Welcome to the WeChat subscription number of “Sina Technology”: techsina

Author | Yixin Xiongsheng

Source: Fuji Research

The epidemic has repeated, and “workers” have stayed at home and brought fire to the small home appliance track.

Xiaomi’s “foundry” Delmar submitted its prospectus for the third time on August 12.

Delmar’s road to listing is not so smooth. Previously, after the first submission in June 2021, it has gone through three rounds of inquiries and the prospectus has been updated twice.

Guangdong Delma Technology Co., Ltd. (hereinafter referred to as “Delma”) is an innovative home appliance brand enterprise integrating independent research and development, original design, self-owned production and self-operated sales. Delmar’s brands include “Delma”, “Philips”, “Weixin”, etc. The main product types include home environment, water health, personal care and health and life bathroom.

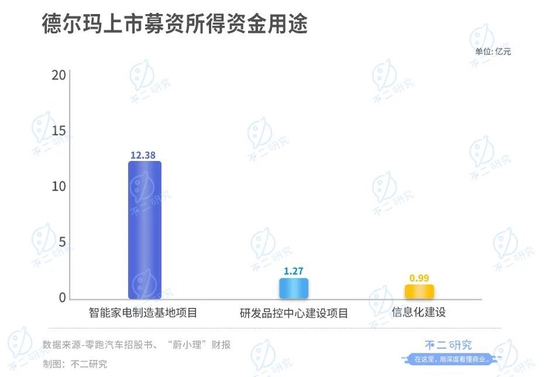

Delmar announced that the funds raised this time are 1.464 billion yuan, of which 1.238 billion yuan will be used for the smart home appliance manufacturing base project, 127 million yuan will be used for the R&D quality control center construction project, and 99.654 million yuan will be used for informatization construction.

According to the new version of the prospectus, Fuji Research found that Delmar disclosed performance data for the full year of 2021 and the first half of 2022. Among them, in the first half of 2022, its revenue was 1.517 billion yuan, an increase of 21.60% year-on-year; the net profit in the same period was 56 million yuan, an increase of 18.17% year-on-year.

Although Delmar has achieved good revenue growth in recent years through brand agency and Xiaomi OEM ODM. Taking 2021 as an example, the sales amount of Delmar’s top five customers will account for 47.23% of the revenue, of which the revenue from Mijia’s ODM business accounts for nearly 50%, but its own profitability is sacrificed.

In an old article in April this year, we focused on the “Xiaomi foundry” above Delmar’s head, and the profitability is yet to be solved. Today, with the upcoming listing test, Delmar still needs to answer: Is OEM a weakness or an armor? As a result, Fuji Research has updated some data and charts of the old article in April. The following Enjoy:

In the post-epidemic era, small home appliances gradually annealed after they became popular, but recently the epidemic has risen again, the home economy has become popular again, and the track has become more and more crowded.

In addition to small home appliance companies such as Xiaoxiong Electric and Xinbao Co., Ltd., home appliance leaders such as Xiaomi, Midea, and Gree are also competing for layout. In addition, there are also many companies that want to take advantage of the wind of small household appliances to enter the secondary market.

▲ Source: Delmar official micro

▲ Source: Delmar official microOn February 18th, the first share of the air fryer, Biyi shares (603215.SH), was successfully listed. The first share of the air fryer, which was brought to the fire by the house’s cooking skills, received 6 consecutive boards once it was listed.

According to Fuji Research, the small home appliance market has become a red sea. Delmar’s current profitability is seriously hampered. The foundry and brand licensing model drags down its core competitiveness. Ability is questionable.

Gross profit margin has been declining year by year, and net profit growth has fallen sharply

In 2011, Cai Tieqiang founded Delmar, an independent brand of small home appliances in Shunde, Foshan. Its main products include environmental humidification, vacuum cleaning, small household appliances, and small kitchen appliances.

After 10 years of development, Delmar will report to the GEM in June 2021 and begin to embark on the road to IPO.

According to Delmar’s prospectus, in 2019-2021 and the first half of 2022, its revenue was 1.517 billion, 2.228 billion, 3.038 billion and 1.517 billion respectively; a year-on-year increase of 56.91%, 46.89%, 53.27% and 21.60% respectively.

From the perspective of revenue, Delmar’s growth is very good, but its net profit growth rate attributable to the parent is not so satisfactory. According to its prospectus, Delmar’s net profit attributable to the parent in 2019-2021 and the first half of 2022 was 111 million, 173 million, 170 million and 61 million respectively.

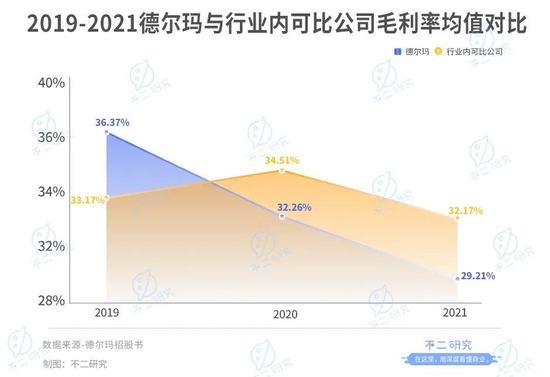

In the case of steady growth in revenue, Delmar’s net profit growth rate attributable to its parent has fallen off a cliff. Obviously, there is a problem with its profitability. According to Delmar’s prospectus, its gross profit in 2019-2021 and the first half of 2022 will be 551 million, 719 million, 887 million and 446 million, respectively, corresponding to gross profit margins of 36.37% and 32.26%. , 29.21% and 29.43%.

Delmar’s gross profit margin has shown a significant downward trend, and Delmar’s prospectus attributed its decline in gross profit margins to rising raw material prices and changes in business structure.

However, Fuji Research believes that the increase in raw material prices is not the main reason for the decline in Delmar’s gross profit margin. According to its prospectus, the average gross profit margins of comparable companies in the industry from 2019 to 2021 are 33.17%, 34.51%, and 32.17%, respectively, and the fluctuations are not large. If the increase in raw material prices leads to a decrease in gross profit margin, it will affect the entire industry, but the change in gross profit margin of the entire industry has not shown a significant downward trend like Delmar.

Therefore, according to Fuji Research, Delmar’s profitability dilemma is mainly due to changes in its business structure, with ODM and trademark licensing business accounting for an increasing proportion of Delmar’s main business.

Only 30% of its own brands can’t escape the Xiaomi foundry label

Delmar’s business can be divided into three major parts: brand agency, Xiaomi OEM ODM, and independent brands.

Before 2018, Delmar’s small home appliance business did not make money, but with a revenue of 654 million yuan, its net profit was -0.85 billion yuan. However, in 2018, Delmar acquired Philips’ water health business with the support of CITIC Industrial Fund and obtained the brand authorization of Vantage, and its performance began to “take off”. In the second half of 2019, Delmar went further and reached a strategic cooperation with Xiaomi, and Mijia ODM once again helped its revenue rise.

However, Fuji Research believes that although Delmar has achieved good revenue growth through brand agency and Xiaomi OEM ODM in recent years, it has sacrificed its own profitability and certainty of future performance.

According to Delmar’s prospectus, the performance ratio of Delmar’s own brands “Delma” and “Vixin” has dropped from 65.38% in 2018 to 38.29% in 2021, and the performance ratio of its own brands has only 4 remaining. The performance ratio of authorized brands Philips and Vantage will increase from 15.15% in 2018 to 38.92% in 2021; ODM business is also developing rapidly, from 12.14% in 2018 to 22.11% in 2021.

The trademark licensing of Philips and Vantage seems to have brought huge performance growth to Delmar, but the hidden risks behind it are also obvious. According to Delmar’s prospectus, the license period of the “Philips Trademark License Agreement” signed by Delmar and Royal Philips is from July 1, 2018 to June 30, 2038, while the period of the trademark licensing contract signed with Vantage is A renewal application is required for annual renewals.

The potential repossession risk behind trademark licensing casts a first layer of uncertainty over Del Mar’s prospects.

The second layer of uncertainty comes from Mijia ODM. Like trademark licensing, ODM has brought performance growth to Delmar, but at the expense of profitability. According to Delmar’s prospectus, the gross profit margins of Mijia’s ODM business from 2019 to 2021 are 27.53%, 19.18%, and 12.57%, respectively. To continue to cooperate with Xiaomi in the future, there is even a risk of further decline in gross profit margin.

In addition, the increase in the proportion of B-end Mijia ODM business has also put greater pressure on Delmar’s cash flow and accounts receivable. According to Delmar’s prospectus, as of January-June 2022, operating activities will generate The net cash flow of the company was 143 million yuan, and Delmar explained that its inventory scale expanded during the reporting period.

However, Fuji Research believes that the increase in the payment collection cycle under the ODM model cannot be ignored on its cash flow. According to Delmar’s prospectus, Delmar’s accounts receivable turnover rate is significantly lower than the industry average and shows a significant downward trend, which is also the drawback of Mijia’s ODM model.

Therefore, according to Fuji Research, Delmar’s growing trademark licensing and Mijia ODM business have brought strong uncertainty to its future prospects. Delmar wants to successfully go public and reach the end in the red sea market of small household appliances. Strengthening the proportion and innovation ability of independent brands is the kingly way.

Emphasis on marketing and less on R&D, the competitiveness of the Red Sea market is doubtful

In addition to business structure issues, Delmar also has many questions. After it submitted its prospectus, the Shenzhen Stock Exchange asked it with as many as 30 questions.

Delmar’s road to listing is bound to be very tortuous. In addition to the business structure problem, Fuji Research believes that Delmar has three more easily questioned problems, namely: focusing on marketing and ignoring R&D, patent litigation with “Midea”, live broadcast Tax doubts brought by bringing goods.

First of all, it is obvious that Delmar focuses on marketing and less on R&D.

According to Delmar’s prospectus, its R&D expense ratios are 3.59%, 3.36%, and 3.64% respectively from 2019 to 2021, while the sales expense ratios in the same period are 16.92%, 15.41%, and 14.93%. The sales expense ratio is significantly high. at the R&D expense rate.

In fact, it is not uncommon in my country’s small household appliance industry to focus on marketing and light research and development. Fuji Research believes that when the industry is still in the “blue ocean” incremental market, it is understandable for the small household appliance market with low barriers to seize market share by focusing on marketing and ignoring R&D, but at present the small household appliance industry has entered the “red ocean”. In a situation where the stock market is fighting, quality control and innovation capabilities are particularly important for companies in the “arena”.

Although Delmar has increased investment in research and development in 2021, it is still far lower than sales expenses. If it does not increase investment in research and development in the future and improve its own quality control and independent innovation capabilities, it will be in the “arena” of small household appliances. Difficult to stand out.

Secondly, the patent litigation issue with “Midea” also reflects Delmar’s lack of innovation ability.

According to its reply to the Shenzhen Stock Exchange’s inquiry letter, Midea Water Dispenser Manufacturing Co., Ltd. (hereinafter referred to as “Foshan Midea”), a subsidiary of Midea Group, has 5 pending lawsuits with Delmar, and Delmar is the defendant. The indictment of the relevant lawsuit states that the accumulative amount of compensation is 28.2 million yuan.

These 5 lawsuits are all intellectual property lawsuits, and the litigated products involve 4 water purifier products.

Although the products involved in this lawsuit do not account for a high proportion of Delmar’s business, it also shows from the side that the small household appliance industry is seriously homogenized, and Delmar’s innovation capability needs to be improved urgently.

Finally, there is the potential compliance risk behind the live streaming that Delmar has high hopes for.

▲ Source: Delmar official micro

▲ Source: Delmar official microAccording to its prospectus, Delmar mainly sells on mainstream e-commerce platforms such as Tmall, Taobao and JD.com through e-commerce platforms, online direct sales and online distribution. From 2019 to 2021, Delmar’s online sales revenue accounted for 71.58%, 61.68% and 49.68% respectively. Although the proportion is declining, it is still at a high level.

In online sales, the live streaming model is also one of Delmar’s mainstream sales methods, but in recent years, many top anchors have “collapsed” one after another. Among them, Wei Ya, who was fined 1.341 billion yuan for tax evasion, is Delmar’s One of the main partners.

Therefore, the Shenzhen Stock Exchange also inquired about its live delivery mode and asked Delmar to explain.

Although using this model can obtain huge traffic and sales in a short period of time, there is also a lot of risk. Consumers are prone to link the image of the anchor with the product. Once the anchor “overturns”, the product sales are also easily affected. Secondly, if there are tax problems, it will also be a big blow to Delmar’s reputation and compliance risks.

▲ Source: unsplash

▲ Source: unsplashAccording to Fuji Research, Delmar’s road to listing has become more and more tortuous. In addition to the product structure problem to be solved, the lack of independent innovation capabilities also makes investors question marks for it.

IPO exam, where is Xiaomi’s “foundry” road?

As the epidemic gradually eased, the hot small home appliance market during the epidemic also began to “fever”. According to data from the China Business Industry Research Institute, the retail sales of small household appliances in the first half of 2021 totaled 25.08 billion yuan, a year-on-year decrease of 8.6%; the retail sales volume was 119.11 million units, a year-on-year decrease of 8.2%.

The performance of small home appliance listed companies such as Xiaoxiong Electric and Xinbao Co., Ltd. in 2021 will be adjusted, and the stock price will be deeply adjusted.

After Delmar submitted the prospectus, it updated the prospectus twice. Behind the continuous high growth of its revenue, there is uncertainty about the prospects. Is Delmar’s listing to solve the shortcomings of its own brand or just the capital behind it? promote?

(Disclaimer: This article only represents the author’s point of view and does not represent the position of Sina.com.)

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-09-02/doc-imqmmtha5688311.shtml

This site is for inclusion only, and the copyright belongs to the original author.