The “Grain Factory Review” channel is dedicated to commenting on the grain factory’s quarterly financial reports, product launches, market performance or other major events. It does not pursue the immediacy and efficiency of information, and mainly provides readers with the opinions of the grain factory researchers.

On the evening of October 6, Kingsoft (03888.HK) announced that the company is evaluating the recoverable amount of its investment in Kingsoft Cloud and plans to make provision for impairment. It is expected that the proposed provision as at 30 September 2022 will range from approximately RMB5.6 billion to RMB6.5 billion before tax and approximately RMB5.0 billion to RMB5.9 billion after tax.

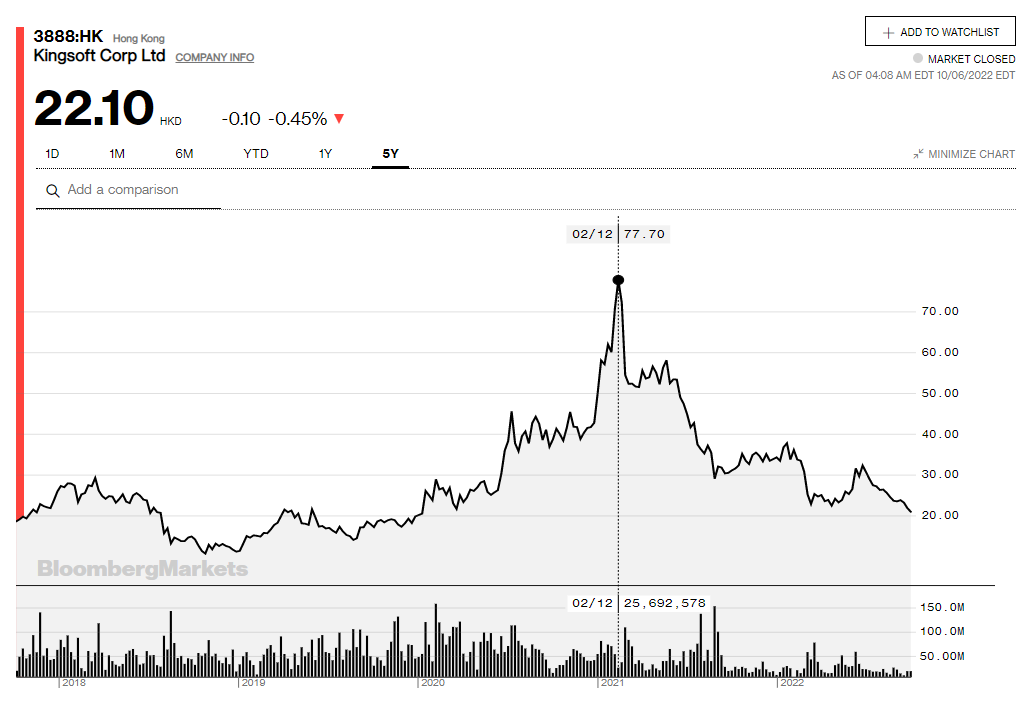

Due to the impairment provision of Kingsoft Cloud Investment, Kingsoft Software is expected to make a significant loss in Q3 this year, which may further worsen the share price of Kingsoft Software, which has fallen to the bottom.

This is not the first bad news for Kingsoft in recent years. On August 24, 2021, Kingsoft disclosed that the profit attributable to owners in the semi-annual report was 165 million yuan, down 98% year-on-year; the next day, Kingsoft’s Hong Kong stock plunged 24%, and the A-share listed company Kingsoft Office also fell by 20%.

Every time I see similar news, I always think: Why didn’t Xiaomi Group acquire Kingsoft ? In my opinion, this is a good deal.

It needs to be stated in advance that this is a highly hypothetical article, there is no inside information, and it is only to demonstrate the rationality and synergy of Xiaomi’s acquisition of Kingsoft. In addition, this article is not intended to be written as a story article for financial media, but will list some core facts and logic for your reference and discussion.

1. There is a close relationship between Kingsoft and Xiaomi/Lei Jun.

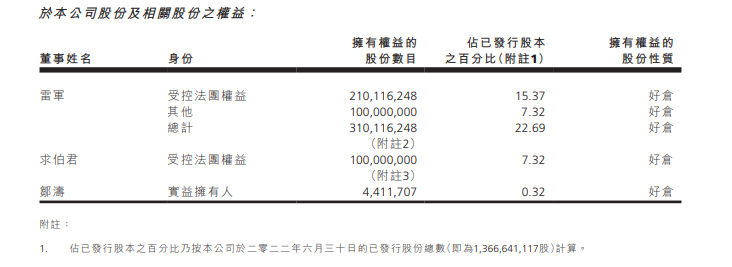

(1) As we all know, Lei Jun’s first programmer job started at Kingsoft, he soon became the general manager of Kingsoft and led the company’s IPO. After leaving Kingsoft for a short time in 2007, he took over Qiu Bojun to become the chairman of Kingsoft in 2011, until today; as of the 2022 semi-annual report, Lei Jun still holds 22.69% of Kingsoft’s shares.

(2) In addition to Lei Jun personally, Xiaomi Group and Kingsoft Software are also inextricably linked . First of all, in the early founding team of Xiaomi, there were a lot of Jinshan seniors; the corporate cultures of the two companies are also highly similar, including the culture of military exploits and brotherhood; secondly, the headquarters of Jinshan Software is currently also in the Xiaomi Science and Technology Park in Beijing. The communication between personnel and business is very smooth. For example, Liu Wei, senior vice president of Kingsoft, recently joined Xiaomi as the deputy director of the organization department. Interested friends can also read Jinshan’s official biography “Breathless”, which has more details.

2. Kingsoft’s current valuation is cheap enough .

There are many ways to judge whether a company’s valuation is cheap, but it may be rare to use the price-to-book ratio (P/B) to judge an Internet company .

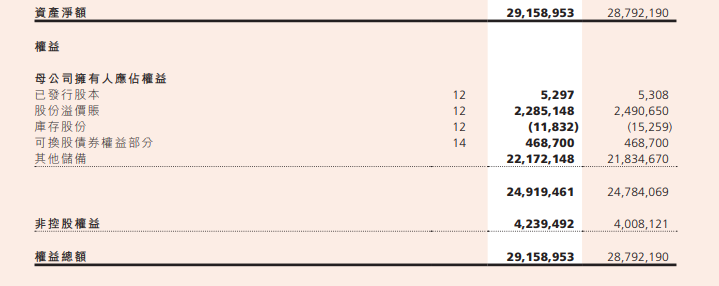

As of the close on October 6, Kingsoft’s closing price was HKD 22.10, corresponding to a market value of HKD 30.2 billion. Calculated at an exchange rate of 1.10, it is approximately equal to RMB 27.5 billion. As of the 22-year interim report, Kingsoft’s net assets were 29.16 billion yuan, corresponding to a price-to-book ratio of 0.94x (the potential loss in Q3 will be calculated later).

It should be noted that these 29.16 billion net assets also correspond to more than 14.2 billion yuan in cash and cash equivalents. Assuming that the acquisition is based on net assets, minus cash and equivalents, the actual acquisition consideration is only 14.96 billion yuan.

If we further consider the major losses in the third quarter at the beginning of the article, that is, 5.0-5.9 billion yuan, Xiaomi can make a counter-offer from the perspective of losses. Then the actual purchase consideration is only 9 billion to 10 billion yuan .

So a new question comes, how should we judge whether 9 billion to 10 billion yuan is expensive or cheap ?

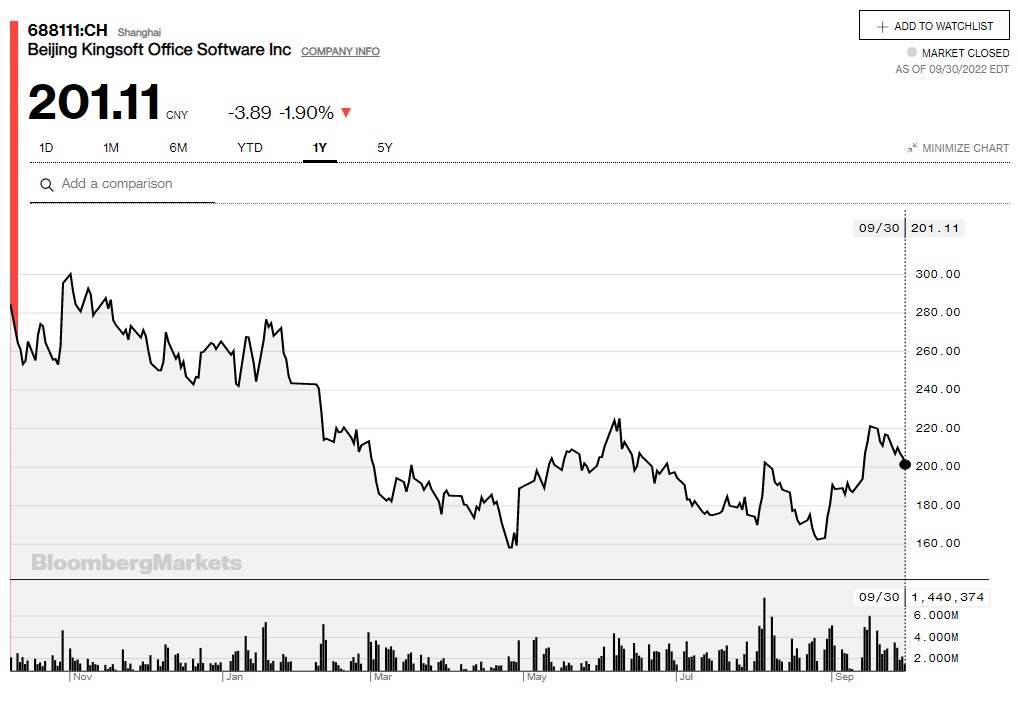

Let me list only one fact: Kingsoft is the controlling shareholder of A-share Kingsoft Office (688111.SH) with a shareholding ratio of 52.71%. The closing price of Kingsoft Office as of October 6 was 201.11 yuan, corresponding to a market value of 92.756 billion yuan, which is only part of Kingsoft’s business, and has not considered games and cloud services.

Of course, I am not a strict financial model here, I did not discuss the valuation premium of A/H shares, nor did I discuss the valuation discount of Kingsoft as a holding company. I only used the controlling rights of 92.7 billion companies to roughly compare 90- The acquisition consideration of 10 billion yuan gives you a feeling .

3. Kingsoft’s Internet business/income and Xiaomi’s form a strong complementarity .

This part does not intend to introduce the business structure and characteristics of Kingsoft Software in detail, but analyzes the strong synergy between Kingsoft and Xiaomi from the perspective of Internet business strategy.

Kingsoft’s current core Internet businesses include office software (WPS), cloud computing (Kingsoft Cloud) and games (Xishanju and Kingsoft World Tour) . There is no doubt that these three businesses Xiaomi’s smartphone and IoT business can generate a high degree of synergy, and can fill the Internet business sector that Xiaomi Group has always hoped to become bigger and stronger.

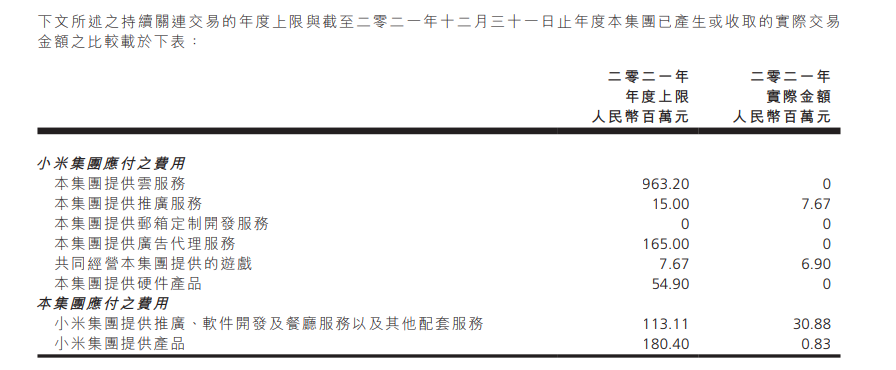

In fact, Xiaomi Group, as a major related party of Jinshan, has signed a long-term “Framework Agreement” with related transactions in a series of fields . For example, according to the 2021 Kingsoft annual report, Xiaomi Group paid more than 1 billion yuan for cloud services to Kingsoft in 2021 alone, and 165 million yuan for advertising agency fees. If Xiaomi acquires Jinshan, in addition to keeping this part of the profit in the Xiaomi system, it can further reduce the related transaction costs and improve the overall operational efficiency.

In addition, judging from past market performance, these Internet businesses may obtain higher valuations in Xiaomi. Kingsoft’s PE multiples before turning losses were weaker than similar Internet companies, only about 20-25x; and at the same time, if Xiaomi Group followed the SOTP valuation method, the capital market gave the Internet revenue PE multiples of about 35- 40x .

Although part of the reason for this is that Kingsoft is a holding company, if Xiaomi can internalize and integrate related Internet revenue after the merger, it also has the opportunity to obtain a higher valuation multiple.

At the end of the article, I would like to reiterate that this is a highly hypothetical article, and it only represents my personal opinion and analysis. I hope everyone can view and discuss it rationally.

This topic has 25 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/7970049223/232166797

This site is for inclusion only, and the copyright belongs to the original author.