Today is the weekend. After the market closed, the Shanghai and Shenzhen stock exchanges issued the “Notice on Matters Related to the Suitability Management of Convertible Corporate Bonds”. The full text is as follows:

Each market participant:

In order to protect the legitimate rights and interests of investors and maintain the order of the securities market, in accordance with the “Administrative Measures for Convertible Corporate Bonds” and other relevant regulations, with the approval of the China Securities Regulatory Commission, the Shanghai Stock Exchange (Shenzhen Stock Exchange) is hereby issued to convertible corporate bonds of listed companies (hereinafter referred to as convertible bonds). ) Appropriate management related matters are notified as follows:

1. Members shall establish a convertible bond suitability management system, assess investors’ risk awareness and tolerance, comprehensively introduce convertible bond features and system rules to investors, and fully reveal investment risks.

Investors should fully know and understand the relevant risk matters of convertible bonds, laws and regulations and the business rules of the Exchange, and prudently judge whether to participate in the relevant business in light of their own risk awareness and tolerance.

2. Individual investors participating in the subscription and transaction of convertible bonds issued to unspecified objects shall meet the following conditions at the same time:

(1) The daily assets in the securities account and capital account for the 20 trading days prior to the opening of the application authority shall not be less than RMB 100,000 (excluding funds and securities raised by the investor through margin financing and securities lending);

(2) Participating in securities trading for more than 24 months.

The provisions of the preceding paragraph do not apply to individual investors who have opened the trading authority for convertible bonds issued to unspecified objects before the implementation of this notice and have not closed their accounts.

3. Ordinary investors who participate in the subscription and transaction of convertible bonds issued to unspecified objects shall sign the “Investment Risk Disclosure Statement for Convertible Corporate Bonds Issued to Unspecified Objects” in paper or electronic form.

4. Investors participating in the transfer of convertible bonds issued to specific objects shall be professional investors who meet the conditions specified in the Measures for the Suitability of Securities and Futures Investors.

V. If the controlling shareholder, actual controller, shareholders holding more than 5% of the shares, directors, supervisors, and senior managers of listed companies participate in the subscription, transaction, and transfer of convertible bonds of the company, Articles 2 to 4 of this Notice shall not apply. provisions of the article.

6. Members should conscientiously implement the requirements of this notice and complete relevant technical transformations as soon as possible. Before the technical transformation is completed, members shall handle the activation of convertible bonds through reasonable means to ensure that investors’ rights are not affected.

7. This notice shall come into force on June 18, 2022. If other business rules of the Exchange are inconsistent with the provisions of this notice, this notice shall prevail.

hereby notified.

This new regulation of convertible bonds is earth-shattering, and its significance is extraordinary. Let me talk about my feelings below:

1. The requirements of the new regulations for the Shanghai and Shenzhen stock exchanges tend to be the same. Obviously, the Shanghai and Shenzhen stock exchanges have reached a consensus through communication and coordination in advance. In the future, the trading rules for convertible bonds in the Shanghai and Shenzhen stock exchanges will gradually approach, until they are highly consistent.

2. The old way of old people, the new way of new people. The cut-off time before and after is June 18, and the new girlfriend will no longer be favored. To put it simply, those who can subscribe for convertible bonds before can continue this game, and those who have not yet entered the market, start, wait until the sun rises on June 18, it will be a new world. The ancients have already seen through all this, as the saying goes: the white rabbits are like the white rabbits, and the clothes are not as good as the new ones, and the households are not as good as the old ones.

3. The threshold for convertible bonds for newcomers to join is 100,000 yuan, two years. This is consistent with the conditions for opening an account on the GEM. In the future, it will be more of a stock market, and the problem of the rapid expansion of the number of new convertible bonds will be completely solved. For a long time to come, 12 million households will be a new limit for convertible bonds. Institutional accounts are not subject to this restriction.

Some people say that this article will seriously restrict the number of participants in convertible bond transactions, but I think it is inevitable to make a big fuss. After all, there are already 12 million eligible accounts, and there are currently 11 million active accounts on the ChiNext board with the same conditions. As for the new debt breaking, it is even more unfounded.

4. The increase in the number of convertible bond participants will be greatly reduced. I think the purpose of this new regulation on convertible bonds is as follows: first, to curb the repeated hype of convertible bonds; second, to limit those ignorant idiots who just want to win and do not want to lose; third, next year and the next year, there is a high probability There will also be more perfect management measures for Shanghai and Shenzhen convertible bonds promulgated. The first aspect I think is the most important factor.

5. The impact on the convertible bond market next Monday. I don’t think there will be a big impact on the whole in the short term. In the future, let us continue to play music and dance. But for the demon debt that is about to enter the stock conversion period, it will be a head-on blow. For example, X city convertible bonds.

Is this the end? not at all!

With the change of access qualifications, the Shanghai and Shenzhen stock exchanges also announced the “Implementation Rules for Convertible Bond Transactions (Draft for Comment)” today, and the specific implementation time has not yet been determined. Its main contents include:

1. The basic system of T+0 remains unchanged;

2. On the last trading day of the convertible bond, Zorro’s mark – “Z” is marked on the face

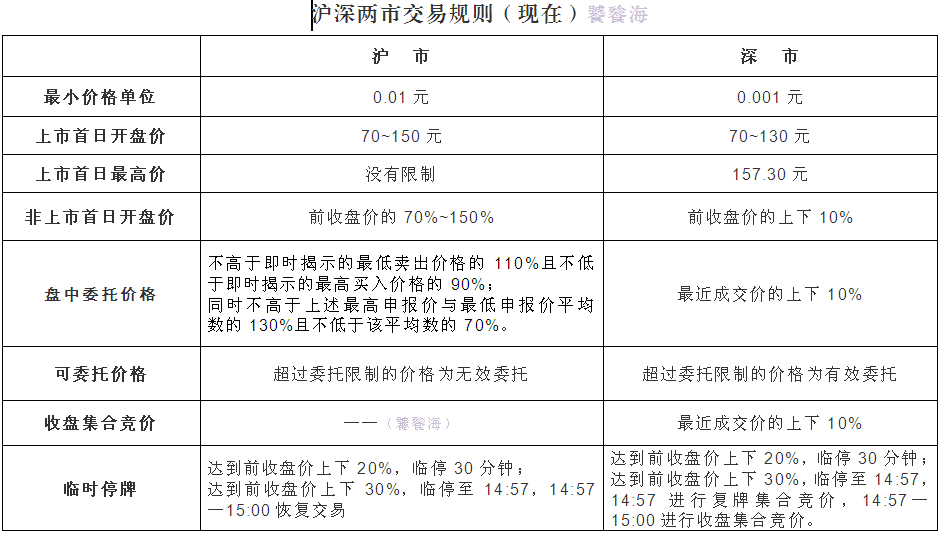

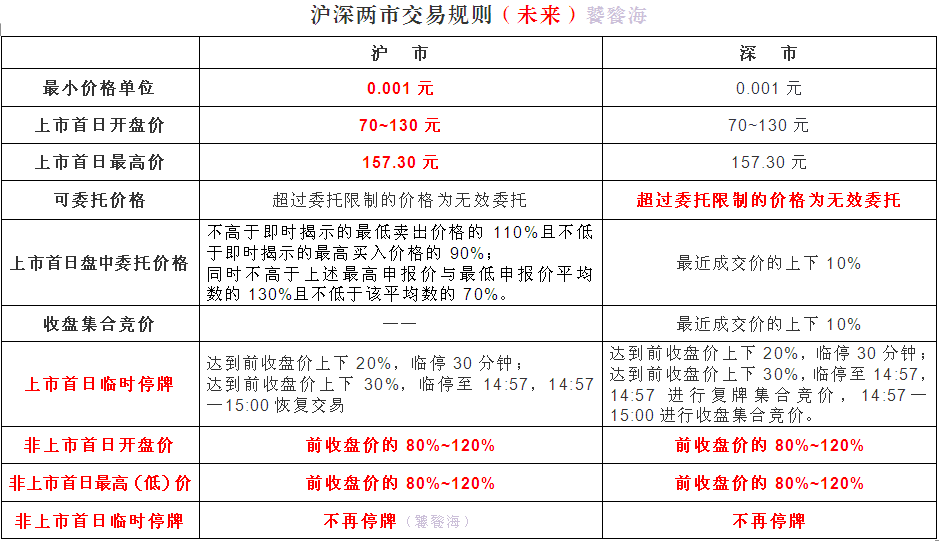

3. Shanghai and Shenzhen stock markets tend to agree on the first-day price limit. That is, the third gear is temporarily stopped: 120 yuan – 130 yuan – 157.30 yuan. The difference is that in the three minutes from 14:57 to 15:00, the Shanghai market is continuous trading, and the Shenzhen market is a call auction. However, if 157.30 yuan is triggered, the two markets will be about the same. However, it is foreseeable that the volatility of convertible bonds in the initial stage of listing will be compressed.

4. The minimum pricing unit of convertible bonds in Shanghai and Shenzhen stock markets is the same. The smallest unit of denomination in the Shanghai market was adjusted from 0.01 yuan to 0.001 yuan, moving closer to the Shenzhen market.

5. From the second day of listing, set the price limit: up and down 20%. The highest (low) effective commission price in both cities is 20% above and below the closing price yesterday, and the convertible bonds will no longer be temporarily suspended. The trading suspension rules for convertible bonds on the Growth Enterprise Market (Science and Technology Innovation Board) are almost identical to those for the underlying shares. I have a doubt here, isn’t this new regulation contradicting the previous regulation that bonds do not have a rise or fall?

6. The declarations in the Shenzhen market that exceed the price limit are changed from temporary storage to invalid, and the Shenzhen market is closer to the Shanghai market.

7. After the Shanghai and Shenzhen convertible bonds are listed, on the premise that the market index remains unchanged, the maximum tolerance for short-term speculation of small-cap new convertible bonds is about 300 yuan. Once it is reached, it will face a suspension verification similar to Yongji Convertible Bonds. Therefore, in the future, when the new debt speculation reaches about 300 yuan, it will be a hurdle.

8. For demon bonds, with the announcement of the trading dragon and tiger list and the introduction of temporary restrictive measures, skyrocketing and plummeting are restricted, and liquidity is greatly restricted, while general convertible bonds are not affected.

Final feeling: In my opinion, the modification of the trading rules of convertible bonds follows the principle of “two consistency, two reinforcements” .

The two are consistent: First, the trading systems for convertible bonds on the Shanghai and Shenzhen stock exchanges are basically the same, and second, the trading rules for convertible bonds and registered stocks are basically the same.

Two intensifications: one is to strengthen excessive speculative supervision; the other is to strengthen risk warnings.

This also reminds from the side that the trend of the future main board stock changing to the registration system is irreversible. A transaction qualification notice released today (to be implemented on June 18) and a draft for comments (implementation time to be determined) are short-term bearish, long-term I don’t know.

Finally, a table summarizes:

Risk warning: The opinions mentioned in this article only represent personal opinions, and the subject matter involved is not recommended. Buy and sell accordingly at your own risk.

This topic has 82 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1314783718/222994808

This site is for inclusion only, and the copyright belongs to the original author.