Welcome to the WeChat subscription number of “Sina Technology”: techsina

Text/Su Qi

Source/Open Pineapple Finance (ID: kaiboluocaijing)

As the “only seedling” of a new listed tea company, Nai Xue’s tea (hereinafter referred to as Nai Xue) attracts attention every time it makes a financial report, but it is always difficult to bring surprises.

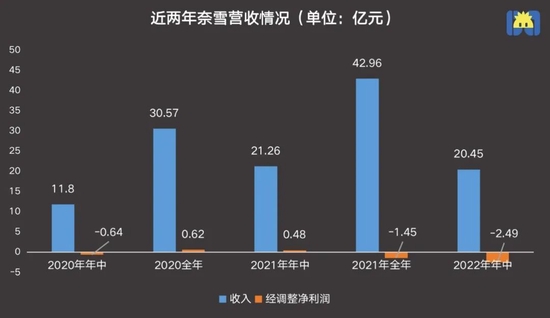

On the evening of August 31, Nai Xue released the 2022 interim results announcement. The financial report shows that in the first half of 2022, Naixue’s revenue fell by 3.8% year-on-year to 2.045 billion yuan, and the adjusted net loss was 249 million yuan, compared with 145 million yuan in the whole of 2021.

After listing as the “first share of tea”, Naixue’s share price began to decline. The day after the latest financial report was announced, as of press time, its share price was HK$5.90, with a market value of HK$10.119 billion, which was 18.86 from the opening price on the first day of listing. The market value of Hong Kong dollars and 32.347 billion Hong Kong dollars has dropped by about 70%.

After listing as the “first share of tea drinks”, Naixue’s stock price was on a roller coaster, and the stock price broke after listing. Since then, the stock price has been on the decline. The market value of 9.793 billion Hong Kong dollars has evaporated 69.7% from the total market value of 32.3 billion Hong Kong dollars from the closing of the first day of listing.

Behind the “endless fall” is Nai Xue’s revenue growth and consecutive losses, and at the same time, the speed of store opening has slowed down, and Nai Xue’s “third space” story is no longer optimistic.

Consumers and investors still have many “choices”: in the same echelon, there are Hey Tea and Lele Tea, as well as the beautiful tea that went out of Changsha and opened stores this year; the cost-effective echelon has a book valued at 10 billion yuan and also burns fairy grass , and Michelle Ice City, which is in the process of A-share IPO guidance and filing.

Some people in the industry believe that if a business model has not been profitable for many years and no profit signal can be seen, it will be considered that there is a problem with the model. Nai Xue needs to check whether her business model should be adjusted. “After all, in the current environment, survival is the most important thing.”

Difficulties in opening a store: All of them were changed to PRO stores, but they still lost more and more

As an offline chain business, the scale of opening a store is related to revenue, user base and brand power. It is the most important indicator for every new tea company, and Nai Xue is no exception.

In the first year after listing, Nai Xue focused on opening stores. By the end of 2021, a total of 817 stores have been opened, of which 326 are new stores. This speed of store opening has finally surpassed HEYTEA, and the total number of stores is also catching up with HEYTEA. According to data from a research institution, HEYTEA will open 198 new stores in 2021 (879 in total for the whole year).

But by the first half of 2022, Nai Xue’s store opening rate has slowed down. As of June 30, 2022, Nai Xue had a total of 904 stores, with a net increase of 87 stores, which was the same as the data in the same period of the same year, but there were 239 new stores in the second half of 2021.

It is worth noting that the newly opened stores in the first half of this year are all PRO stores, and the existing standard stores will be gradually converted into PRO stores after the lease expires. Nai Xue explained in the financial report that since the revenue of the PRO store is basically the same as that of the standard store, and the overall cost is lower than that of the standard store, in this financial report, the standard store and the first-class PRO store are merged into a “first-class tea shop”.

Bao Yuezhong, a new retail expert, said that Naixue was greatly affected by the epidemic in the first half of this year. It is a wise choice to adjust the store and slow down the opening speed, otherwise the book will be more ugly.

However, some people in the industry said that this may mean that Nai Xue’s previous strategy of “third space”, that is, providing consumers with freshly made tea and baking at the same time, failed.

Bao Yuezhong also pointed out that although all the changes to PRO can reduce the pressure of opening a store, it will also weaken the store’s spatial social ability and change consumers’ perception of Naixue’s store positioning, which requires Naixue to synchronize its product structure and marketing methods. Make adjustments to prepare consumers for these new stores.

Kai Pineapple Financial Drawing

Kai Pineapple Financial DrawingRegarding store layout, Nai Xue’s plan in the prospectus is to open about 300 and 350 new stores in first-tier cities and new first-tier cities in 2021 and 2022, respectively.

In the first half of 2022, Nai Xue opened 47 Nai Xue tea shops in first-tier and new first-tier cities. In the first half of 2021, the number was 61. The speed of Nai Xue’s store expansion in first-tier and new first-tier cities is far from planned. further and further.

Bao Yuezhong said that most of Naixue’s stores are located in shopping malls, but the traffic in shopping malls is also slowing down this year. At the same time, there are not many remaining spots in shopping malls in first-tier cities, so its development speed in first-tier cities has been affected. There may still be room for shopping malls in second- and third-tier cities.

The density of stores is not enough, the saturation of Naixue stores in first-tier and new first-tier cities is not as good as that of competitors, and it cannot cover store costs. As a result, it seems that all standard stores are replaced by lighter PRO stores, and more and more stores are opened. In exchange, the operating data of a single store declined.

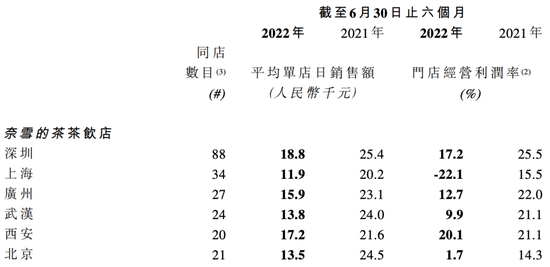

Judging from the cities where Nai Xue mainly operates, the data is not very optimistic. As of June 30, 2022, the average daily sales per store decreased by 4,000-11,000 yuan compared with the first half of 2021, and the store operating profit margin decreased by 8%-13% compared with the first half of 2021. Affected by the epidemic, the operating profit margin of Shanghai stores was negative.

In terms of store type, the performance is not as good as last year. As of June 30, 2022, the average daily sales of Naixue’s first-class tea shop and second-class tea shop were 13,200 yuan and 96,000 yuan, respectively, which was less than the standard store’s 20,300 yuan in 2021; The operating profit margins of first- and second-class tea shops are 11.5% and 10.5%, respectively, which are also much lower than the 17.5% of standard stores in 2021.

“The reason for the poor performance of Naixue stores is that they will not only be robbed of orders by competitors with higher store density, but also will be robbed by their own stores in the same area.” An employee of a new tea brand told Kai Pineapple Finance that originally the area was robbed. There is only one store, and after the rapid opening of the store, there is one store every few hundred meters, and the traffic flow is seriously diverted, resulting in a significant drop in the turnover of a single store.

It can be seen from the financial report that in order to increase operating income and expand the scale, Nai Xue will continue to open stores and increase the density of first-line and new-line stores. The dilemma facing Nai Xue is that the operating efficiency of a single store continues to decline, which will in turn limit the speed of opening a store. Some practitioners said that if this continues, Nai Xue may fall into more and more losses for a long time. The more the loss, the more open the “cycle”.

Performance problems: declining revenue, widening losses

The store data was not as good as expected, and Nai Xue’s revenue data was not satisfactory.

Originally, Nai Xue has survived a difficult 2020, and revenue will increase by 41% year-on-year in 2021, exceeding 4 billion yuan. But in the first half of this year, total revenue fell 3.8% year-on-year to 2.045 billion yuan.

Nai Xue, whose revenue has fallen, also extended the performance loss in 2021. According to the financial report, after Naixue’s performance in the first half of 2022 was adjusted according to non-IFRS measurement, the loss reached 249 million yuan, while the loss for the whole year of 2021 was 145 million yuan.

Kai Pineapple Financial Drawing

Kai Pineapple Financial DrawingIn the first half of 2022, the total number of the company’s stores will increase compared with the same period in 2021, but the company’s total revenue will drop significantly compared with the same period in 2021. The reasons are related to the epidemic and price reduction strategies.

Affected by the epidemic in the first half of the year, the company’s store revenue was affected. Nai Xue said in the announcement that from April to May, consumers’ willingness to spend was more cautious, and the performance of its stores was also under obvious pressure. However, from mid-to-late May, the performance of stores recovered. After the stores in Shanghai resumed business, the same store The income has recovered to about 70% of the local level before the outbreak of the epidemic.

Since March this year, Nai Xue has started to cut prices significantly, with the main price band down to 14-25 yuan, with a minimum of 9 yuan, and bid farewell to the era of 30 yuan. Song Lin, an investment manager who pays attention to the consumption track, said that price cuts have led to a decline in profit margins. Under the premise of poor store expansion, costs are difficult to cover, and small profits cannot be over-sold, which will bring negative results.

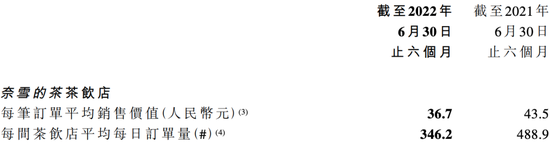

The latest financial report shows that the average unit price in the first half of this year was 36.7 yuan, a year-on-year decrease of 15.6%; the average daily order volume per store was 346.2 orders, a year-on-year decrease of 29.2%.

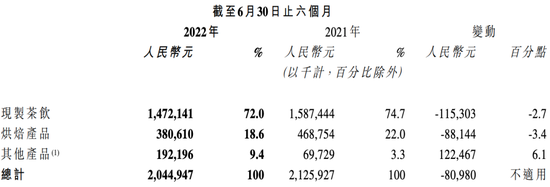

In terms of retail business, Nai Xue has a variety of bottled pure tea, fruit tea and sparkling water products into offline chain shopping malls and other channels, and the proportion of revenue has increased from 3.3% in the same period last year to 9.4% in the first half of this year. According to the financial report, the business is expected to record losses this year due to costs such as channel laying in the early stage.

The core reason for Nai Xue’s loss is expansion. Song Lin said that due to the high labor costs, rent and other fixed expenses caused by the increase in the total number of stores, the company’s losses have expanded.

According to the financial report, among Nai Xue’s costs, with the expansion of stores, the cost of raw materials is gradually diluted, but the proportion of revenue from employee salaries and benefits and rent is increasing year by year. At the same time, the revenue contributed by food delivery is also increasing, from 35.8% in the first half of 2020 to 44.6% in the first half of this year, which has also led to an increase in delivery service fees.

Kai Pineapple Financial Drawing

Kai Pineapple Financial DrawingFrom the financial report, Nai Xue’s biggest cost at present is labor cost. In order to further reduce labor costs and improve standardization, Nai Xue began to develop automatic tea-making equipment, and revealed in the financial report that by the end of the third quarter of 2022, it will be promoted and used in stores nationwide to improve the flexibility of store labor. Nai Xue said that the hourly production capacity of a single person in a store with an automatic milk tea machine can be increased by at least 40%, but this data can only be verified in the next quarterly financial report.

If it is said that Nai Xue’s willingness to lose money in order to expand the market size before listing is in line with the logic of expansion, then by 2022, it is time for Nai Xue to make a choice.

“As a business, whether to use high investment to obtain high profits, or to use low investment to obtain corresponding profits, this is a question that needs to be grasped by the enterprise itself.” Bao Yuezhong pointed out that Naixue is now taking the “encryption” route of large investment stores, but Relatively speaking, there is still a problem with output, which will put more pressure on revenue and profits.

Can the story of benchmarking Starbucks still make sense?

Since Nai Xue went public, her situation and performance have been rather awkward.

First of all, let’s talk about the situation in the secondary market. After Naixue strived to be the “first share of new tea drinks”, the performance has been declining all the way. Today’s stock price and market value have dropped by about 70% from the day of listing.

Song Lin analyzed that because Naixue was scarce in the secondary market before, the listing at that time was good for the entire industry. But at present, the offline catering industry is already affected by the epidemic. Investors are becoming less optimistic about loss-making companies, their valuations are more rational, and their profitability requirements will be higher.

Let’s talk about the market performance after the listing. According to industry insiders, Nai Xue has gone through a lot of trial and error in both strategic moves and marketing moves, but the former is “slow” and the latter “passed”.

Its analysis, for example, in terms of strategies such as price reduction, bottled milk tea, bottled tea, etc., Nai Xue follows the strategy; and in the marketing of “Metaverse”, the first NFT blind box launched has a general response, and because Nai Xue coin And virtual stocks have raised questions from the outside world, and it is still impossible to verify whether it can bring transactions and conversions to offline stores.

Nai Xue has always wanted to do space business and go public with a story about Starbucks, which also means that the model is heavier and the investment is greater, but in this regard, the progress after the listing is still not as good as that of its competitors.

Nai Xue has a sub-brand Taiwan Cover, which aims to cover more price-sensitive user groups. In addition, in terms of investment layout, only Tea Yiji is currently public. Compared with the expansion of the industrial chain and category through investment, Naixue is more trying to open cross-border stores. She has launched a cocktail house concept store “Naixue Bla Bla Bar”, an experiential tea shop “Naixue Dream Factory”, etc. . The latest news is that the “Naixue Dream Factory” was closed in May this year, and was later transformed into a “Naixue Life” experience store, which opened on August 31. It is reported that this store is jointly built by 15 brands that Nai Xue has cooperated with. It focuses on lifestyle, with six categories including drinks, desserts, snacks, light meals, books, and flower arrangements.

On the other hand, Heytea, in addition to using its sub-brand Xixiaocha to hit the sinking market, chooses to invest in other beverage categories. The coffee category includes Seesaw and Minority, and the tea category includes Heji Taotao, Suge Fresh Tea and Wang Ning. There are oat milk TePlant, pre-mixed cocktail WAT and juice wild extract mountain and so on. Some analysts commented that this model is more flexible, can focus on the main business, and is more adaptable to the current environment.

Song Lin also feels the same. He believes that consumers will try their best to consider cost-effectiveness when making consumption decisions. At the same time, many catering brands are sinking, either discounting prices or making second-hand brands. “Naixue is also doing it, but it is not thorough enough. More energy is still focused on the ‘encryption’ of stores in first- and second-tier cities and the large stores that integrate lifestyles. It feels like a counter-trend.”

“But as a business model, if it has not been profitable for many years and cannot see a profit signal, it will be regarded as a problem with the model. If you can’t go dark on such a road, Naixue needs to review its business model.” Bao Yuezhong said , a healthy business ultimately has to think about how to survive.

*The title map comes from Visual China. At the request of the interviewee, Song Lin is a pseudonym in the text.

This article is reproduced from: http://finance.sina.com.cn/tech/csj/2022-09-01/doc-imizmscv8632751.shtml

This site is for inclusion only, and the copyright belongs to the original author.