Has U.S. inflation peaked? Maybe every investor wants to know the answer.

This year, the market has worried that high inflation will trigger aggressive interest rate hikes by the Federal Reserve, and many people even regard high inflation as a “Pandora’s box” for U.S. stocks.

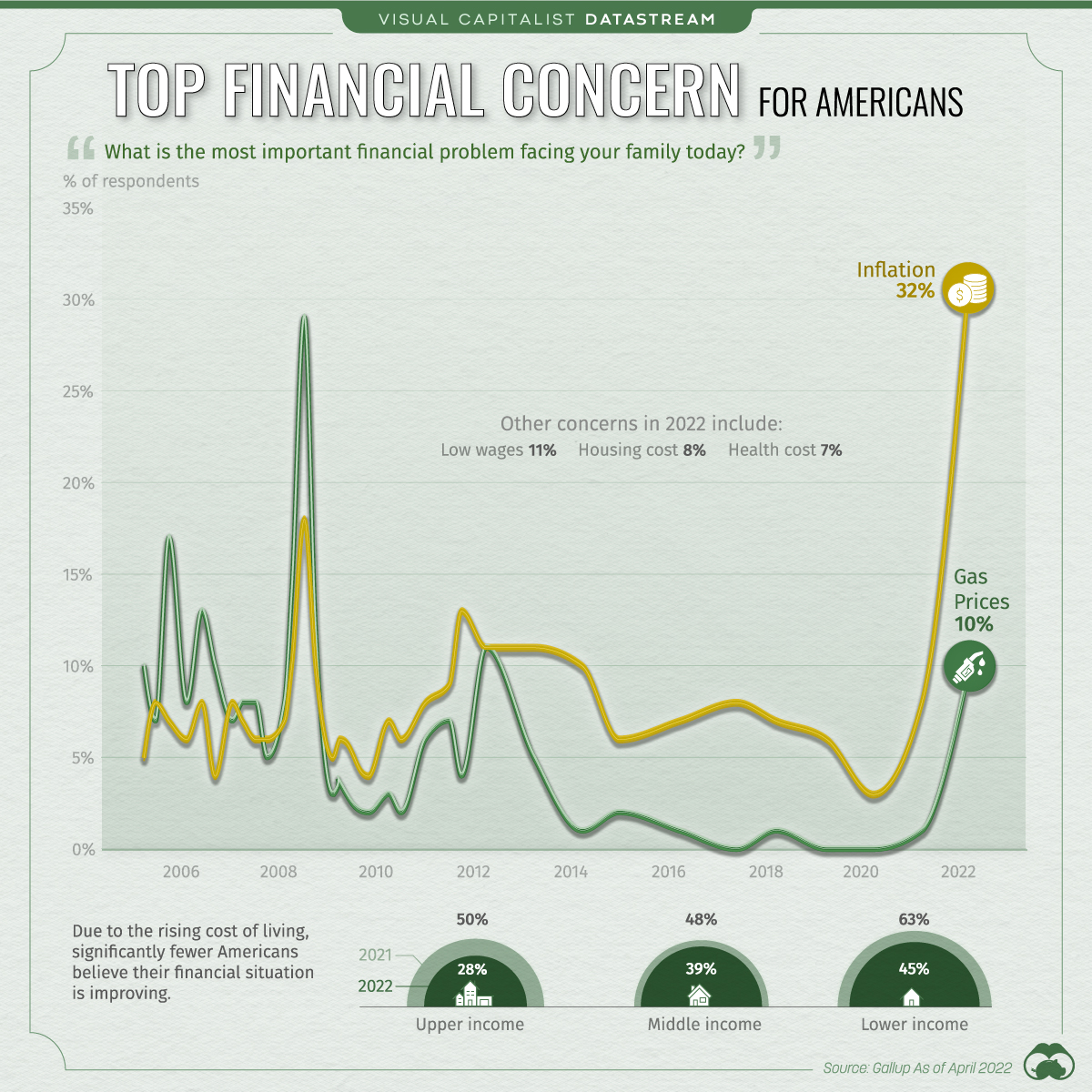

Gallup, a US consulting firm, found in a recent private survey that inflation has overtaken issues such as low wages and high housing costs as Americans’ top financial concern. From a trend point of view, the inflation issue will attract more attention from 2021, and as an important “contributor” to overall inflation, natural gas prices will also attract more attention from 2021.

Source: Visual Capitalist

Since the second quarter of last year, the market has been engaged in a big debate over whether “inflation is temporary or, as former US Treasury Secretary Summers said, this is the beginning of high inflation not seen in a generation”.

With inflation soaring around the world this year, the “inflation temporary theory” has gradually been overwhelmed by the “inflation persistence theory”.

U.S. Treasury Secretary Janet Yellen said on Tuesday that inflation is likely to remain high, acknowledging that she should not view last year’s sharp price increases as a “transient” phenomenon.

And the recent inflation alarm has been sounded again! Regarding the high inflation situation in the United States, the White House admits that it is not optimistic. The International Monetary Fund (IMF) First Deputy Managing Director Gita Gopinath said on Wednesday (8th) that according to current forecasts, the US inflation rate may remain above the Fed’s target for a long time, and there is a “de-anchoring” of inflation expectations in the country. “risks of.

White House press secretary Karine Jean-Pierre also warned of rising data on Wednesday, predicting that inflation data due this week will likely show more evidence of high inflation.

Former Fed Vice Chairman Alan Blinder even said the Fed may need to raise rates by 50 basis points at a time in the next three to four meetings and may have to endure a recession to help inflation fall back to its 2% target. .

And now, when the May CPI data is about to be released, when the market still has the illusion of cooling inflation, Mohamed El-Erian, chief economic adviser of Allianz Group, once again warned that the inflation level has not yet been seen due to the continuous upward surge in energy prices. top. When the “inflation tentative” was gaining momentum in June last year, it warned that the Fed had made a mistake on inflation.

In fact, the high inflation that Americans have not seen in several lifetimes seems to have begun to “semi-permanent”. So when it comes to the stock market, how should investors make choices during the peak inflation period?

Derek Horstmeyer, a professor of finance at George Mason University, counted the performance of all listed companies on the New York Stock Exchange and Nasdaq in 1973.02-1974.12, 1978.09-1980.05, and 2021.02-2022.03 three-round inflation surges. yields are the best.

Professor Horstmeyer believes the best move for investors looking to quickly reposition their portfolios when inflation is soaring is to turn to materials and energy companies.

Source: Wall Street Journal

cow friends,

cow friends,

Do you think inflation is about to peak?

How to invest in high inflation?

Welcome to leave your wonderful insights in the comment area~

edit/somer

This article is reprinted from: https://news.futunn.com/post/16322167?src=3&report_type=market&report_id=207860&futusource=news_headline_list

This site is for inclusion only, and the copyright belongs to the original author.