Now to invest in container shipping, we must first clarify that the current high freight rate is going to go down for a long time . This should be a consensus , and it is implied in the stock price. Does the market value this price and expect the freight rate to continue to rise in the future? Therefore, those investors who are gaming the rise and fall of freight rates should go now.

So what are you still investing in?

The first is low valuation . At the end of this year, this is a company whose cash is higher than its market value after deducting interest-bearing liabilities. Its business is all real cash flow, and its asset structure is also very good. Ships are not the kind of factory equipment assets that need to be discounted once invested and changed hands, and the book value is underestimated. It has a very good dividend distribution capability. As long as the long-term dividend policy in the future is determined, as long as the dividend is distributed every year and then invested, it is completely possible to obtain a good return. Some people don’t look at the valuation, but I like to look at it. The net profit of Haikong in two years is 200 billion+, and the current market value is 236 billion, which means that the valuation of the original assets is less than 36 billion, an extreme year can be An asset that earns 100 billion is only worth 36 billion? ? ? Unbelievable, from the perspective of assets, Haikong once sold a Long Beach Terminal LBCT with a book value of 2.6 billion, and it sold for more than 10 billion… The bankruptcy liquidation value should not be so low….

The second is the length of the game business cycle , that is, the continuity. As I said from the beginning, it is the bottleneck of the US infrastructure that has led to today’s high freight rates, but it takes a very long time for the US to improve its infrastructure processing capacity. It is expected that the growth rate of US demand will definitely decline in 22 years, but it cannot be a cliff-like decline. As long as the volume of goods can be maintained for 21 years, the high freight rate will be maintained. Maintenance does not mean that there will be no short-term fluctuations. There is still a monthly difference in the volume of container transportation. and low season.

The third is the industry competition pattern . Because of the improvement of the competition pattern and the increase of concentration, the high concentration of ship owners and the high dispersion of cargo owners, we believe that when the freight rate of container shipping returns to the normal state, it is also a normal state of upward movement of the freight rate center, and the loss is It is impossible. In the first half of 2020, the volume of goods shrank very much, and there was no loss.

Research on container shipping, China has the most leading geographical advantage, because the world’s container shipping center is China, the world’s top 10 container ports, 7 China, 9 Asia, the basic container is the core of Asia and China, but this research advantage is not from It is reflected in the valuation, but it is lower than the outside world. Consolidation is really very complicated. Basically, it is macroscopic. It involves the needs of various countries and regions, involves too many industries, and involves too many aspects. Good quantification, hard to analyze, hard to judge, so we have seen many professionals in the past have many misjudgments at the macro, micro, and even satellite level. Take a look at a very strange recent data, saying that the volume of imported containers in the United States and West has dropped by 36%, and Yixing is immediately scared. It can be seen that there is no in-depth research and clear consolidation organization overseas, and there are no container shipping companies in the US stock market. Yixing is only 30 billion yuan. Market value, will American professional institutions spend a lot of time researching and learning such a complex industry? Can’t buy how much you understand? Think about it, most of the container shipping companies are listed in marginal markets, such as Maersk and Denmark. Denmark only has a population of 5 million. Where do Danish analysts go to research container shipping? China has the advantage, and the world’s highest stock liquidity of container shipping, but they have not taken the initiative to grasp the pricing, the world’s lowest valuation.

Take the recent long- term agreement as an example. There are many freight forwarders on Snowball, and cargo owners have come out to express their opinions. Whether they are people in the industry or not, of course, it is very easy to come up with some freight forwarders after the freight forwarding industry involves too much. From a point-of-view point of view, judge the macro from the micro world, because the micro world is the place closest to you and the place you can see the most clearly.

Let me explain to you why this long-term association is like this. Take Haikong as an example. This year, many small and medium-sized cargo owners are asking for their grandfather and grandmother to ask Haikong to sign a contract. Some of them are indeed places like the Provincial Department of Commerce and the city. Organised by the relevant departments, Haikong is not easy to refute the face, but you have no historical contract performance record, what should you do? Haikong cut the nov contract, that is, the contract for the freight forwarder (explain here that the historical performance of the freight forwarder is very bad, so later the shipping company became smart, and most of the freight forwarding contracts were fak contracts, and the deadline was 15 days or a month, and I’m not afraid of their breach of contract, this is usually not what we mean by long-term associations), here we sign a higher price to the consignor, and it also carries a loss-of-flight clause, that is, the part of this part of the consignor is now in the form of There are various reasons for not fulfilling the contract. Of course, the shipping company does not care that this part of the cargo owner does not perform the contract. They do not occupy much of the long-term contract, and they can also filter out high-quality customers for long-term cooperation, which is not a loss.

And today, I saw that msc took the initiative to reduce the freight rate of the long-term association. I inquired about this through some channels. They said that there is no such thing at all, and there is no such thing, so I guess what is the situation? , according to the existing information, he had an appointment last year, and he gave such a high price this year, proving that he is not a good customer, and he may have made a lot of money in the middle… and the contract between Maersk and msc There are indeed many kinds of subdivisions. He is most likely the kind of contract that does not carry cabin insurance but the price is agreed to fluctuate… and his contract may not be signed by himself, but by the fob… This is not The kind of real long-term association we think.. is not a long-term association at all… Of course, the above is just my personal guess…

All kinds of freight forwarding groups, all kinds of strange quotes, there are too many ways to play, some of them offer low prices, and then harvest your one-time play when they arrive at overseas ports, and some of them spread the price blindly, can you ask me if this price can give me a space, It’s silent, the industry is too big, and there are too many experts.

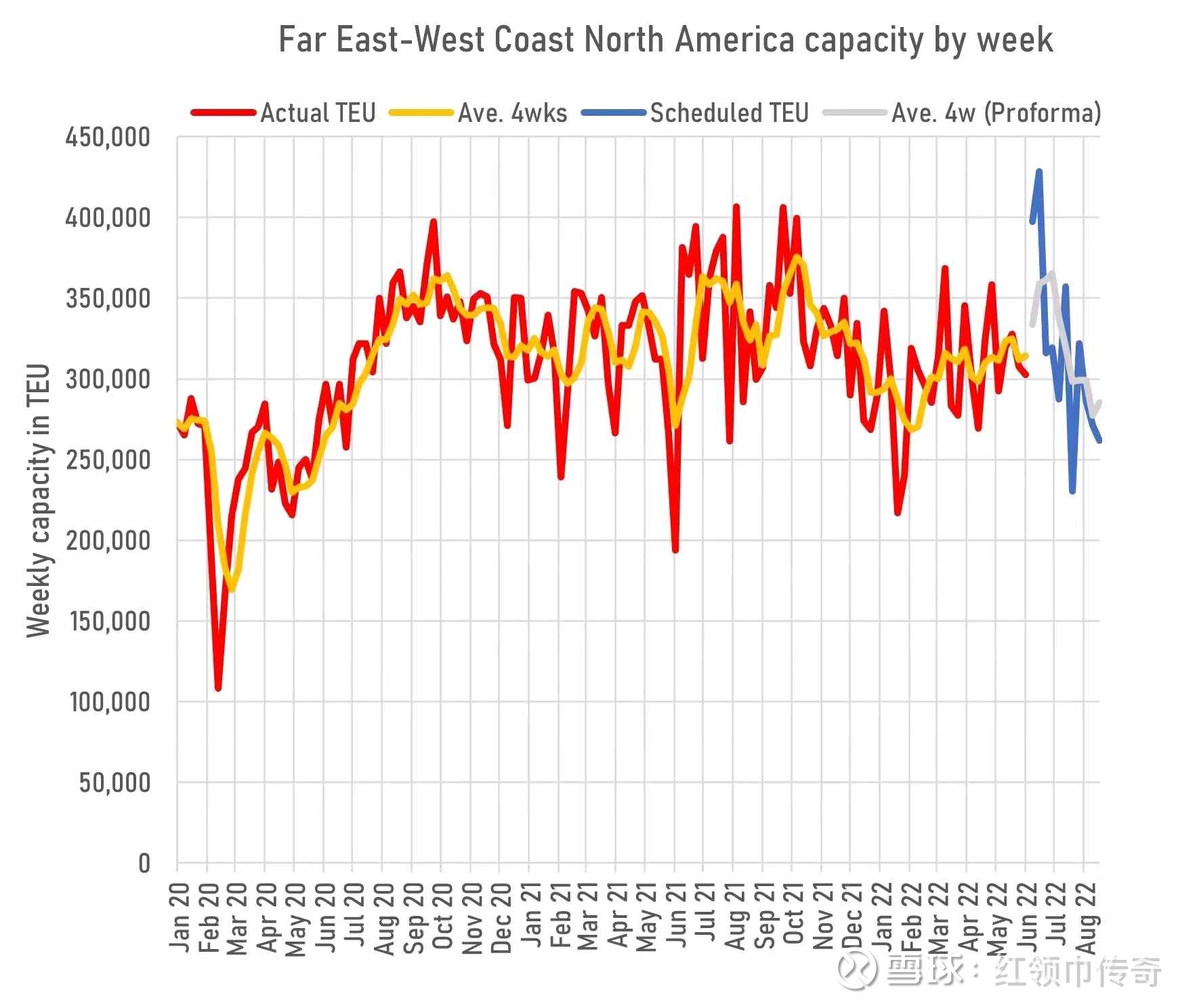

There is also such a view of what kind of cargo owners, how much the order has dropped, historically, foreign trade cargo owners have this view every year, if you don’t believe me, you go to it… Even last year’s big foreign trade year had it.. “No “Orders are dying”… Now America West is really weak, but I think it’s not the weak volume, but the strong capacity, the capacity of America West has increased a lot recently.. The capacity increase may decrease later

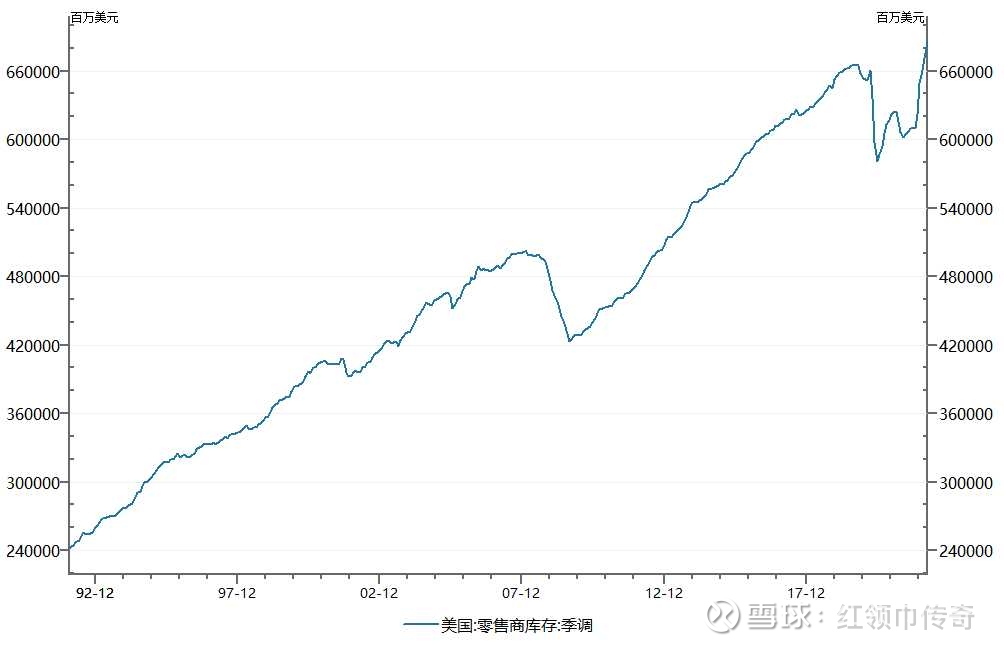

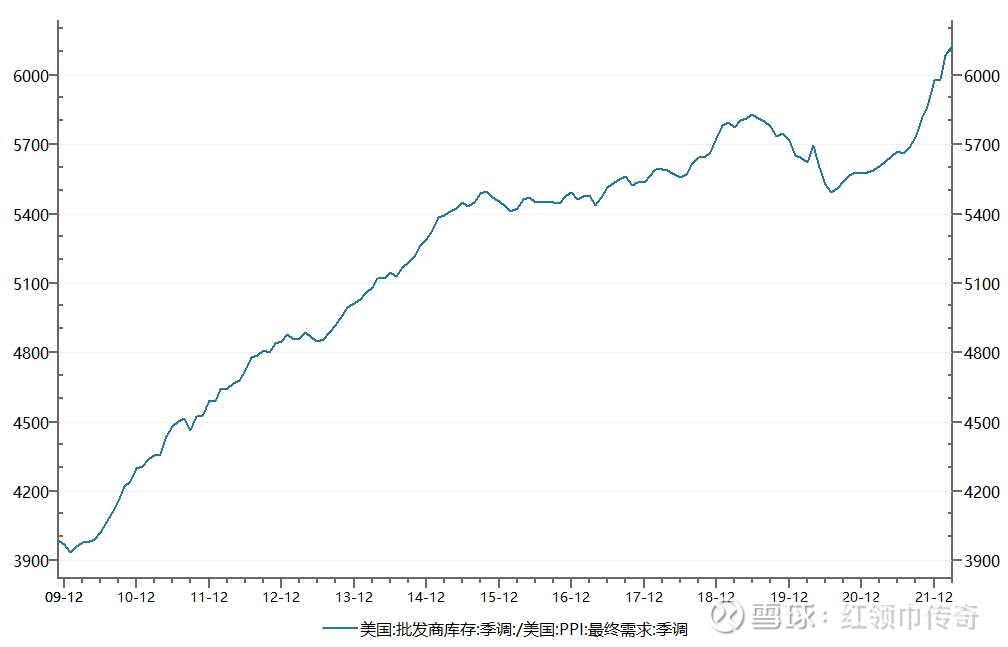

Whether the inventory of American retailers or the demand of the United States has always been a long-term process of rising with economic development, not to mention the increase in inventory, it seems that it cannot be sold. It is true that some products have a bad industry cycle, but there are also some The commodity industry cycle is good. Consolidation and transportation are really complicated. The warehouse sales are not higher than the inventory in the United States. It is just a matter of some hindsight analysts and self-explaining opinions from the media.

I’m just sharing my personal opinions and I’ll make complaints about it. I’m just a small retail investor, and my opinions are not necessarily correct. I still have no room for downside in my judgment on the stock price.

$COSCO SHIPPING Holdings(SH601919)$ $COSCO SHIPPING Holdings(01919)$ $Orient Overseas International(00316)$

There are 78 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/5310697058/222357370

This site is for inclusion only, and the copyright belongs to the original author.