Text: Dongzi

Editor: Qi Ran

As the world leader in new energy vehicles, Tesla is the vane of the entire industry. However, during the rising period of the new energy industry, Tesla will walk out of the “worst year” in recent years in 2022.

This undoubtedly sounded the alarm for my country and even the global new energy vehicle industry.

01

disappointing year

After a 50% surge since 2021, Tesla’s market value once exceeded one trillion yuan, and it also successfully sent CEO Elon Musk to the throne of the world’s richest man. However, after entering 2022, Musk is a bit “doing nothing”: building rockets (SpaceX), building tunnels (The boring company), man-machine interaction (Neuralink), doing everything except building cars, especially the acquisition of Twitter ( Twitter) became the trigger for the collapse of Tesla’s stock price.

In April 2022, Musk announced plans to acquire all of Twitter’s shares at a price of $54.2 per share, turning Twitter into his own private company. In the same month, Tesla’s stock price fell by 19.19%, the largest month in nearly three years. decline. Since it is an acquisition, it needs financial support. While shouting “never cash out”, Musk used the usual equity pledge and cash out to obtain funds. Especially at the end of the year, he cashed out 3.58 billion US dollars in one go, becoming an overwhelming Tesla. The last straw.

In the fourth quarter of 2022, the new energy vehicle capital market crisis led by Tesla broke out completely. Tesla’s stock price was directly cut in half, leaving only more than 300 billion US dollars in market value. The three “Wei Xiaoli” listed on the US stock market were not spared. In the fourth quarter, they fell by 38.17%, 16.82% and 11.34% respectively, and their total market value evaporated by nearly 20 billion US dollars.

From the appearance, Tesla’s plunge this time is caused by multiple factors such as the growth rate of net profit in the third quarter of 2022 falling by more than 70% year-on-year, the failure of car sales to reach the expected 1.5 million units, and the shutdown of Tesla in Shanghai. .

But at a deeper level, the capital market reflects future expectations, and Musk’s series of “non-business” and “contradictory words and deeds” behaviors have also reduced the expectations and credibility of himself and Tesla.

To some extent, Musk, like Jack Ma, has become one of the few people who “single-handedly” brought the company and even the industry down.

02

“New forces” welcome the cold wave

If Tesla is self-immolated because of Musk’s playing with fire, then the decline of domestic electric cars, especially new car-making forces, is an outbreak of poor performance all year round.

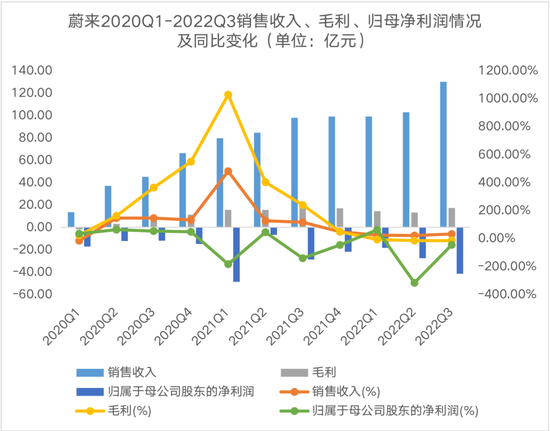

Judging from the financial situation of the three “Wei Xiaoli” companies in recent years, “either they are losing money, or they are on the way to expand their losses.” As the best-developed company among the new car-making forces, Weilai’s fastest-growing period is from the second quarter of 2020 to the first quarter of 2021, with sales revenue and gross profit growing at a rate of double or even several times, but The net profit is always negative, and the best quarter also lost 659 million yuan, and even the better the sale, the more the loss.

By 2022, Weilai will be even worse: the growth rate of revenue has declined, but the speed of losses has been rising all the way. The losses in the first three quarters were 1.825 billion yuan, 2.745 billion yuan, and 4.142 billion yuan, a year-on-year change of 62.56%, -316.37% % and -44.89%.

It is not difficult to see that the “potential” of the new car-making forces is exhausted, and the expectations of the capital market are getting lower and lower. The change in valuation has caused the stock price to fall so much. It is hard to imagine that when the market’s patience completely disappears and turns For the scene of “despair”.

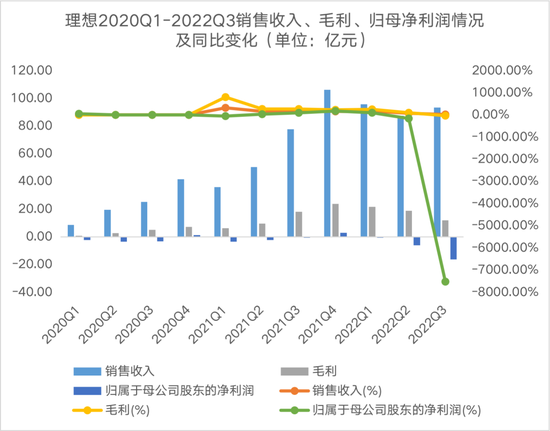

Image source: Internet public data, compiled by 1DU Finance and Economics

Of course, the reasons behind the poor financial situation are multiple.

In September last year, Xiaopeng G9 was officially launched. The starting price of 309,900 yuan is already a relatively high level among trams. vehicles, 623 vehicles and 1546 vehicles, a total of only 2353 vehicles. According to relevant reports, Xiaopeng G9 has carried out price cuts and configuration adjustments two days after its listing. This temporary change of plan reflects the confusion of the company’s internal strategy from the side. For the new car-making forces, which are still in the initial stage of development, it is easy to “roll over” because of the pursuit of speed. Compared with established companies, it is difficult for such problems to occur.

In addition, subsidies for new energy vehicles have been implemented for more than ten years, and it is impossible to continue subsidizing them. Therefore, the state’s subsidies for new energy vehicles will gradually decrease, and the car purchase subsidy has been terminated at the end of 2022 (“Notice on the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles in 2022”). Subsidies are no longer given.

For some tram companies that rely on subsidies to “profit” or reduce losses, losing subsidies is like losing the last fig leaf. It is difficult to modify performance in this way to maintain financing advantages. In today’s difficult financing environment environment is more difficult to survive.

In addition to the unfavorable internal management and external policies of the company, new energy vehicles themselves also have technical problems such as serious battery life attenuation and safety. According to related reports, the mileage of some trams has been greatly reduced in the cold winter environment, even exceeding 50%, resulting in the need to charge once after driving 200-300 kilometers, which is greatly reduced compared with the 700-800 kilometers of fuel vehicles.

In addition, in the first quarter of last year alone, there were as many as 640 new energy vehicle fire accidents, a year-on-year increase of 32%, and most of the spontaneous combustion occurred silently, which was more difficult to warn and extinguish than fuel vehicles.

Therefore, from the perspective of technological maturity and safety, compared with fuel vehicles that have been developed for more than a hundred years, new energy vehicles still have a long way to go to completely defeat fuel vehicles with 20 years of development. It has become one of the reasons why people are not optimistic about the tram market.

03

fall or rise again

The capital winter that the tram industry may face next is a disaster for some companies, but an opportunity for some companies.

In the past few years, with the help of the popularity of the Internet, new car-making forces have emerged, and the slogan of “smart” has also been labeled “Internet” for them. In the past few years, most of the new car-making forces have followed a relatively aggressive growth model that focuses on marketing. In the era of competing for Internet characteristics, new car-making forces are more sought after by capital.

However, with the popularization of new energy vehicles, the characteristics of the industry gradually return to the automobile industry itself. For the new energy automobile industry, its essence is the automobile industry and manufacturing industry, and after all, it depends on scale, efficiency, and cost to win.

Veteran car companies represented by BYD have accumulated abundant capital and sound business strategies. Theoretically, the competition for electric vehicles has entered a stage that is more beneficial to veteran car companies.

In terms of scale, BYD’s 2022 sales will exceed 1.86 million vehicles, SAIC New Energy 930,000 (January-November), Changan New Energy 230,000 (January-November), Great Wall New Energy 120,000 (January-11 moon). As for the new car-making forces, Weilai has 120,000 vehicles, Xiaopeng has 120,000 vehicles, Ideal has 130,000 vehicles, and Jikrypton has 70,000 vehicles. There is a big difference between the two.

Not long ago, BYD just released a new high-end car brand Yangwang and its core technology “Easy Sifang”, as well as the million-level new energy off-road U8 and supercar U9. It shows the technical research and development strength and accumulation of established car companies, as well as the growing product power. Under such circumstances, the new forces are under increasing pressure.

In terms of cost and efficiency, the advantages of traditional car companies have also begun to emerge. They have formed a complete value chain system of internal logistics – production and operation – external logistics – marketing – after-sales service earlier. In terms of sales and after-sales, traditional car companies have established a complete physical network of 4S stores and after-sales systems. However, new car-making forces are still promoting the construction of experience stores in the core business districts of cities, with single means and fewer channels.

04

conclusion

The focus of competition in the new energy vehicle market has shifted from the Internet to the automotive industry itself. Scale, cost, and efficiency have become decisive factors affecting the success of electric vehicle companies. If the new car-making forces want to gain a firm foothold in the present, they still need to get rid of capital dependence and change from blood transfusion to hematopoiesis as soon as possible. After all, relying on others is not as good as relying on yourself. Only when you are strong is the real strength.

The picture comes from the public network, invaded and deleted.

(Disclaimer: This article only represents the author’s point of view, not the position of Sina.com.)

This article is reproduced from: https://finance.sina.com.cn/tech/csj/2023-01-13/doc-imxzzfmr4915022.shtml

This site is only for collection, and the copyright belongs to the original author.