of the DS series killing the Quartet. It also took out the first phase data of NSCLC, almost to the point of “walking your own way, leaving others no way to go”; in addition, Dapaglifozin announced the third phase data of HFpEF, and Ravulizumab from Alexion announced the third phase data of NMOSD and generalized myasthenia. The indications were approved and Eplontersen from Ionis released the ATTR-PN Phase III data, all of which are very competitive with the first-line big drug companies; the bad news is that the WEE1 inhibitor Adavosertib, which had previously attracted attention, was indeed cut off by the official announcement.

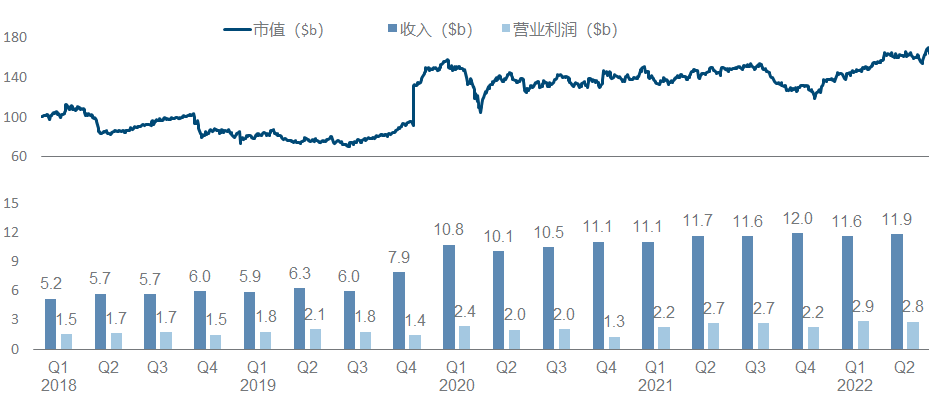

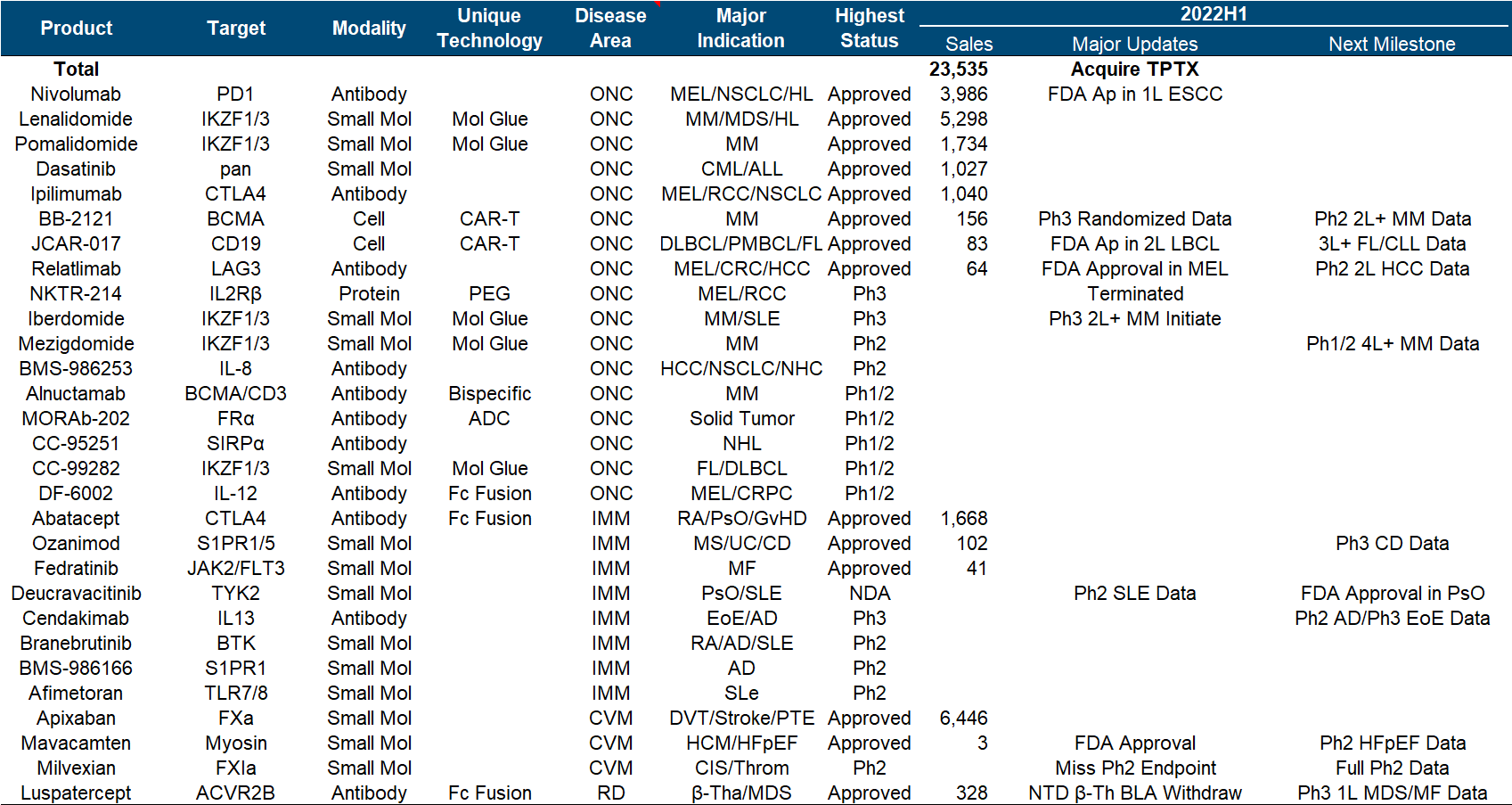

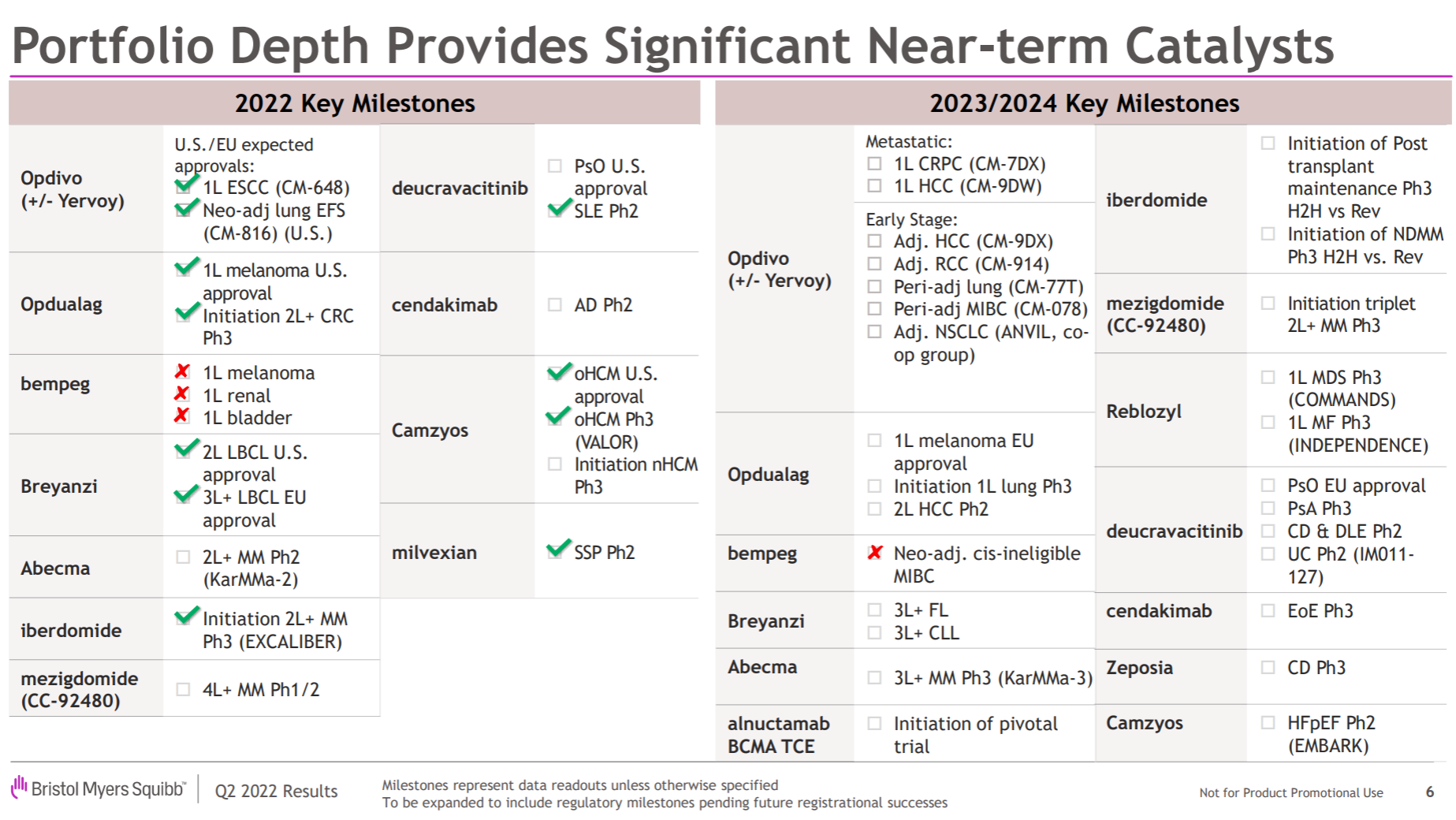

10. Bristol-Myers Squibb

Except for the acquisition of Celgene at the end of 2019, O drug seems to have exhausted the fortune of Bristol-Myers Squibb. In recent years, the company has indeed not found a good growth point, and its market value has been hovering around 150 billion.

The main direction of the entire product pipeline is obvious. One is the tumor immune line led by O drugs, especially the immune checkpoint series, and the other is the various molecular glues extended by the two major amines brought by Celgene. The big news this year is on the previous line. Relatlimab has been approved by the FDA , which has almost renewed the life of the entire I/O field. NKTR-214, which is a heavy cooperation with Nektar, is finally completely dead, and JCAR-017 is a second-line LBCL indication. Approved; in addition, the FDA approval of Mavacamten and the release of Phase II SLE data for Deucravicitinib are also worthy of attention.

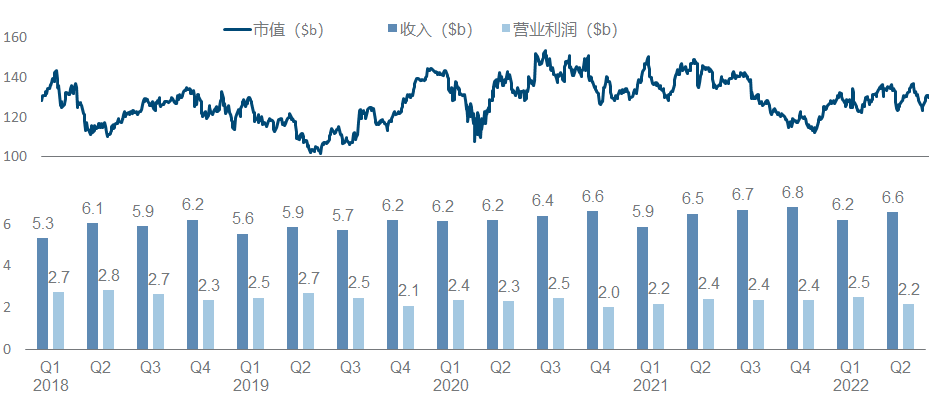

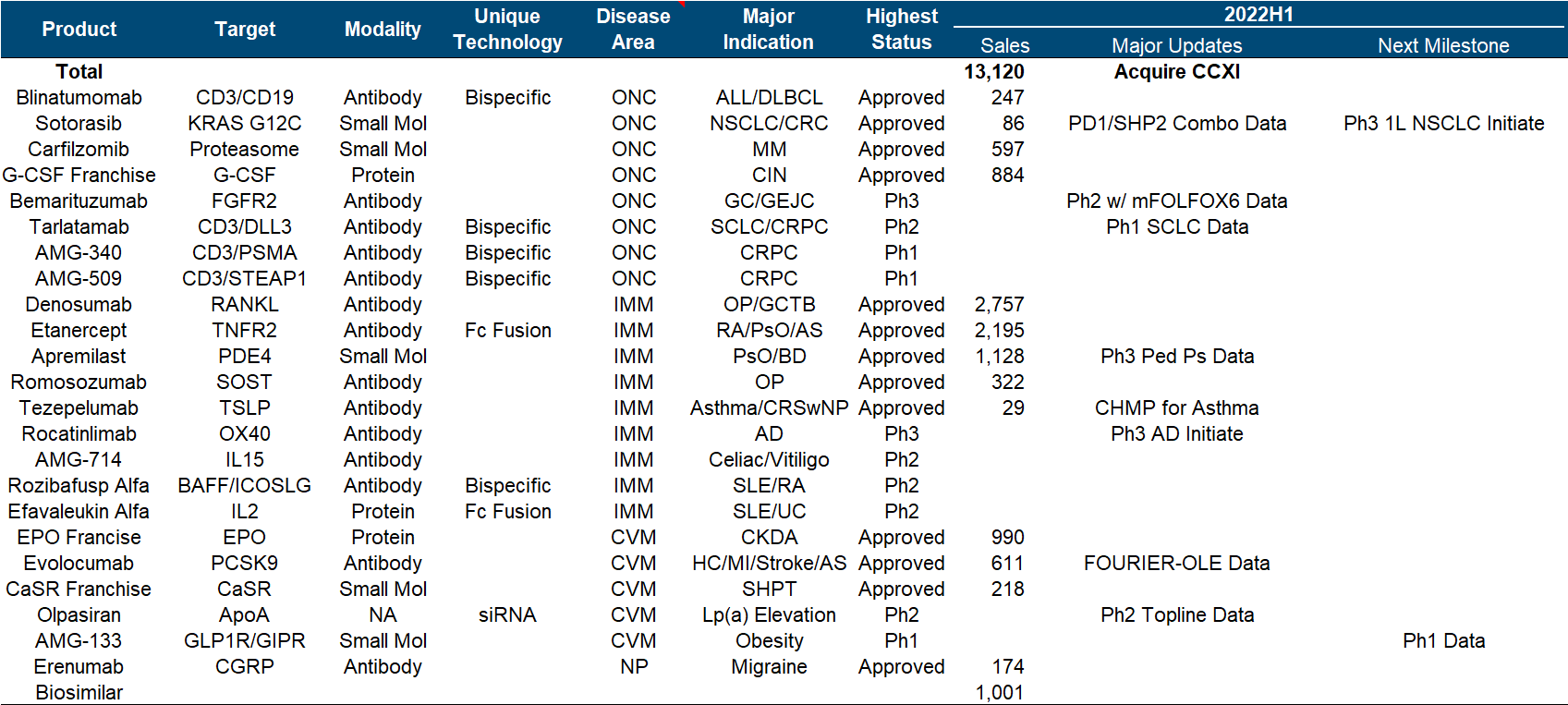

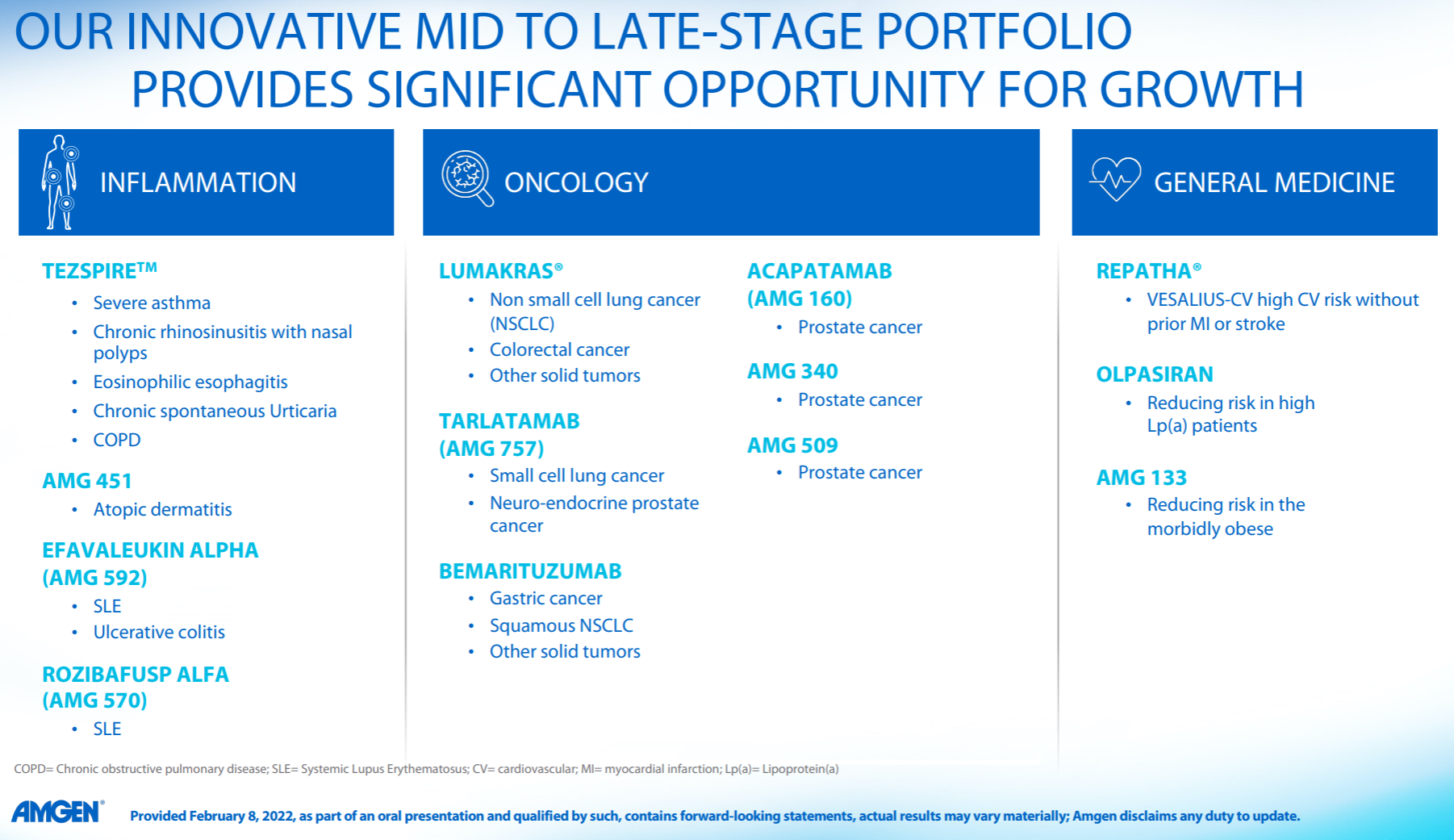

11. Amgen

Amgen has been relatively calm in recent years, and its performance and market value have basically not changed much. It is no longer the courage of EPO and G-CSF to open up the road. As the leader of the dual-antibody platform, it seems that neither science nor business has achieved it. How affordable.

In the whole pipeline, Sotorasib is the most eye-catching in the industry. After breaking the curse of KRAS, the data of its combination with PD-1 and SHP2 were announced at WCLC this year; in addition, Olpasiran from Arrowhead announced the second phase preliminary data.

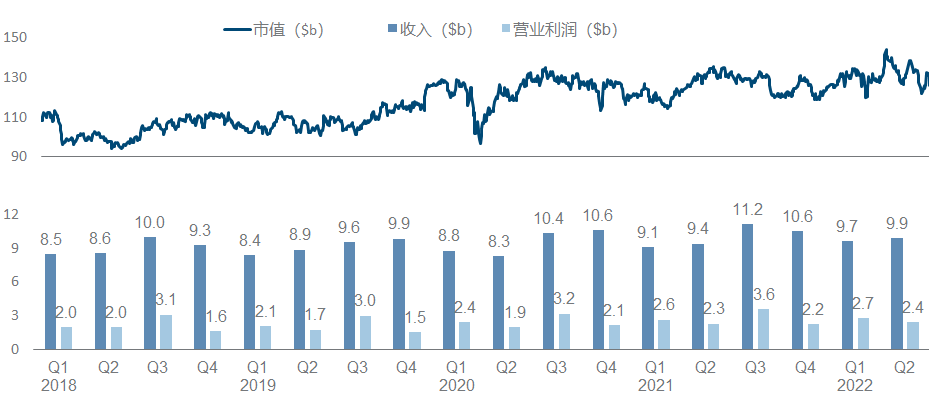

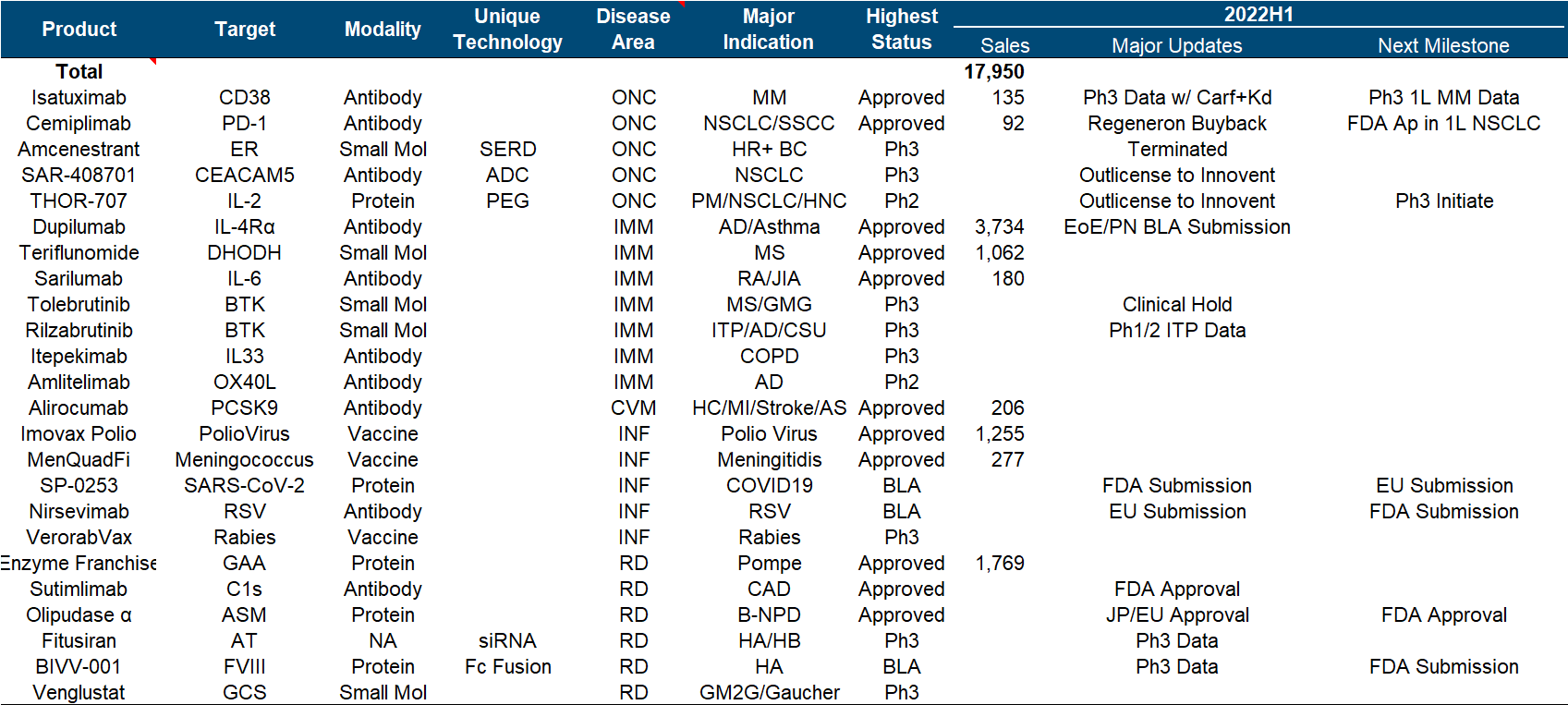

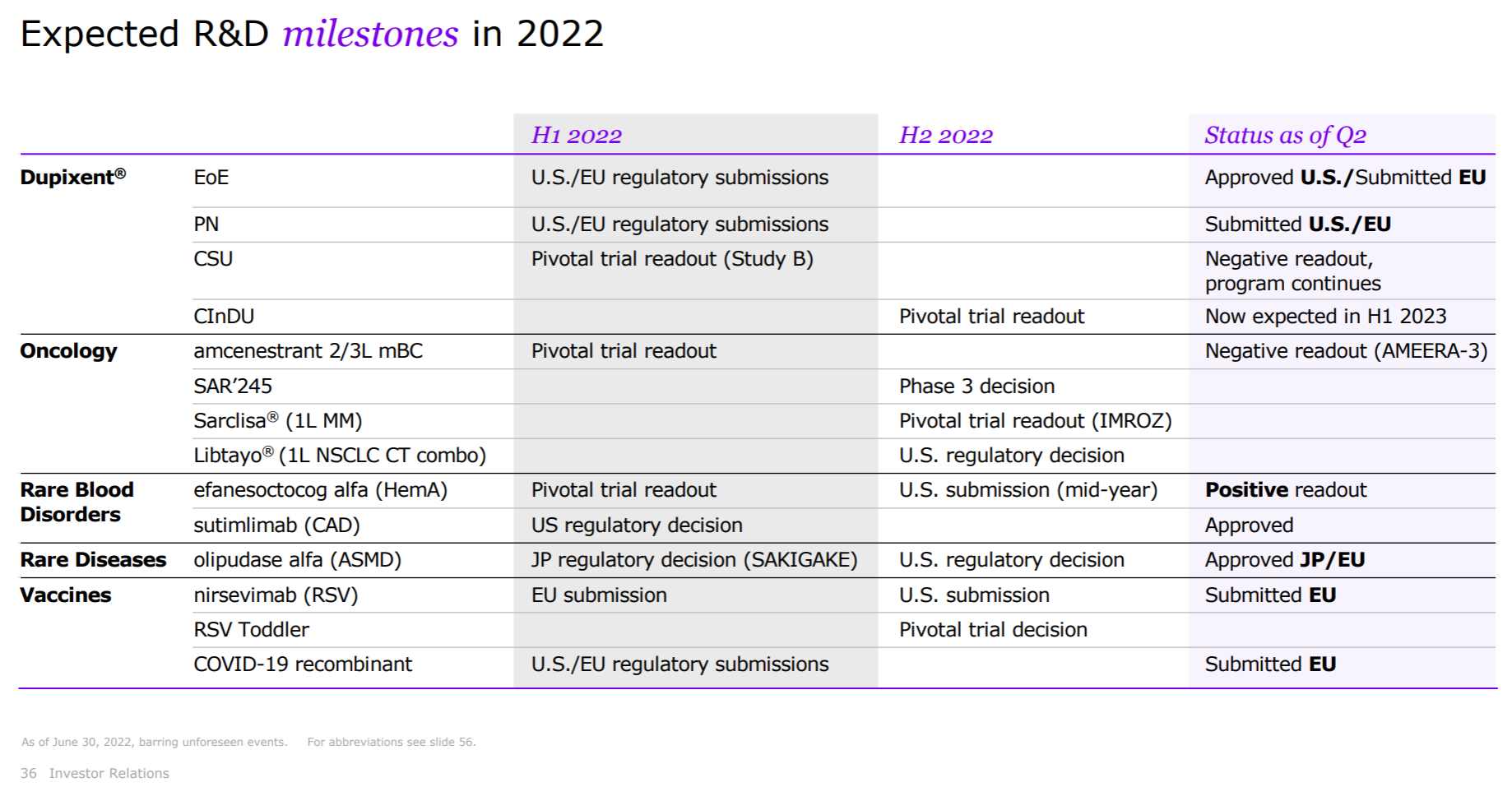

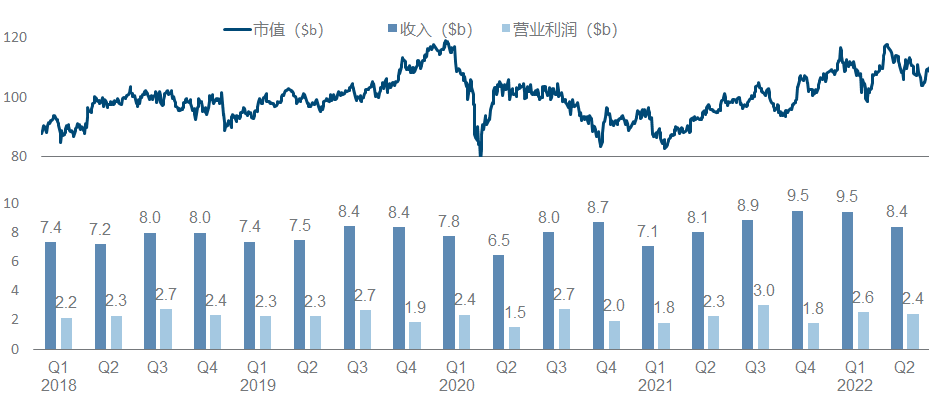

12. Sanofi

There are always people ridiculing that Sanofi is the shame of a big pharmaceutical company (today’s milk method), after all, the biggest performance increase in recent years is actually the breath of Yang Regeneron (however, people have recently taken PD-1 back), buy The two BTKs obtained by Principia seem to be in jeopardy. It is no wonder that the market value is still difficult to break through with such big killers as Dupilumab.

Sanofi should undoubtedly be the most miserable champion in the recent big pharmaceutical companies, from the failure of Rilzabrutinib’s pemphigus phase III last year, to the clinical suspension of Tolebrutinib and the complete failure of Amcenestrant this year (see the previous section for the sad highlights ). The slightly better news is that Futisiran and BIVV-001, two hemophilia treatments, have released Phase 3 data each , in addition to what we know as the deal with Innovent.

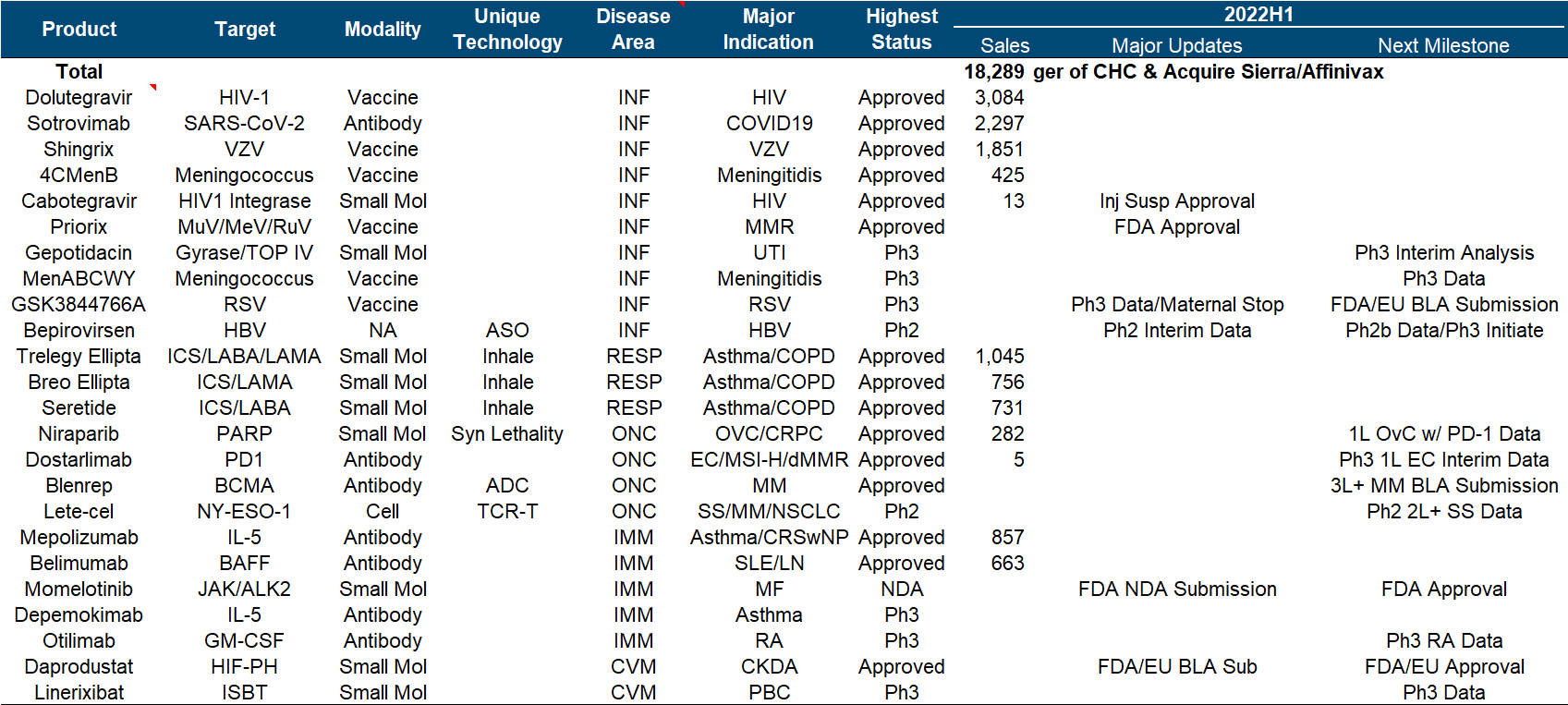

13. GlaxoSmithKline

As a traditional manufacturer of vaccines and respiratory diseases, GlaxoSmithKline has also taken a big bite in the new crown, which can be regarded as covering up the decline in performance to a certain extent, but it still cannot boost the market value (more recently after the divestiture of consumer medical care). dropped to less than 70 billion).

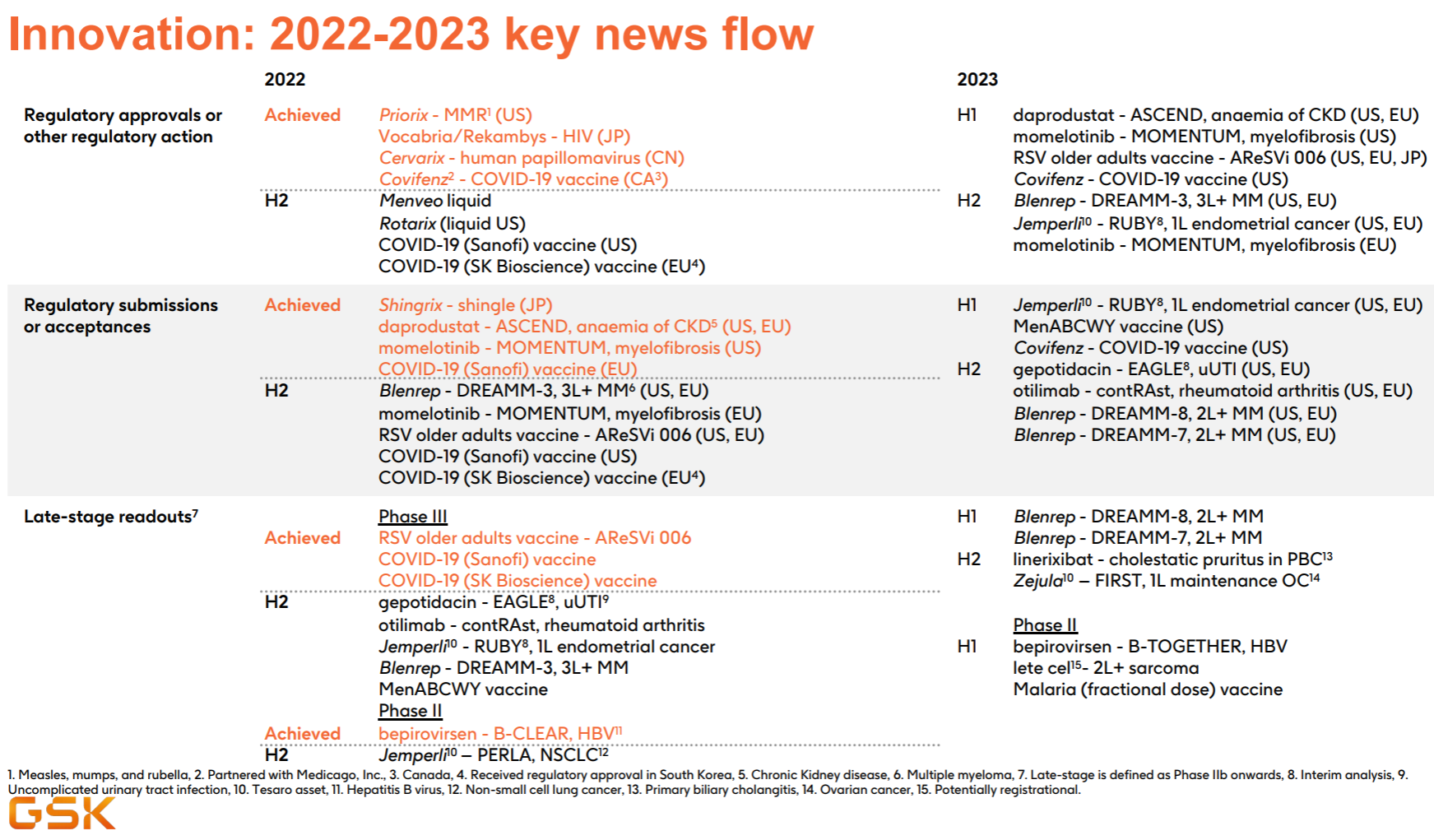

At first glance, this product pipeline is known to have almost perfectly missed the tumor and immunity of the past few years, and the focus is on infectious diseases and vaccines. Major progress since the beginning of this year, including the FDA approval of the MMR triple vaccine , the release of the third phase data of the RSV vaccine , and the release of the second phase interim data of Bepirovirsen.

In order to fill in the pit of this article, I read 13 companies before and after (the financial reports and performance presentation materials of the past 4 quarters + all PRs since this year + research reports of major investment banks since the past 2 years), and finally wrote two off-topic feelings:

1) The “big business disease” that we often observe and ridicule is real, but it must first become a “big business” to qualify for this disease, not only because they once had blockbuster products and brilliant performance, And it is precisely because they have established a complete industrial chain and mature internal system. The mysterious understanding is the ” background “. In order to pursue the stability of the system, it will inevitably bring redundancy and friction. Under certain conditions, especially the growth rate After the decline, there is a backlash against efficiency; however, most small companies that seem to be efficient lack precisely this kind of system that can guarantee the longevity of the foundation. In the early years, in order to survive, they could only pursue efficiency. No, even if you can make blockbuster varieties, it may still be difficult to escape the fate of ups and downs. The success of technology and the establishment of business are separated by these backgrounds .

2) Chinese pharmaceutical companies are still far from the above-mentioned industrial chain and internal system, so they are not qualified to talk about “big company disease” (it does not mean that some companies will not age before aging and the emergence of “big companies”). It can be seen only from the level of information disclosure. The public information of any of these giants (of course, there are also significant differences between them) can form a complete set of dimensions such as disease, mechanism, product, and market. However, most Chinese pharmaceutical companies do not even disclose the sales of the most basic core varieties. We still have a long way to go.

$Johnson & Johnson(JNJ)$ $Pfizer(PFE)$ $Lilly(LLY)$

This topic has 24 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1335311504/229702943

This site is for inclusion only, and the copyright belongs to the original author.