What is a neutral strategy?

First, let’s look at the simplest example. We all know that index-enhanced products achieve a certain excess return on index returns and obtain an absolute return.

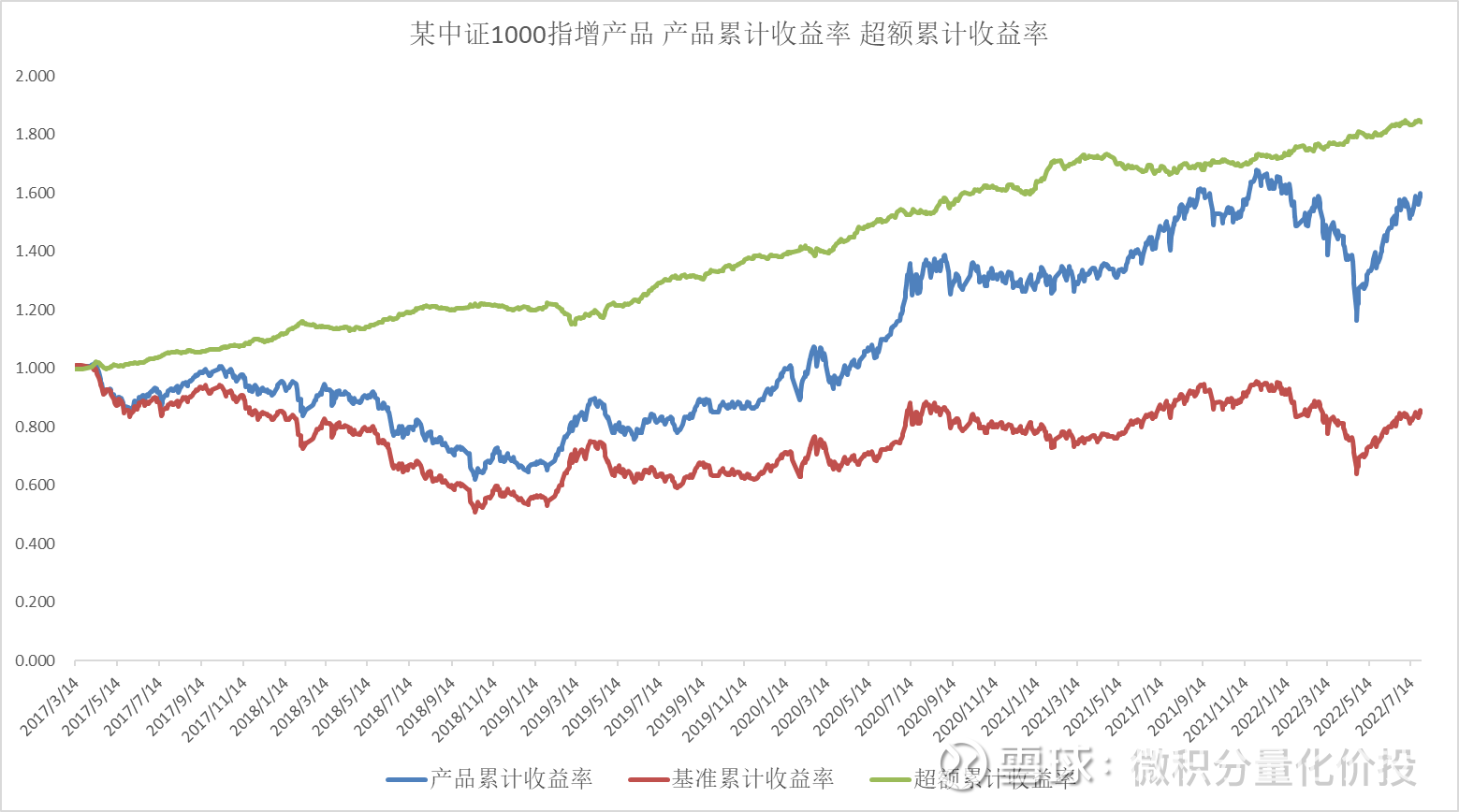

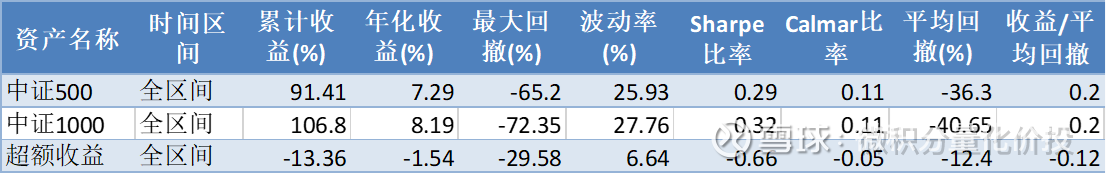

Next, let’s take a look at the difference between these yields through a publicly offered CSI 1000 index product. Because the open-end public fund product needs to reserve a certain amount of liquidity, the performance benchmark of this product is: 95% CSI 1000 index yield + 5% bank deposit interest rate (after tax) for the same period.

It can be seen intuitively from the above figure that the cumulative rate of return of the product is highly consistent with the benchmark cumulative rate of return, but higher than the performance benchmark, so there is a certain excess return. And the index is much more stable, and the performance is very good.

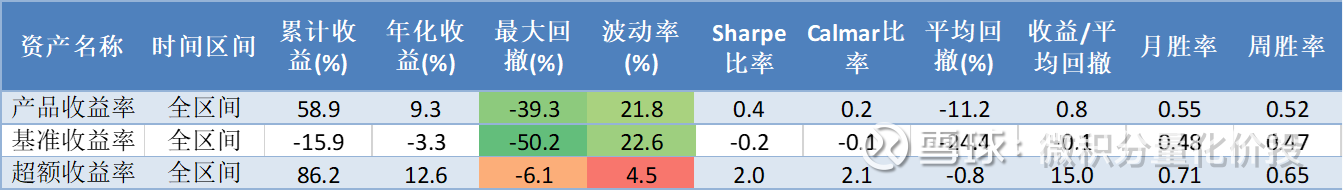

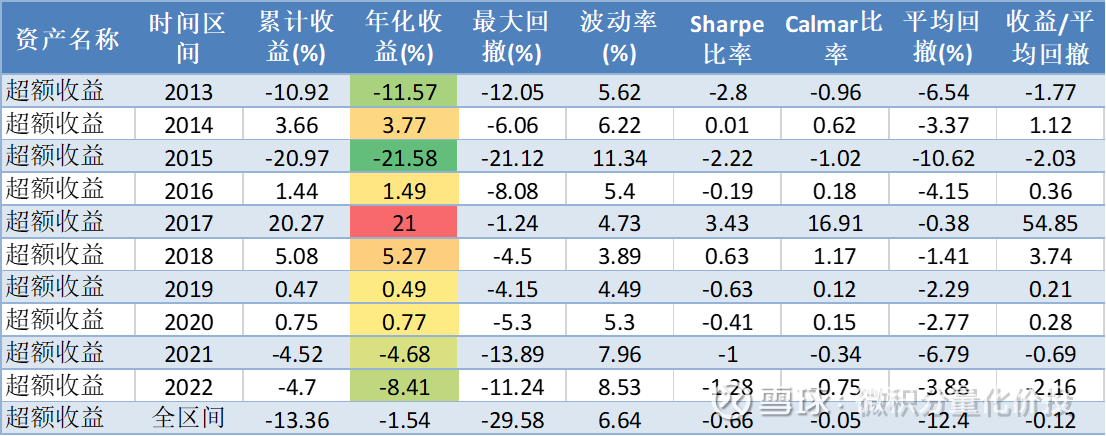

From the specific performance evaluation indicators:

In terms of risk-oriented maximum drawdown, draw drawdown, and volatility, the volatility of excess returns is much smaller, and the final annualized return is not low. The comprehensive risk-benefit performance-to-price ratio is much higher than product returns and benchmark returns.

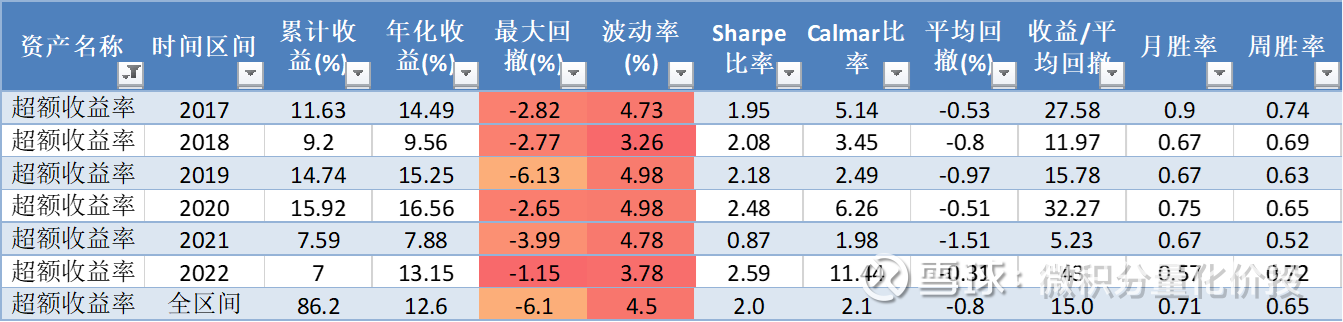

If you look at each year, the largest drawdown occurred in 2019, and the rest of the years were relatively small. This excess income is the steady happiness.

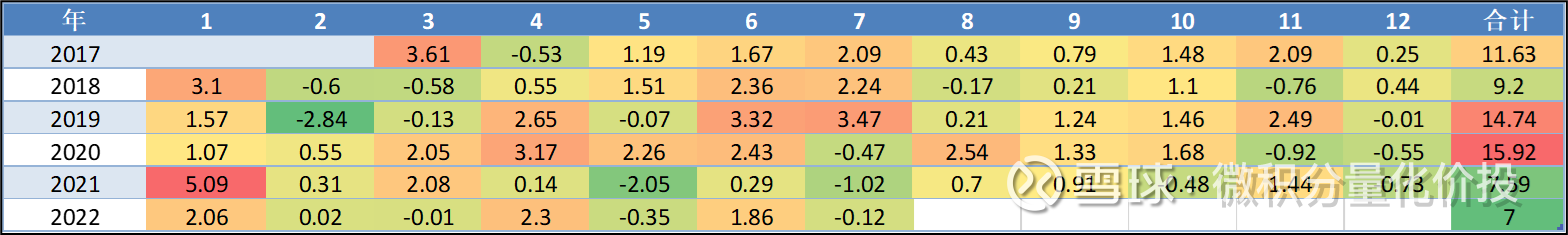

From the perspective of monthly excess returns, it is also very stable.

But the absolute return of the index products we buy includes not only the excess return, but also the return of the underlying index. Just like we drink Coke and drink it very well, but we also need to consume sugar in the middle. So how do you get the absolute rate of return? A simple idea is to introduce a short stock index futures hedge alongside index products to hedge the underlying index returns, leaving only the “best” excess returns.

What is basis rate?

The above is just a theoretical conjecture. Sometimes, we often say that the ideal is full and the reality is very skinny. The biggest problem is the issue of hedging costs. What is the cost of hedging, that is, the basis?

First of all, we need to know that futures contracts are not continuous. They are not the same as stocks. It is enough to buy or sell them all the time. Futures contracts have a certain period. For example, this contract will expire in June. If you want to continue to hold it, you need to close the contract in June and then buy the contract in July or October. Only by rotating the ground can you keep your position in existence, and this rotation may cause losses.

What is basis, basis is defined as:

Basis = stock index futures point – index point, if the stock index futures point is less than the index point, then it is a negative basis. For example, the closing price of CSI 1000 stock index futures is 7087, and the corresponding CSI 1000 index point of the day is 7117, then the corresponding basis is 7087-7117 = -30

Basis Rate = Basis / Index Points = (Stock Index Futures Points – Index Points) / Index Points. The corresponding point above is -30 / 7117 = -0.421%. Note that because it involves the expiration of futures contracts, we generally calculate the annualized basis rate for easy comparison.

Why is a negative basis a hedging cost? Suppose, we construct a combination of multi-index and short stock index futures. At T0, the time period income is: 7117-7087 = 30, assuming that on the expiration date, we need to close the position and then re-establish a new position. , because the delivery mechanism of futures will make the futures contract and the spot contract contract (if they are inconsistent, there will be arbitrage opportunities. With the participation of arbitrageurs, the futures price will be equal to the spot price), so at T1, the combined income For X – X = 0, then the combined value from T0 to T1 is: 0 -30 = -30. That is, in the case of negative basis, you will lose 30 points of gain. Then if it is a positive basis, it is equivalent to an additional income of 30 points.

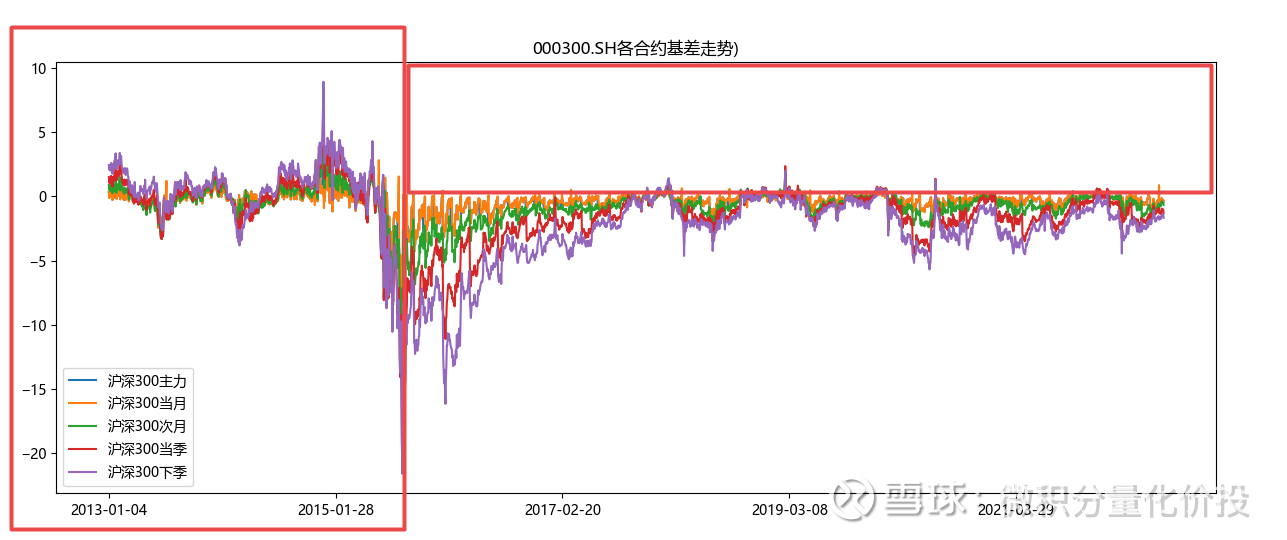

The following is a relatively long basis rate (not annualized) trend of CSI 300 stock index futures.

Judging from the historical basis rate of CSI 300 stock index futures, in fact, before 2015, the probability of positive basis was much higher, but after that, most of the time it was negative basis, and sometimes the negative basis was relatively large. In fact, this can also explain why after 2015, there were many quantitative hedging products, why they are not fragrant. For example, assuming that the previous hedging return was 10% annualized, because it is a whole basis, assuming that the excess return on the positive basis is 3%, then the excess return is 7%, and assuming that the negative basis rate is now 3%, then The return after hedging is 7%-3% = 4%, directly from 10% to 4%, the decline is still very large. In the past, for hedging, the market would give you a red envelope. Now, if you do hedging, you will not be given a red envelope, and you will be given a red envelope. The decrease in this kind of income is relatively large.

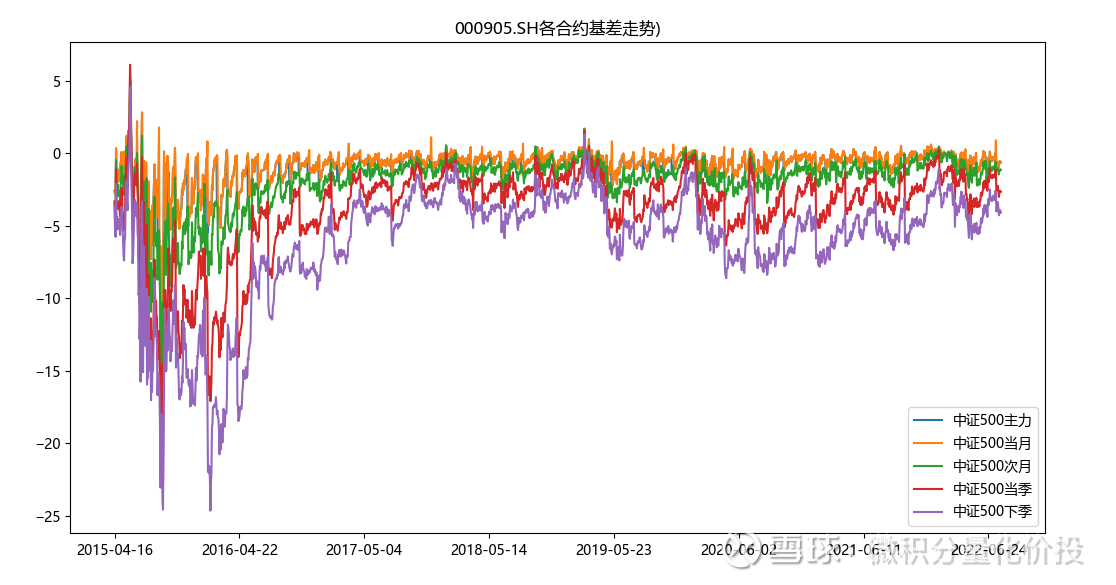

For the CSI 500, there is a similar conclusion that negative basis is the norm.

If we open a position in reverse, assuming a pure long stock index futures position, then the negative basis is equivalent to the excess return we get. This is the excess return provided by the market system and does not require the active management ability of the fund manager. Therefore, if the excess return of an index increase cannot outperform the basis rate, it means that the allocation value of the index increase is very low.

Opportunity for a neutral strategy

From the above analysis, we know that the final return of the neutral strategy depends on two factors, one is the index-enhanced excess return, and the other is the cost of hedging, that is, the basis rate. (A negative basis rate represents costs, and a positive basis rate represents benefits).

Judging from the index increase data of a public offering above, the annualized excess return of 1000 index increase is about 7%-10%. Let’s take a look at the basis rate. Because the listing time of CSI 1000 futures is relatively short, historical data is relatively missing, mainly based on the recent basis rate.

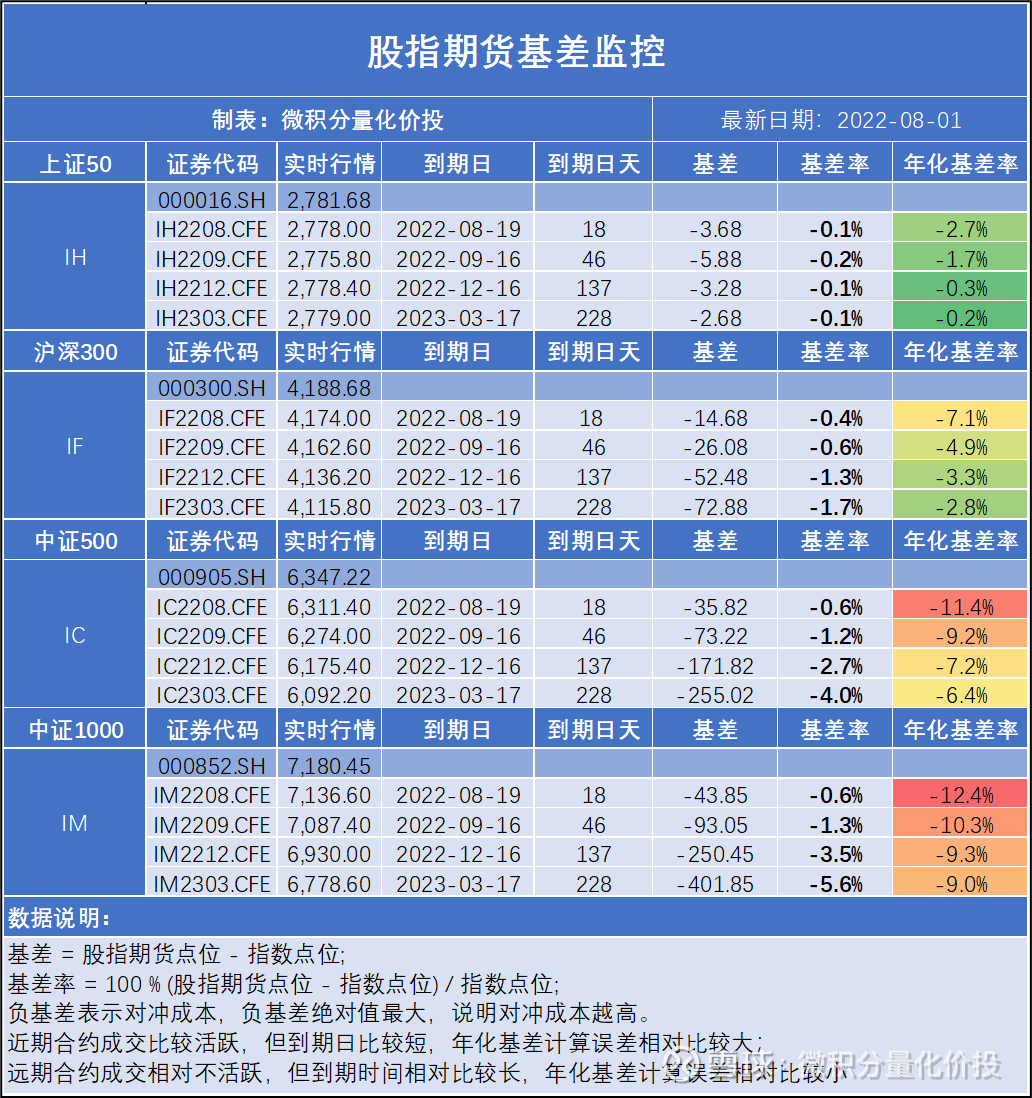

Judging from the data monitored above, the annualized basis rate of the CSI 1000 is relatively large, greater than the CSI 500, greater than the CSI 300, and greater than the SSE 50.

At present, the basis rate of the CSI 1000 is about 10%. Considering that the annualized excess return is only 7%-8%, if you build a neutral strategy portfolio, you will still lose money. However, there is a workaround, wait for the basis to be relatively small, and open a position, which can avoid excessive losses due to the basis, but this has another limitation, that is, the contract will have an expiration time. When changing positions, it is necessary to consider the basis issue.

Long and short combination

Before there is no CSI 1000, if you want to do short-selling small-cap market capitalization stocks, you can only do short-selling 500 stocks, but the basis of CSI 500 is relatively large. Is it possible to short small-cap stocks by longing IC and shorting IM? What about the market value. Although shorting IM will have a negative basis of about 10%, but shorting IC will have a positive basis of about 7%, the two offset each other, and the negative basis of shorting is 3%. If the excess return of 1000 exceeds 3%, then the basis can be covered. Moreover, the correlation between CSI 500 and CSI 1000 is also relatively high, and the difference is not particularly large.

The following is the excess return of 1000 air certificates through multi-CSI 500. Judging from the cumulative return of excess returns, the trend is not stable, and there are certain fluctuations. Before 2016, relatively speaking, the style of small market capitalization dominated. Long CSI 500 and short 1000 securities contributed to negative returns. From 2016 to 2019, it was a relatively positive income market, and the small market capitalization relatively underperformed. However, it has been relatively stable recently, and the fluctuation range is not large.

From the perspective of cumulative excess returns, it is a negative contribution, not stable, and the maximum drawdown is slightly larger.

In terms of annual returns, it severely underperformed in 2015 and pulled back in 2017. The recent fluctuations have been small, and this excess return cannot completely cover the negative basis contribution.

Judging from the case of this backtesting, there is no stable excess return by directly multiplying CSI 500 and Air Securities 1000. If you need stable income, you may need to do your own style timing.

summary

The listing of the CSI 1000 has brought investors the expectation that the neutral strategy can greatly expand the capacity. However, judging from the performance of the CSI 1000 after the listing, the CSI 1000 stock index futures have a relatively big problem, that is, the basis is too large. At present, the annualized basis rate is about 10%, which exceeds the annualized excess rate of return of ordinary index enhancement strategies. If you open a hedge portfolio at this time, there will be a high probability of loss.

If it is extended to a long-short strategy, with multiple CSI 500 and A/S 1000, there is no stable absolute return. You need to do your own style timing before you may have a stable excess return.

Therefore, for now, it can only be said that the ideal is very plump and the reality is very skinny. The listing of CSI 1000 stock index futures does not bring too many opportunities for neutral strategies.

At this point, the full text is over, thank you for reading.

If you find any mistakes or omissions in my analysis, your corrections and additions are welcome.

The above content is only used as a personal investment analysis record, and only represents personal opinions. The analysis content is based on historical data. Historical performance does not indicate its future performance. It does not serve as a basis for buying and selling, and does not constitute investment advice.

#雪ball star plan public offering master# #ETF star push officer # #CSI 1000 stock index futures are listed, what new ways to play#

@ Egg Roll Index Fund Research Institute @ Today’s topic @ Snow Ball Creator Center @ Egg Roll Fund @ ETF Star Push Officer @ Ball Friends Welfare

Quickly retrieve historical articles

$CSI 1000ETF(SH512100)$ $CSI 500(SH000905)$ $CSI 1000(SH000852)$

This topic has 1 discussion in Snowball, click to view.

Snowball is an investor’s social network, and smart investors are here.

Click to download Snowball mobile client http://xueqiu.com/xz ]]>

This article is reproduced from: http://xueqiu.com/4778574435/226966062

This site is for inclusion only, and the copyright belongs to the original author.