Last week Industrial Bank ushered in dividends, this week Minsheng Bank is about to usher in dividends, and more banks will usher in dividends in the future. Many stockholders have left messages for me, and found that they have a common feature that they pay special attention to the dividend rate. Although the dividend rate is very important, it is not comprehensive, and sometimes it is easy to fall into a misunderstanding. So how do you think about bank dividends? Let me share my personal views today. I selected 5 familiar banks for analysis, involving 4 aspects, as follows:

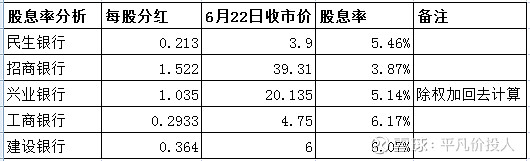

1. Dividend rate

Figure 1

As shown in the figure above, ICBC and China Construction Bank are the highest, followed by Minsheng Bank, followed by Industrial Bank and China Merchants Bank. From the perspective of dividend yield, ICBC and CCB are the best choices, and China Merchants Bank is the worst choice. Let’s not jump to conclusions and continue to analyze the second dimension.

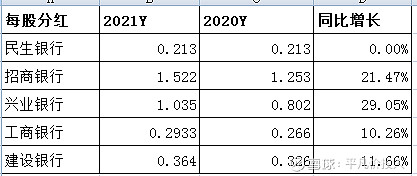

2. Growth rate of dividends per share

Figure II

As shown in the figure above, it can be seen that Industrial Bank has the highest growth rate, followed by China Merchants Bank, followed by ICBC and CCB, and Minsheng Bank is the worst. From the second dimension, it seems that Industrial Bank is the best choice, and Minsheng Bank is the worst choice. Next, we continue to analyze the third dimension.

3. Dividend ratio

Figure 3

As shown in the figure above, it can be seen that China Merchants Bank has the highest proportion of dividends, followed by ICBC and CCB, followed by Minsheng Bank, and Industrial Bank is the worst. But if you look at the year-on-year growth rate, Industrial Bank is not the worst, but has the highest growth rate. So, but there are obvious flaws in the dimension. In addition, it can be seen that the growth of net profit attributable to the parent is significantly positively correlated with the dividend ratio, that is, the better the profit growth, the better the dividend growth.

4. Endogenous growth

The last dimension is financing. From the data of the last two years, only Industrial Bank has issued convertible bonds for financing. It is not that Minsheng Bank does not want to raise funds, but that it does not have the ability to raise funds. Excluding these two, CCB, ICBC and China Merchants Bank have no financing situation and have achieved endogenous growth.

To sum up, the dividend distribution of bank shares should be analyzed from multiple dimensions, not just one indicator, otherwise it will fall into the trap of false dividend distribution. In addition, from the perspective of fundamentals and growth, choosing high-quality banks and holding them for a long time can not only obtain reasonable dividends, but also satisfy long-term investment returns.

The above are just personal opinions and should not be used as investment advice! Special reminder: Any investment activity requires you to think and make decisions independently, otherwise you will be at your own risk!

$China Merchants Bank(SH600036)$

This topic has 24 discussions in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/1394315489/223364543

This site is for inclusion only, and the copyright belongs to the original author.