Generally speaking, I personally don’t like high-debt companies. For example, my heavyweight stocks, “Mao Wuyang Fen Song”, are all cash cows and low debt. Then why would I invest in Three Gorges Energy? As of the first quarter of 2022, the long-term interest-bearing liabilities of Three Gorges reached 101.6 billion yuan (long-term loans of 94.2 billion yuan + bonds payable of 7.4 billion yuan), and many people are afraid and doubtful about this.

Regarding the huge interest-bearing liabilities of Three Gorges Energy, I personally think that it can be discussed from two aspects: 1) How to treat the long-term interest-bearing liabilities of Three Gorges Energy? 2) How will Three Gorges Energy repay these liabilities in the future?

How do you view the long-term interest-bearing liabilities of Three Gorges?

1) First, look at the industry attributes of new energy power generation

New energy power generation is a capital-intensive industry, and financial strength is a barrier to entry. As a central enterprise and backed by the Three Gorges Group, Three Gorges Energy has low financing costs and smooth financing channels, and has obvious financial advantages. The company’s current loan interest rate is generally 50-75bp down from LPR, and the cost of capital is relatively low. In terms of bond issuance, the coupon rates of bonds issued by the company in recent years are all lower than the average level of the same period.

One thing is very clear: Who has the ability to borrow tens of billions of low-interest capital loans from banks? Moreover, the current ROE of Three Gorges is nearly 10%. Although it is not high, it is more than twice the long-term loan interest rate of 3.5%, which is definitely beneficial to shareholders!

In this sense, Three Gorges’ long-term debt (especially low-interest debt) is a competitive advantage!

2) Second, look at the competitive characteristics of new energy power generation companies

High-quality wind and solar energy resources are mainly distributed in limited areas and specific locations, and the local consumption capacity and the transmission capacity of the local power grid are also the main factors restricting the ability of power generation to connect to the Internet. Therefore, the competition among enterprises for high-quality power generation projects with superior wind energy and solar energy resources, sufficient local consumption capacity, and sufficient power transmission capacity is very fierce.

The competition of high-quality resources constitutes the main content of industry competition, that is, whoever has money can have more high-quality resources; whoever occupies more high-quality resources has a competitive advantage!

In this sense, the long-term liabilities of the Three Gorges are high-quality resources!

3) Finally, where did the money borrowed by Three Gorges Energy go?

The following is the financial report data of the past years

In the image above:

New debts = “long-term borrowings + debts payable” in the current period – “long-term borrowings + debts payable” in the previous period

Newly added solid production = “fixed assets + construction in progress” in the current period – “fixed assets + construction in progress” in the previous period

It is clear that the annual increase in solid production is very close to the increase in debt, which means that the money borrowed by Three Gorges Energy is basically used to build new wind farms and photovoltaic farms (i.e. not used for other purposes)

Under the current national energy policy, the local power grid company needs to provide grid-connected access to new energy power generation and purchase all new energy power generation within its coverage area at the price determined by the government. New energy power generation projects do not exist in the operation stage. substantial competition.

New energy is the general trend, and the power generated by new energy can be sold as much as possible. New energy power plants are high-quality production capacity, and there will be no worries of overcapacity and backwardness in the future!

In this sense, the long-term debt of the Three Gorges is high-quality production capacity!

How will Three Gorges Energy repay its debts in the future?

I once discussed “interest-bearing debt” in the article “Four Issues in Three Gorges Energy Investment and My Thoughts” ( web link ): “I make a simple calculation, after entering the mature stage, about 15 years Interest-bearing debts can be repaid”

How did I say 15 years? Let’s talk about my thinking and deduction

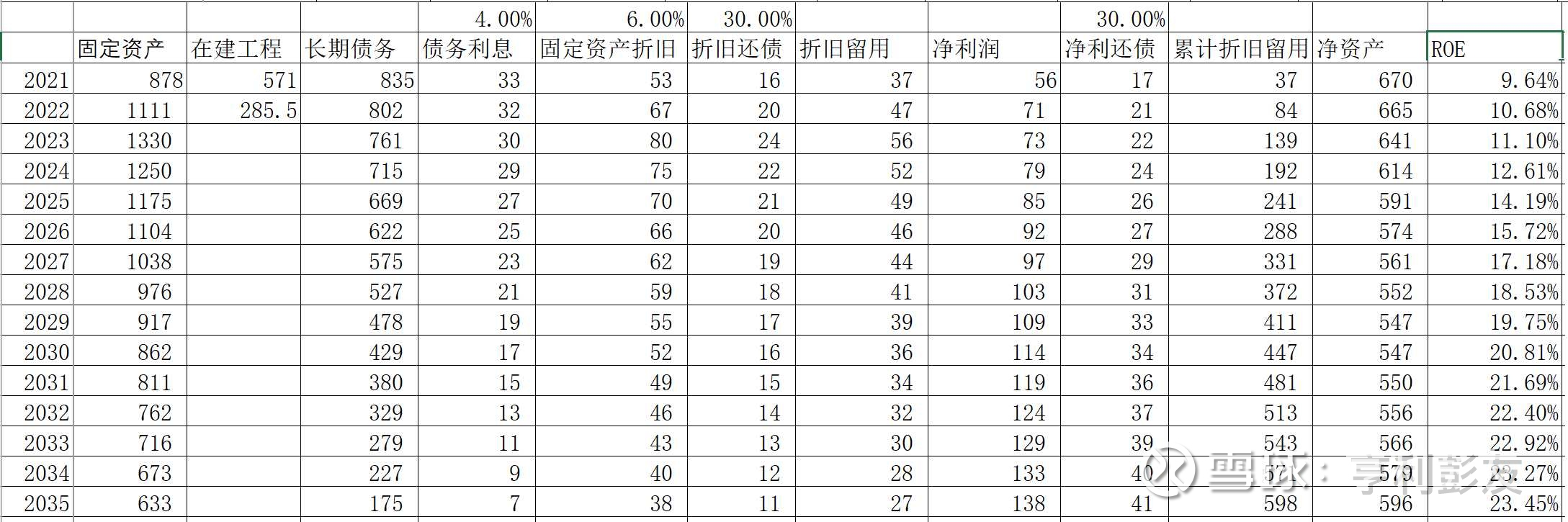

The figure below is my deduction result based on the following assumptions:

1) Assuming that 2022 will enter the maturity year, and there will be no new projects in the future

2) Assuming 4% interest on debt and 6% depreciation on fixed assets

3) Assume that 30% of depreciation of fixed assets and 30% of net profit are used to repay debts

Above picture can be seen:

1) After 15 years, that is, in 2035, the long-term interest-bearing liabilities can be reduced to about 17.5 billion;

2) Entering the mature stage, net profit can still maintain growth, and ROE will gradually increase to more than 20%;

3) In the mature stage, 70% or more of the net profit can be used for dividends

In the end, the above are just my personal thoughts and speculations!

$Three Gorges Energy(SH600905)$

$Yangtze River Power(SH600900)$

There are 45 discussions on this topic in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/8118950998/222304124

This site is for inclusion only, and the copyright belongs to the original author.