Original link: https://www.hellobtc.com/kp/du/08/3995.html

Author: Arad / Fire Compilation / Source: Vernacular Blockchain

This is the original 1732nd issue of the vernacular blockchain

Author | Arad

Compile | Fire

Produced | Vernacular Blockchain (ID: helloBTC)

The “home economy” under the epidemic has made video games more popular than ever, but at the same time, by-products such as encrypted assets and NFTs have also entered the mainstream. In fact, it has been more than ten years since the birth of encrypted assets, but it is only in the last year or two that many executives in the game industry seem to have become more interested in it.

But according to the news on January 22, 2022, a report on the state of the global game industry shows that most developers do not care about NFT digital collectibles or encrypted assets. Over the past year, we’ve seen publishers and developers, large and small, test the waters in the polarized NFT market. So are crypto assets or NFTs useful to the gaming industry?

It’s time to put aside abstract concepts and look at reality itself, and to this end I bring you a practical paper.

The following is the text of the translation?

Thanks to Lars at Naavik for being able to write this article, actually inspired by him (although he didn’t know about it). Several times, Lars has been very adamant that encryption doesn’t add anything new to the game – what he thinks can be done with encryption, can be done without encryption.

And unfortunately, in his conversations with crypto practitioners, they were somewhat at a loss, and despite their belief in crypto, it was difficult to explain what it brought.

Likewise, the vast majority of crypto-game ideas are either too lofty or unrealistic, or are saying some empty promises. The common sentiment among investors is: “You want crypto games. You think you don’t, but you do.”

So, what exactly is the value of encryption technology to creators and players? Hence the article I wrote today. I hope that by the end of this article you will feel the same way I did: games will inevitably cross the chasm into cryptoassets.

The following list is what we will discuss today:

1. Decentralized infrastructure

2. Relying on liquidity

3. Original drivers and quasi-equity

4. Composability

5. Player Payouts

6. Funding and Alliances

7. Universal Login and Universal Identity

8. Crypto-native games

9. Other content

Before we go any further, let me say that there are more categories of Lars’ points, but I think there are two points: that encryption may allow the existence of quasi-equity; games that are fully deployed on-chain are indeed novel enough to warrant encryption. .

I will touch on both of these below.

@karlybierma (the author claims to be a bald old man with a kipa and a VR rig)

01

Decentralized Infrastructure

Development studios can use open source software to make in-game purchases, develop marketplaces, and record ownership.

So: Access to ready-made open financial rails without paying an additional 2%-30% corporate service fee.

Since it is open, developers can participate anonymously. Some of the best online content is created by pseudonyms, so there’s no reason why it shouldn’t extend into game production. Using the chain as a tokenized financial infrastructure means that legal entities are not a necessity like traditional businesses.

Asset ownership can be tracked on-chain rather than operating in opaque private databases.

02

rely on liquidity

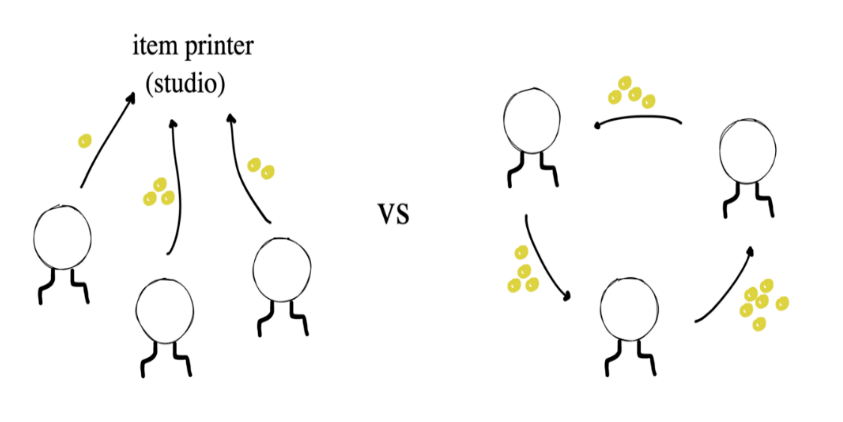

Freed from having to guarantee a supply of store items or purchasable content, studios now have an alternative – they can incorporate resale royalties into game assets – and create an active, healthy Economy.

Constantly releasing new purchasable content/assets will no longer be the only way to successfully monetize a game – collecting royalties from a fast-moving economy is also a good way. This is good for both studios and players in the long run.

It’s a fundamental shift; from sunk costs looking for breakthroughs to players looking for ways.

An economy can revolve around the exchange of communities, user-generated assets, resources, or fashion items. Shifts of this magnitude tend to open up new and previously unimaginable economic models, so my list above may just scratch the surface of what the next decade will create.

The caveat here is that technically these can all be created without encryption applied. Ebay or Steam might be persuaded to increase creator royalties, or creators could try to create their own royalty-enabled marketplaces, albeit with more difficulty, on the traditional financial track.

But there is a more direct way to do this using encryption. Currently we can see that royalties are ubiquitous in NFTs, and while they are not fully enforceable, they are almost never seen in traditional art or games.

03

Raw drivers and quasi-equity

-

original drive

If you can feel a sense of ownership in the game, players will be more enthusiastic to participate in game management. Like founders and employees, having a financial stake inevitably makes players feel more identified with the game’s accomplishments.

Of course, owning an NFT is fundamentally different than owning equity — but can actually have similar psychological effects.

Even if the division of actual fairness is not so clear, the division of ownership increases the power of the tribe, which is the original driving force.

The original drive is a collective spirit of cooperation, passionately managing what you think is yours, and hoping for recognition and honor in the team, or other financial gain. This is a big part of the driving force behind the development of Bitcoin, Ethereum, and Tokens.

Will everyone love this new game world? Do not. Will it happen? Yes. Will games that embrace this new reality evolve faster than their peers? perhaps. Will the world be a better place for this? I have no idea.

Frankly, it’s nothing new that players want rewards that are aligned with the game’s incentives: MTG players are highly aligned with the game because they spend a lot of time and money acquiring cards, building decks, and improving their strategies; World of Warcraft players have certainly chimed in with its success, paying subscription fees and spending hundreds of hours on raids over the years to equip their characters, earn achievements, make friends, and make a name for themselves.

There is no doubt that players are always aligned with the success of their games. Especially if it’s a multiplayer game. But if the game fails, game over!

The demise of a multiplayer world is similar to the demise of any sport or group. All reputation and players, capital, etc. gained within the group are wiped out – becoming almost meaningless.

Another analogy: You’ve spent your life trying to advance the social and economic development of the planet? But unfortunately humanity has started to move to the next planet…

So anyway, the point is that players also want their games to be successful, because if they don’t, they’re also losing a lot of time and energy, and they’re taking risks.

But let’s look at the optimistic scenario. What happens if the game is successful? Players can continue to play as normal, and their progress is recognized by the team. Unlike all other games traditionally, there is very little monetary gain that can be transferred to the outside world at first. But early success usually leads to more opportunities for wealth, including political and social status.

If the game fails, players suffer losses that are often hundreds of dollars or thousands of hours, but if the game succeeds, there is little noticeable gain. This is especially true for early players, as they don’t know what the future fate of the game will be — whether it will be short-lived and die soon — which is the fate of most multiplayer games.

What if the game had a way to reward players? What if the game performs well but the player takes a high risk? You might want to argue, is it a legitimate requirement for all adventurers to get the benefits?

But you can’t ignore the presence of the original drive.

The original driver is the strength of the organization. It is the pure energy of a group of people united under one banner and cause. It’s been ubiquitous in gaming for decades, especially after the advent of social platforms like Youtube and Reddit.

However, new cryptographic paradigms can allow it to grow and amplify even further. Don’t ignore the presence of the original drive. It’s the most effective growth and marketing strategy the gaming world has ever seen.

-

quasi-equity

As a bonus, I would like to point out that using cryptoassets puts quasi-stakes in the hands of players. To be fair, it’s hard to say whether game developers are actually willing to share revenue with their player base. But since the importance of listening to players is so emphasized, can’t giving back to players become a phenomenon and a trend?

I tend to think yes. The reason is that some small groups in the gaming world are starting to move to the rev-share model. (The full name is Revenue Share, the basic meaning is that you get X% commission from the income you create for Y company.)

It can unleash everyone’s drive in a more direct, traditional way without changing the actual game design (e.g., no need to enable free trading of game assets or earnable tokens).

Ben Kenobi

Ben Kenobi

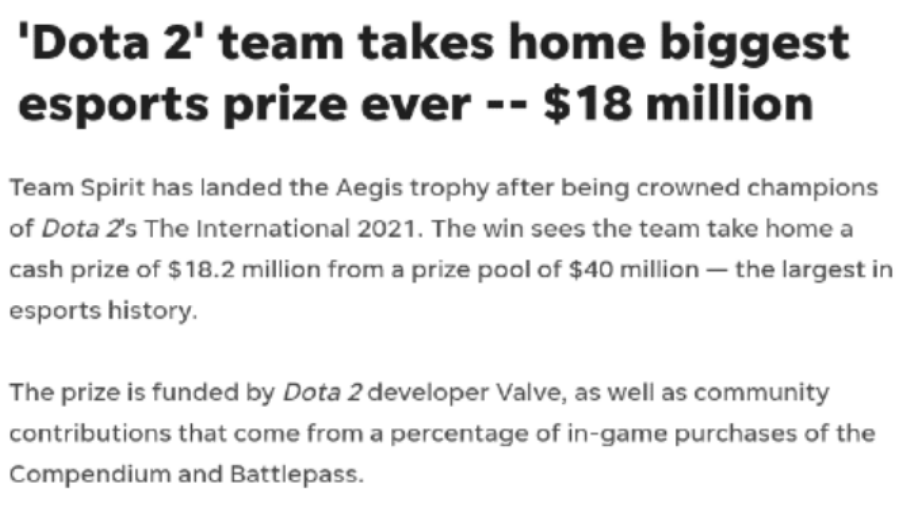

The concept of rev sharing is not unprecedented. For nearly a decade, Dota 2 has been allocating 1% of its revenue to its champion prize pool, which has allowed them to grow rapidly. It’s an excellent marketing tactic that fosters a closer relationship between Valve and its player community.

But I would like to speculate about the possibility of direct revenue sharing from research. I speculate it hasn’t happened yet, for two main reasons:

Compliance and Legal Issues

Payment method restrictions

Let’s take a closer look at these two questions:

1) Legal and compliance issues; how to make it possible to distribute some form of dividend to random unidentified people even in the absence of regulation.

Can encryption solve this problem?

Not yet, but it could be. Revenue sharing can happen automatically through a series of autonomous contract interactions, similar to many of today’s Defi protocols that distribute protocol fees to token holders (some even have teams in Western jurisdictions, such as Synthetix). Game developers could replicate this approach and even forgo the tradable token model in favor of a different system based on game scores that is recorded on-chain but not immediately financialized.

Alternatively, a portion of the revenue generated by the game can be automatically sent to a separate vault managed by the player’s token holder (again, the token can be made non-tradable, or just an internal game score calculated by arbitrary metrics). The purpose of the treasury is completely unspecified, but it can actually be used as a form of distribution that is not under the direct control of the game developer. It’s easy to push the player base in that direction.

Admittedly, this is all a legal grey area.

Nonetheless, at least crypto has pioneered, allowing anonymous teams to capitalize their creations . Encryption abstracts the boundary layer of the real world and brings us into a more digital and decentralized universe. Creators used to have to rely on traditional financial infrastructures that are deeply concerned with their real-world identities and physical addresses. Not at all in the crypto world.

2) Payment channel restrictions; need to collect financial information of a large number of participants, keep data safe, pay obnoxiously high fees, and then harvest on a global scale, including control in many jurisdictions and banking systems. Needless to say, it’s going to be a hell of a nightmare. This is not a precedent.

Can encryption solve this problem?

Yes, it can be solved. Without giving too many examples, just look at the hundreds of projects that have already done so – whether it’s their own tokens or their ETH-denominated revenue, you can see that mass distribution of tokens to a group of players (addresses) is very easy.

04

composability

Lest any confusion, I would like to emphasize that “composability” is by no means the same as item crossing (using items from one game in another).

Composability is a powerful tool for tracking ownership on shared open ledgers. Digital assets are becoming more like objects in the physical world: they can be pawned, lent, used as collateral, exchanged, stored at home or in a bank, with historical data records for every action, and a clear owner.

Digital Game Objects have few of these properties. I’d like to say “NFTs solve this problem”, but I don’t think almost anyone sees this as a problem at the moment. When you go through them, it’s normal to feel like you’ve failed. In hindsight, they only start to seem absurd.

Physical objects are objects native to the physical world – i.e. not limited by how they interact with them. Instead, digital objects exist almost exclusively in closed systems/databases – not at all in the wider cyberspace. This is our current state.

On the surface there doesn’t seem to be an actual problem to solve here. Yet I dare say: NFTs can turn our lives more and more towards the digital world.

05

Player consumption

In crypto games, the game is more likely to have many game items as NFTs, which can then be exchanged on the secondary market. However, this paradigm will have a material impact on player spending, meaning they will spend more and operate in more ways.

There are two reasons for this:

1. The typical investment in a game is no longer a sunk resource for the player. The time, money, etc. spent all have the potential to be partially or fully recovered in the future. Playing one game for years, then switching to another game can be a smooth transition. After all, no one wants to have the feeling of “wasting all these years”.

In theory, the only thing that matters is the amount of entertainment the player gets out of it. But as higher creatures, we naturally tend to spend more if we know in advance that we can later resell the items we have spent for money or time, because the resources all pay off.

2. The high-end commodity market is truly open. Imagine a League of Legends player mastering Garen, who owns all the Garen skins in the store—he buys all 12 for $5 to $20 each. He’s a high earner and plays League of Legends a lot, so he doesn’t mind spending $150 in total. If he wants to really differentiate himself from other Garen players, it’s going to be hard because everyone can easily get these skins.

Now imagine that all skins are NFTs. Suddenly, he has some options that he didn’t have before: he can buy rare skins that are no longer available in the store, maybe skins that were given away or sold to players a long time ago, mind you, and he can verify exactly which of them still exist today ; he can also find skin tokens with unique provenance; like those minted in the first few weeks of the competition, or used by the World Champion in the finals. All these options are only possible in this new paradigm.

You can imagine our Garen main would definitely be eager to have one of these, and would probably be willing to spend hundreds of dollars to get it, tripling or quadrupling his payout. Not to mention sellers, who might also want to spend some of that money back in games.

This is how NFT-based game economies can make current game economies look like hawkers.

There have actually been such exchanges: Spectral Tiger mounts in World of Warcraft, houses in Ultima Online, ships in EVE Online, Karambit knives in CS:GO, rare hats in Team Fortress 2 and Rocket League.

They are all exchanged for hundreds or thousands of dollars. Same principle, albeit lacking verifiable scarcity, provenance, ownership, composability, and royalties.

I don’t think the existing big games will go the route of balancing economic gain and long-term value. They don’t risk loss of revenue and reputation. Larger studios will jump on the bandwagon only if the model is proven to work well at scale – a model they can replicate with high-quality execution. However, it will take some time to mature.

06

Funding and Adjustments

Successful games are notoriously difficult to make, requiring many years and deep pockets. Creators currently have 4 options to help achieve their goals:

-

accept venture capital

-

Pre-order and early access sales

-

Get developer contracts from major publishers

-

crowdfunding

Often developers end up using a mix of these approaches, but it always takes effort.

With crypto, game studios have greater options for fundraising; selling NFTs, be they fashion items, battle passes, land, concept art, or anything else they see fit; doing token sales is also an option, no matter what Is it pseudo-governance or a “utility” Token .

It’s a form of crowdfunding, but with one major difference from Kickstarter (crowdfunding) — backers can get involved. Traditional fundraising should only reserve space for those with the official “investor” title in early business ventures.

Before I go on to stress this point, there are a few things to note:

Some game studios, whether intentionally or unintentionally, choose a simple path to assetization, which doesn’t really make sense for the game they’re making and doesn’t enhance the game experience. A typical example is that 90% of crypto games sell scarce land by default, which in most cases backfires on itself.

This has been abused — like many Kickstarter games that overpromise and underdeliver, or abandon the project after a while, or simply run away with the money — all of which can happen due to the open nature of crypto.

OK, back to the point.

Um, isn’t it?

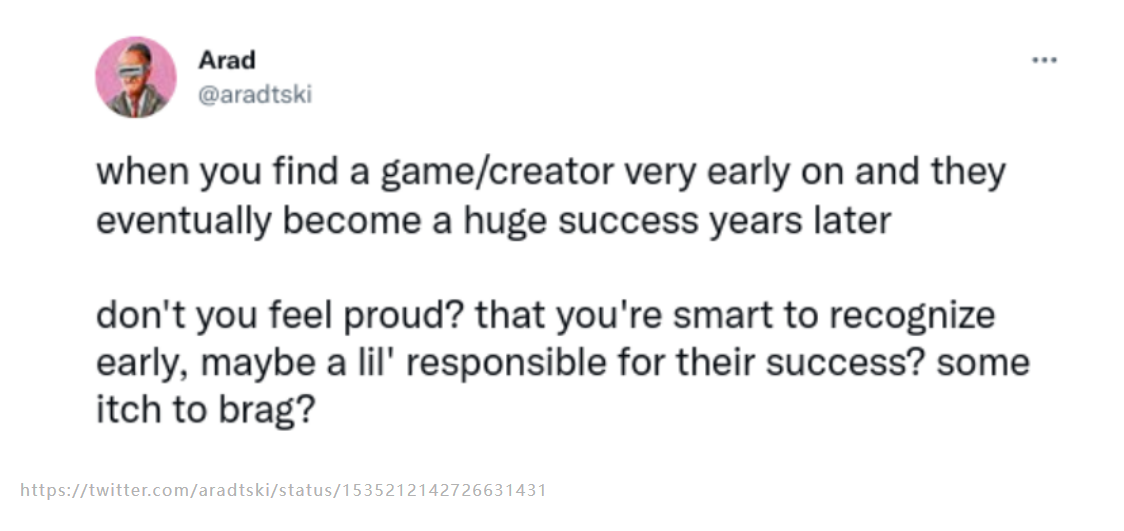

It’s not much different from an art patron finding out that an unknown artist made him famous and his own, through years of hard work. You will brag about your vision and own his precious work at a ridiculous price.

In fact, NFTs are the same, except that lesser-known artists often find their “enthusiastic patrons” as early collectors through social media. As in the traditional art world, if the artist became famous, those early collectors could be proud, brag, and get involved.

Who of the following has a better chance of fame?

Artists who tweet their artwork and work on commissions and freelance;

Or the artist who tweeted his art and minted it as an NFT?

I think the second artist has a higher chance of developing a fan base of collectors who support his work – he opens doors for them to take part in his journey – and by doing so, paved the way for himself as well. The first step to becoming a well-known artist is to get your core constituency to support you.

guess what. The game will also go down this road, you may not like it, you can try to reject it. But it’s practically inevitable — people like to predict the success of games, and they like to build online discussion groups around those games. They also like to argue about it.

Put money into it now, and you can get tempting investment opportunities and group organizations. It’s a new growth strategy if you’re willing to put money in — if it can be used to fund game development.

07

Universal Login and Universal Identity

-

Universal login

Universal login credentials have always been a golden goose – users hate tossing between different accounts for different services, often with different credentials that need to be managed or remembered. But it’s actually very difficult to do so – it requires an ultra-wide penetration of a single authentication method. Only the big companies, mainly Facebook and Google, can come close.

But the real golden goose—must be universal login using public key cryptography—if adopted this authentication standard would be extremely decentralized, open, simple, and not dependent on a centralized registry provided by a single company or network interface.

But life is tough, and there is currently no public key authentication standard at this rate. Until Ethereum and dApps came along. Suddenly a set of web applications using the same standard appeared. In order for users to sign and submit deals, wallets must adhere to the public key signature scheme specified by Ethereum.

So these days, this standardized authentication method is built into every crypto asset (dare I say web3) wallet. Although originally intended strictly for crypto exchanges, now it’s best suited to be that golden goose. It’s fast and brings other benefits that were previously unimaginable with common authentication methods – namely integration with the entire financial infrastructure network!

-

Universal Identity

Universal Login also comes with Universal Identity. Privacy-conscious users may choose to have their activity assigned to a different address, but given that most won’t, some very neat and unique options open up for game developers: determine which games you’ve played before, or you use which protocols have been passed and customize the game tutorial shown to you accordingly. For example, if you get a diamond rank on “RTS Game x” and start playing “RTS Game y”, you definitely don’t need to start all over again as a newbie. If the game recognizes that you have never been exposed to NFTs before, it will teach you the basics of encrypting digital assets.

As a studio, you can do unique marketing gimmicks like letting players of another game play your game and get gifts based on their level/item/achievement in the other game, e.g. Special items for champions/classes/roles held in other games to give criteria. This could allow for an agreement between the two gaming companies to be done in a mutually beneficial manner, or as an aggressive player acquisition strategy. It’s basically targeted marketing, more personalized.

External developers can create experiences that do not interact with the game itself at all, but are based on ownership of their assets. For example, a small indie studio developed a mini-game where players could bring their axes (Axie Infinity creatures) into it while playing.

All of these take advantage of persistent identities and the openness of the chain and are therefore completely new to crypto gaming.

08

Crypto-native (on-chain) games

Crypto-native games build something entirely new by using public blockchains. They stick the token on the traditional game model and call it the antithesis of web3 games.

Typically, the game state is entirely on-chain, and most interactions with it are done through exchanges. The game is the agreement, and the agreement is the game. Players can then use the protocol’s interface and extend or interact with it in countless different ways.

My favorite analogy is chess. Chess is a protocol – a set of immutable rules. Players use this set of rules to create their own interface and play chess; they can play against anyone anytime, anywhere. Of course, the analogy isn’t perfect, as the real-time state is not publicly documented, but the core idea is similar.

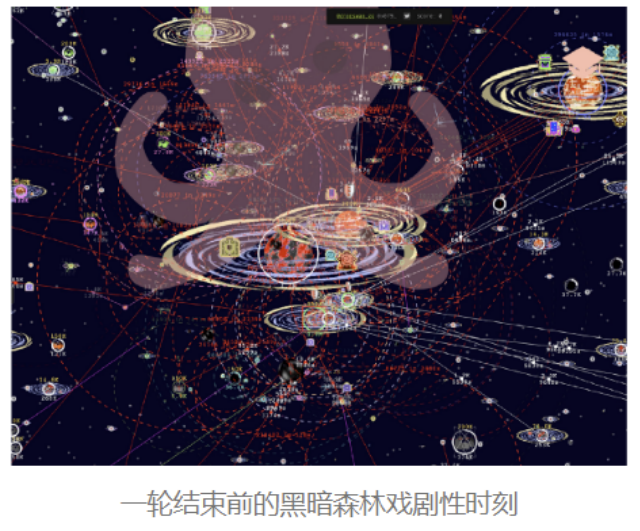

On-chain gaming has been relatively in the spotlight over the past two years, mainly because the Dark Forest has taken off, which is a good example. Crypto-native games are so difficult to make that no one has made a game as engaging and complex as Dark Forest in the past two years.

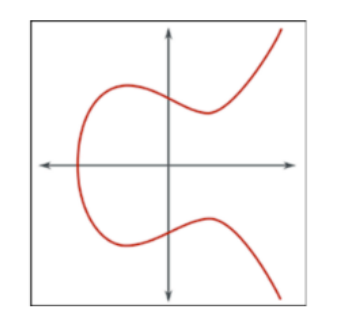

Encryption is not a “complete package”. It can be integrated in a modular fashion – at the edge of the user experience, or deep into the mechanism design.

Regarding on-chain gaming, I believe we are walking into a dark tunnel – constraints and design spaces are so different from everything else that we don’t know what’s at the other end of this tunnel – the only way to get through river.

09

Other content

Everyone can analyze economic and gaming activity, very similar to how the NFT market does today.

Like a professional player can use a specific item he uses, like a famous baseball player’s glove has value, especially if they played a great game with them. Going a step further, developers can add special bonuses to specific items with unique histories, be it aesthetics or otherwise. Imagine if that baseball glove really carried the spirit of the famous player and gave you a better catch or a shimmer in the dark when you played with it. This is a new design space with interesting possibilities.

Hard-coded rare items that can be viewed in public contracts may generate value more easily. Often, game studios can’t guarantee that a legacy project won’t be released again in the future. In fact, they often republish these items sometime in the future to raise funds. Once players have access to this guarantee, value accumulates more easily, leading to higher economic growth rates.

Youtubers and streamers can monetize by discovering small games early and making them popular. If these games are found to be valuable before anyone else, it will also propel the indie game industry forward. It’s like moving to an unknown town, buying a house in the city center, and then the town grows 10-fold in population and industry in ten years – you’re part of that success because you’re a part of it, intentionally or not.

10

summary

A new war saga is upon us, and yet we will not fight in this war. As with all short history of crypto assets, all we should do is wait until they start seeing it for themselves. But at the same time, we at least have this confidence to see.

Original title: Crypto Gaming: A Most Practical Thesis

Original link: https://ift.tt/UICjvzb

Author: Arad

Compilation: Fire

This article is reprinted from: https://www.hellobtc.com/kp/du/08/3995.html

This site is for inclusion only, and the copyright belongs to the original author.